Best Tax Return Software in Germany [2026] - Live In Germany

Do you have to submit your tax return to Germany right away? Without having to pay a costly German tax advisor, you can file your taxes. These online tax filing programs in Germany will show you how to file your taxes as an ex-pat with ease.

Completing a tax return in Germany seems overwhelming for most people. The good news is that now you can file your tax return with English instructions using online software.

The software is in English and as a result, you can use the English interface to complete everything. In addition, the software for your tax return will give you customized English tax advice on how to get the most out of your refund.

In Germany, How Do You Get Your Taxes Back?

In Germany, you must file a tax return at the end of the year to get some of your taxes back. There is a comprehensive guide to the four methods for submitting your tax declaration in Germany written below:

- Utilize software for online tax returns

- Utilize a tax professional

- Join a Lohnsteuerhilfeverein as a member.

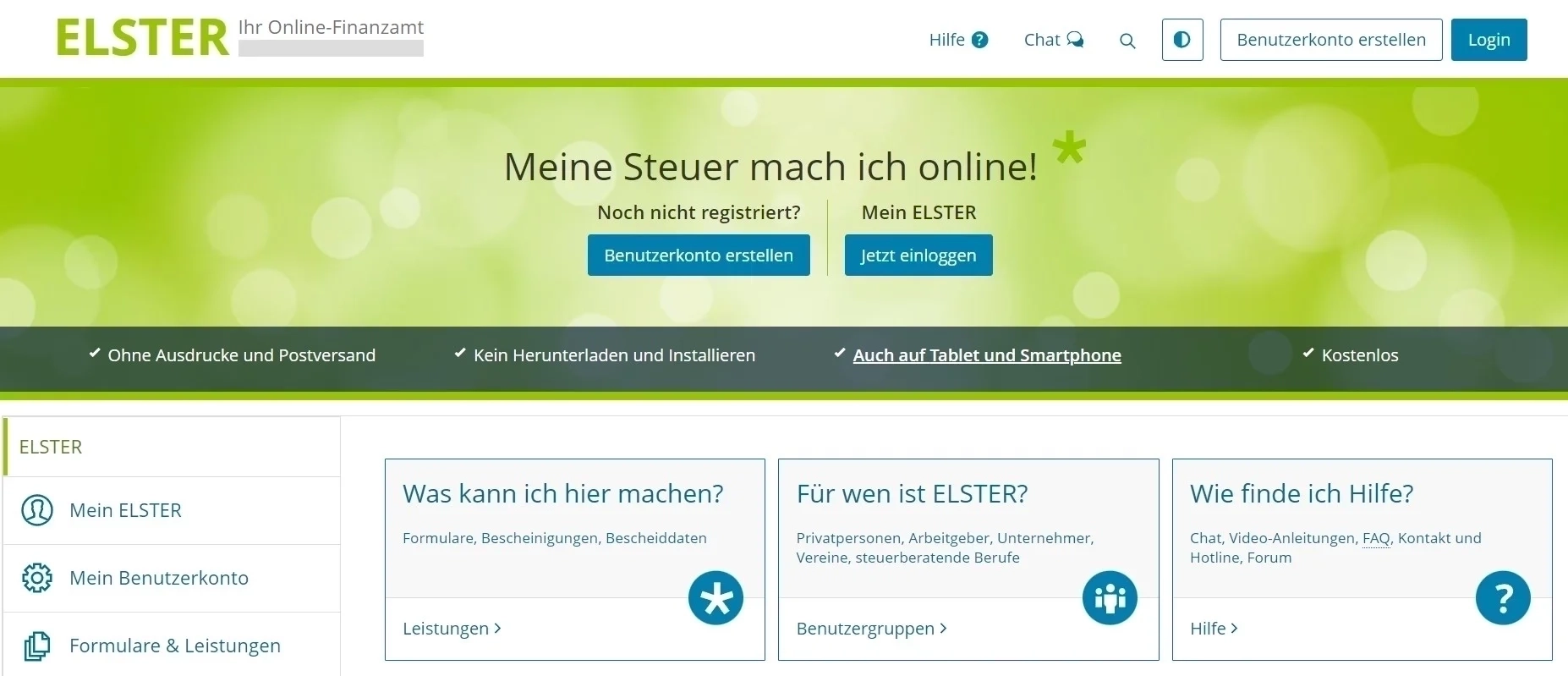

- Use ELSTER, the official online form for the German tax authorities.

How To File Your German Tax Returns

You can file your taxes in one of these ways:

- Employ tax software. The best tax software, including online services, are the subject of this article

- Sign up for a Steuerverein. This only applies to employees’ income tax.

- Utilize a duty specialist. This is recommended for self-employed individuals who are required to pay business tax and value-added tax, but not necessarily for Kleinunternehmer, who may benefit more from tax software.

- Make use of the free official Elster software. The majority of the other tax software in this article is easier to use, but this software is only available in German. If you don’t know what you’re doing, this choice isn’t the best.

What Documents Must You Submit to The German Tax Authority?

Using tax software or a tax online service, you can submit your files online. You are not required to submit any paperwork beforehand, nor are you required to submit any invoices or other files. However, the tax authority may later request some files as proof.

To file your tax return, you need a Tax Number from the tax authority. This can be requested several days in advance through the official Elster software.

Five of Germany’s Best Tax Return Software (English Interface)

Here is the five best tax return software in Germany with an English interface if you don’t speak German but want to use the software in English.

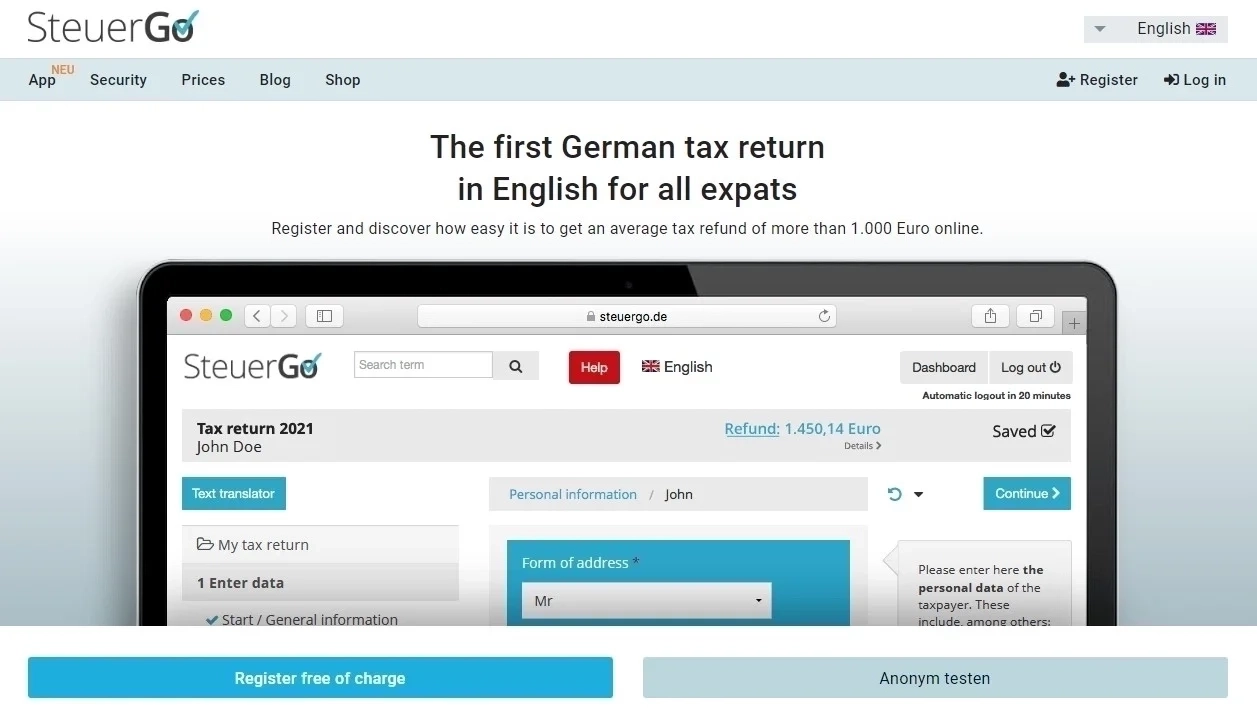

SteuerGo

SteuerGo makes it simple to submit your annual tax return online. To determine your tax refund, you can use SteuerGo for free. The fact that you only need to pay for using SteuerGo when you submit your tax return is a great benefit.

SteuerGo’s use is simple. A brief questionnaire must be completed by you. They are simple to comprehend. In addition, SteuerGo provides free, individualized tax advice based on your data to maximize your refund.

The estimated amount of the refund will be displayed after you have completed the questionnaire. After that, you can decide whether the one-time fee is worth it and file the tax return.

After you pay, SteuerGo will give an agenda so you can set up the right supporting reports alongside your expense form. The tax office will receive your tax return electronically.

SteuerGo can also assist in automatically checking the notice when you receive it from the tax office in the future. In case you want to file an objection, it also offers guidelines and templates.

Facts About SteuerGo

- Quick and simple refund calculation without the need for installation. You can edit anywhere online.

- Use SteuerGo on any of your gadgets with an internet browser.

- Only pay when the tax return is submitted.

- Your previous year’s data can be transferred.

- You will receive a tax document checklist and letter templates. You can automatically receive your tax assessment notice. You can safely submit your tax return online.

- Interface and customer service is in English.

- Polish, Hungarian, and other European languages, in addition to English, are available as well.

- No subscription is required because the accuracy and completeness of all entered data are checked.

- Suitable for individuals with income from pensions or real estate, families with children, and employees.

- The starting price is 34.95 EUR.

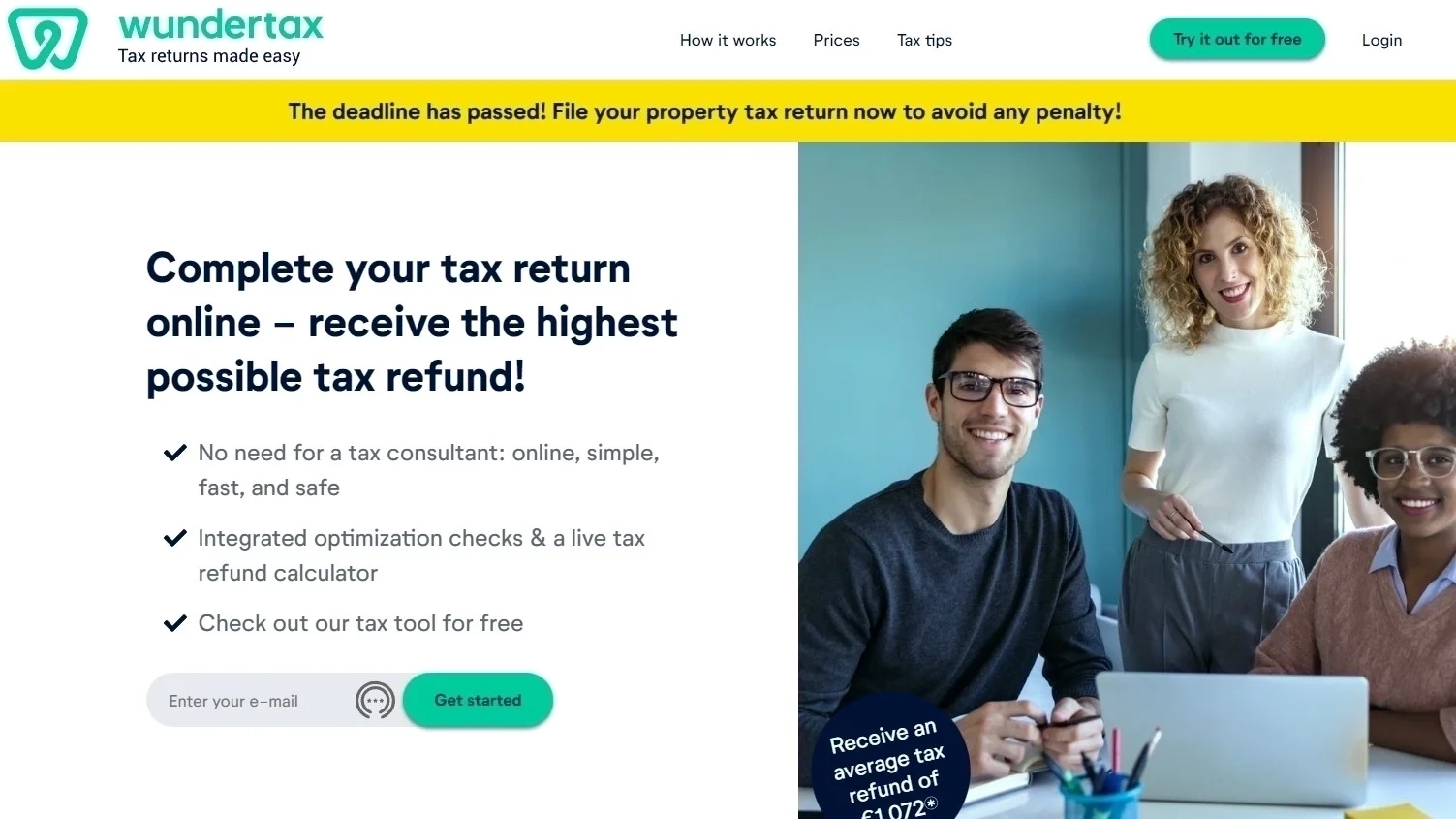

WunderTax – GermanTaxes

In 2015, Wundertax was established. In the beginning, it was a method for students in Germany to submit their tax returns online. The following year, Wundertax expanded its service to include additional target groups because the service was well received.

These days, students can utilize Wundertax, yet numerous others including workers and independently employed individuals use this platform. You can only pay for your estimated tax refund if you decide to file your tax return.

Facts About WunderTax

- No establishment is required.

- Simple, quick, and secure online.

- Pay only when your tax return is submitted.

- Guidelines for the interview in detail.

- In 17 minutes, prepare your tax return.

- Integrated checks for optimization.

- Calculator for tax refunds live.

- No assessment of earlier information is required.

- Free customer service and an interface in English.

- Tips for English taxes.

- A tax return that is climate neutral.

- Suitable for employees, students, self-employed individuals, soldiers, police officers, and others.

- The cost begins at 34.95 EUR (5 € Discount – Exclusive for Live in Germany Visitors)

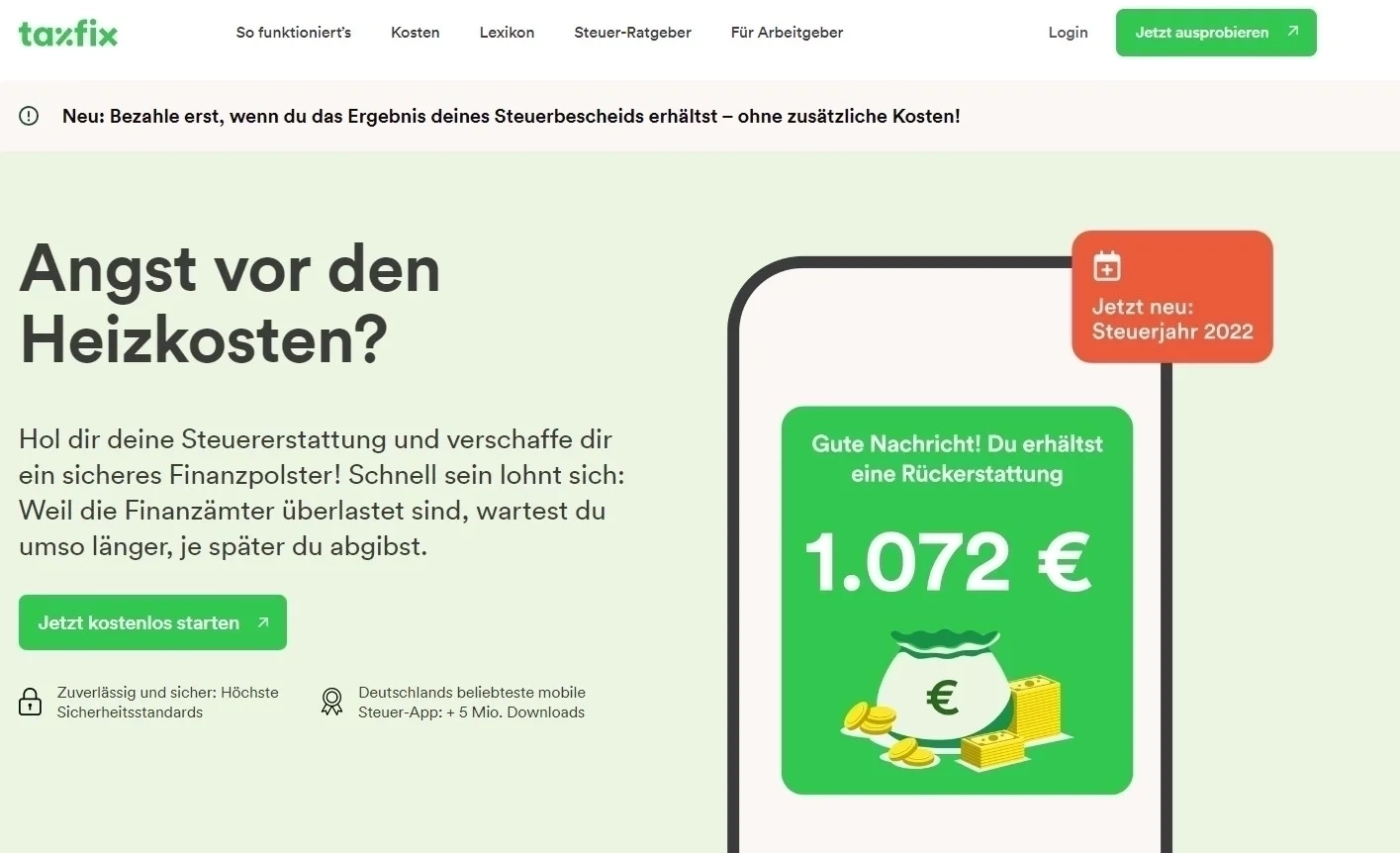

TaxFix

With over 5 million downloads, Taxfix is one of Germany’s most downloaded mobile tax apps. You don’t need any prior tax knowledge or experience to file your return with Taxfix. The application utilizes a request reaction process. You only need to respond to approximately 70 questions about your tax return. This will take less than 30 minutes on average. After that, you will not be charged to view your anticipated tax refund.

Only submitting your tax return necessitates payment. Taxfix will securely transfer your data to the tax office using the ELSTER interface. Taxfix lacks support for complex tax cases like those involving self-employment, freelancers, adult relatives receiving financial assistance, income from private pensions and real estate, etc.

Facts About TaxFix

- No establishment is required.

- Use an app or a browser to complete your tax return.

- Simple to rapidly utilize and document your expense.

- Interface and customer service in English.

- Instruction and tips on taxes in English.

- Taxfix will import the information into the app automatically when you take a picture of your pay stub.

- Automatic data check.

- Pay only when your tax return is submitted.

- Get a free estimate of your tax refund.

- Your tax information will be sent securely.

- Suitable for individuals with families, employees, students, pensioners, temporary workers, officials, trainees, and ex-pats, among other groups.

- A one-time cost of 39.99 EUR, or 59.99 EUR for civil partnerships and married couples.

Taxando

In Germany, you can calculate your tax refund using the free tax app Taxando. Only if you use the standard or premium plan must you pay. If your anticipated tax refund is less than sixty euros, you can file your return for free with the standard plan. Taxando’s standard plan does not accommodate complex situations like self-employed individuals, freelancers, rental income, capital income, and cryptocurrency, which is one disadvantage.

The app is not designed specifically for students, even though you can use the standard plan as a student. All tax cases can be supported if you select the premium plan. A tax advisor will check the accuracy of your tax return with the premium plan, and you can also ask questions about taxes.

Facts About Taxando

- Simple to use.

- Installation is not required.

- Different languages available: Polish, Russian, English, German, Italian, Polish, Bulgarian, and Romanian.

- Instantaneous estimation of your refund.

- Free to use until the tax return is submitted.

- Declare your international income.

- Taxando is available for use on any device.

- Send your tax return to the tax office electronically.

- Taxando will send you an electronic tax assessment.

- If your anticipated tax refund is less than 60 EUR, the standard plan is free.

- With the premium plan, a tax advisor reviews the tax return.

- 33.8 EUR is the cost of a standard plan. Alternatively, a premium plan costs 99 EUR.

PromoCode: 60651

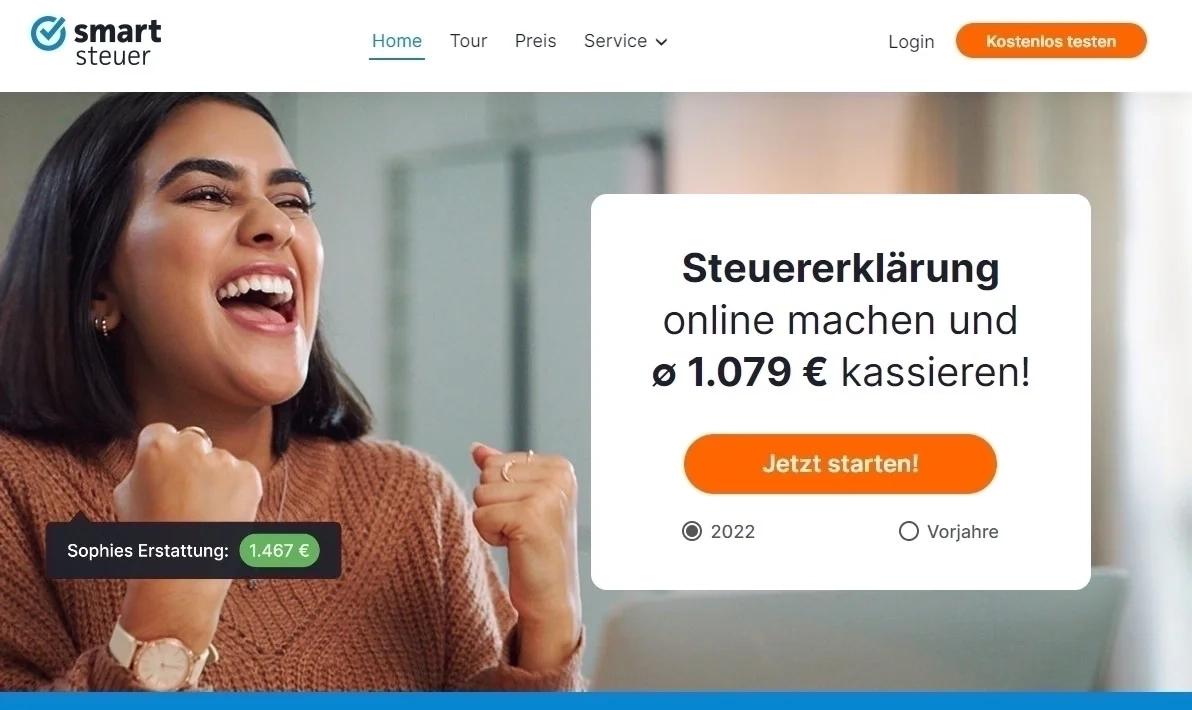

SmartSteuer

In 2010, Smartsteuer was introduced. Additionally, it has rapidly grown to become one of Germany’s leading providers of online tax return services. Lexware, a German-based accounting software company that has been around since 1989, now includes Smartsteuer. It can be used on any computer or tablet that has an up-to-date browser and internet access.

You can view your tax assessment notice online through Smartsteuer when you receive it from the tax office. In case you want to file an objection, it also offers guidelines and templates. The fact that you can file up to five tax returns per year for 34.99 EUR is a great feature of Smartsteuer. This means that you can, if necessary, complete tax returns for other members of your family for a single fee.

Facts About SmartSteuer

- No establishment is required.

- Other than English, Smartsteuer’s connection point upholds around 100 different dialects using Google Decipher (even in Chinese).

- Customer service in English is free.

- Get a free estimate of your tax refund.

- Record your government form in under 60 minutes.

- Automatic data check.

- Your previous year’s data can be transferred.

- Pay only when your tax return is submitted.

- Simple to use by responding to questions.

- guidance through each step.

- Get English tax advice to get the most out of your refund.

- Through ELSTER, Smartsteuer sends your tax information securely online to the tax office.

- Get letter templates and a tax checklist.

- View your notice of tax assessment online.

- Suitable for self-employed individuals, students, pensioners, and others

- For up to five tax returns filed in the same year, the price starts at 39.99 EUR.

Three Best Tax Return Software In Germany With A German Interface

On the off chance that you know some German, it is most likely better to utilize German assessment from programming. This is since a lot of German tax return software is extremely extensive and adaptable to every life circumstance.

Additionally, the German tax return software is very pleasing to use. The three most effective German-language tax return software are listed below.

TaxMan

Lexware, a German accounting software company established in 1989, produces the tax return software known as Taxman. It is a software with a lot of features that can also help people with complicated tax situations. Examples include income from self-employment, investment capital gain, and income from real estate.

Facts About Taxman

- A piece of software for filing taxes must be installed on your computer.

- Instructions for your German tax return in detail.

- A comprehensive verification of the accuracy of your data.

- Consists of checklists and tax-saving tips.

- You can upload and manage your documents directly within the software with a receipt manager.

- Your previous year’s data can be transferred.

- You can see how the amount changed based on the data you entered and the estimated tax refund.

- If you are having issues using Taxman, you can get assistance from free customer service.

- Utilizing the Taxman software, send your German tax return directly to the tax office.

- Ideal for employees, families, investors, landlords, homeowners, students, job seekers, commuters across borders, retirees, self-employed individuals, and others

- Check the tax assessment notice sent by the tax office regularly.

- If you want to submit an objection to the tax office, you can get free templates.

- For up to five tax returns filed in the same year, the price starts at 29.9 EUR.

Wiso Steuer

One of the most comprehensive ways to file your tax return in Germany is with Wiso Steuer. Wiso Steuer is used to sending more than 2.8 million tax returns to the tax office each year.

Wiso Steuer is appropriate for any circumstance in life: Employees, students, couples, homeowners, pensioners, investors, and individuals who work for themselves Wiso Steuer can also be used if you make money from your own business in addition to working for an employer.

The basic Wiso Steuer plan costs 29.95 EUR. You can file up to five tax returns per year with this plan. This means that you can, if necessary, complete tax returns for other members of your family for the same price.

Additionally, Wiso Steuer provides a ProfiCheck plan through which a tax professional can review your tax return. You can ensure that your tax return is accurate in this manner. The tax professional is also available for questions and individual tax advice. Additionally, the ProfiCheck plan has a starting price of 128.95 EUR.

A downside of Wiso Steuer is that it is just in German. Therefore, if you don’t speak German, it might not be for you. But if you know enough German, you should check it out. In the German market, it ranks among the best tax return software.

Facts About Wiso Steuer

- Works with every device via download, browser, or application.

- Only pay when your tax return is submitted.

- Very comprehensive and applicable to all circumstances in life.

- Numerous pieces of information will be naturally filled for you as Wiso Steuer pulls this information straightforwardly from the expense office.

- The anticipated tax refund is visible.

- With just one click, submit your tax return to the tax office electronically.

- Videos and comprehensive guidance on taxes are included.

- With your smartphone, you can easily take pictures and add them to your tax return.

- You can ask questions about taxes and have a tax expert look over your tax return with the ProfiCheck plan.

- For up to five tax returns filed in the same year, the price starts at 29.95 EUR.

ELSTER

Electronic Scientific Discovery, or ELSTER, is its acronym. The German government has created this online tool. To submit your German tax return online for free, you can use ELSTER.

The fact that ELSTER is free is the primary benefit. It is a legitimate government tool for electronically submitting your tax return.

ELSTER can only be purchased in German. If you don’t have adequate German information, utilizing ELSTER can challenge you.

In addition, the ELSTER tool is challenging to use. You must be aware of the tax form you are required to submit. Even though ELSTER provides explanations, tax language can be challenging to comprehend.

Conclusion

These cutting-edge software providers and apps have made it easier than ever to file your tax return. During testing, Taxfix was the most user-friendly option for regular employees, while Wundertax is the most adaptable option that supports almost all taxpayer categories.

Source: People vector created by pch.vector – www.freepik.com

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)