Best Dental insurance in Germany - Live In Germany

If you are thinking about getting dental insurance or you want to get information about dental insurance in Germany, then you will get all the information here. In this article, you will get to know about the best dental insurance in Germany. You will also know why and for whom supplemental dental insurance is important. I will explain all the types and prices of dental insurances according to my experience.

Germany has the highly-qualified dentists as well as good population coverage that make its dental care system one of the best in Europe. The dental care system of Germany is up to the mark, but it is also expensive. The general health insurance does not cover all dental treatments. In this guide, you will also know whether you should consider dental insurance for yourself and your family or not.

Best Dental insurance in Germany

Dental Care in Germany

Dental health care in Germany’s health care system is semi-privatized. Normally, with a valid health insurance, you may get the dental care free of cost, but it also depends on the type of treatment you need. Most basic treatments are free of cost. You might have to contribute a little for dental treatment, depending upon the type of health insurance you have.

Quick Comparison of the Best Dental Insurance Providers in Germany

If you don’t want to read long articles, then here are the highlights of the 3 best dental insurance providers in Germany:

Ottonova: They provide the following services:

- 100% digital and customer friendly.

- All services are available in English.

- 3 different plans.

- Waiting period is 3 months.

- Superfast repayment.

- Appointment booking service.

- Getting an English-speaking doctor for you.

- From 8.73 Euros per month.

Feather:

- 100% digital and customer friendly.

- English services are available.

- Two different plans.

- No waiting period at all.

- You can cancel at any time.

- From 10.9 Euros monthly.

Getsafe:

- 100% digital and customer friendly.

- English services are available.

- One simple plan.

- Waiting period is 3 months.

- Repayment within 48 hours.

- From 9.31 Euros monthly.

Why Do You Need Dental Insurance In Germany?

You can save yourself from many future treatments, if you get good dental care. However, in some cases, people need dental insurance regardless of how much good dental care they are getting. It is related to genetic history. If you got dental problems genetically from your parents or grandparents, then you might need dental treatments in the future.

The people who have been getting dental treatments in their home country and if their country has an advanced dental treatment system, then they already know how the dental insurance system works.

What is the Approximate Cost of Dental Treatments in Germany?

The following are the approximated dental treatment fees in Germany.

- Professional teeth cleaning: 50 to 120 Euros

- Root canal treatment: 300 to 1000 Euros

- Plastic or composite fillings: 60 to 200 Euros

- Gold or inlay: 400 to 800 Euros

- Ceramic fillings: 400 to 900 Euros

- Ceramic bridge: 1.300 to 2.200 Euros

- Implant with ceramic crown: 2.500 to 3.500 Euros

Normally, the public health insurance like TK or AOK covers only 30 to 60 percent of the treatment cost. However, a big portion of the treatment cost can be covered either from your own pocket or with the additional Supplemental dental insurance. Sometimes, private insurances cover the entire amount. In this article, you will know which insurance covers full treatment cost and which covers half treatment cost.

Does Public Health Insurance Cover Dental Care?

Almost everybody has public health insurance in Germany, which also covers dental treatment. However, not all the treatments are covered by public health insurance. This is because the public health insurance companies have been reducing dental coverage to cut the cost. The treatments that are covered in public health insurance include regular dental check-ups, hygiene work, basic fillings, wisdom teeth removal and scaling.

Public health insurance also has some crucial benefits because the government encourages people to take care of themselves. For example, the public health insurance covers 75% of your costs if you go regularly to your dentist continuously for 10 years.

Do German Buy Supplemented Dental Insurance ?

Many German people buy supplemented dental insurance along with their public health insurance because they do not want to pay a lot of money when they need some specific dental treatments. For example, when they go for dental implants, crowns, root canal treatments, or professional dental cleaning, they need to pay partially by themselves. In order to save themselves from this hassle, people buy supplemented dental insurance.

Some advanced dental treatments cost several hundred Euros and some cost thousands of Euros and if you have public health insurance, then you have to pay partially.

What Does Supplemental Dental Insurance In Germany Cover?

As we have discussed earlier about supplemented dental insurance, which is also called “Zahnzusatzversicherung” in German. People buy supplemented dental insurance because public health insurance does not offer complete cost coverage. Almost all the private dental insurance covers the following treatments:

- Dental check-ups

- Dental prosthesis

- Hygiene work

- Professional dental cleaning

- Implants

- Dental treatment

- Inlays

- Bridges

- Dentures

- Crowns

The best thing about Supplemental dental insurance is that you do not have to wait a long time for an appointment like in the case of public health insurance. The private dental insurance is also better in case of cost coverage, as you might get 100% repayment for professional and major treatments. You can also have better and fast access to dental specialists with private insurance.

Do I have to pay for my dental treatments upfront?

Yes, First you have to pay for your dental treatments, once you get the invoice (Rechnung). Then you can give it your supplemental dental insurance, They will reimburse you your money depending on your tariff. Some dental insurance tariff covers 100% of the treatment and some only part of it.

Do I need Supplemental Dental Insurance if I have Private Health Insurance ?

No, You do not need to buy supplemental dental insurance, if you already have private health insurance. This is because private health insurance already covers a lot of dental treatments. However, if you need 100% cost coverage, then you can ask your current private insurance.

Who Should Buy Supplemental Dental Insurance In Germany?

Generally, everyone should have supplemented dental insurance along with public health insurance. If you are experiencing the following situations, then you should also consider having supplemented dental insurance.

Dental Issues In Family: If any of your family member has experience dental issues then it is high probability that you might experience some as well. Having dental insurance can save alot in future.

Better care and treatment: Some of the basic treatments and basic filling is covered in your public health insurance but you would like to have a better treatment then dental insurance is a wise choice.

Bad Habits: If you are a person who didn’t get time to take care of your dental hygiene or you smoke or chew tobaccos, then it is also recommended to have a dental insurance because it could save when the time comes.

Tooth Aches: If you are experiencing a minor tooth aches or if you are expecting some tooth implants or tooth replacement in future then dental insurance is definitely recommended as these treatment easily costs thousand of euros.

Past History: If you got major dental treatment in your home country in the past, then you might need more dental treatments in future in Germany.

What should be covered in the Supplemental Dental Insurance?

The cost coverage of treatment in supplemented insurance depends on the insurance company that you choose. Therefore, you should carefully read in the contract which treatment is included and which is not included before buying the insurance. Usually, comprehensive dental coverage is provided by supplemented dental insurance in Germany. Your contract must include the following treatments:

- Professional dental cleaning

- Root canal treatments

- Major dental treatments like implants

- Tooth whitening (in some policies)

Is there any discount, if you sign up at young age?

It is recommended to have the such insurances at early age because if you get this insurance at the later age then chances are that you pay more than the person who sign up in early age.

Is it Worth to Buy Supplemental Dental Insurance In Germany?

Supplemented dental insurance covers almost all the costs, sometimes even 100%. It might be possible that you get better treatment with supplemented dental insurance. For example, you may get a tooth implant with supplemented dental insurance instead of a bridge that you were going to get with public health insurance.

The bright side of supplemented dental insurance is that it is extremely affordable and easy to get. As some insurances start from 10 Euros monthly with a good coverage. If you get at least once a year, professional dental cleaning which is 100 Euros, then you have already covered your yearly fees.

Germany’s Best Dental Insurance Providers

On the basis of our analysis, the following are the best supplemental dental insurance providers in Germany. Many expats have been benefiting from these providers.

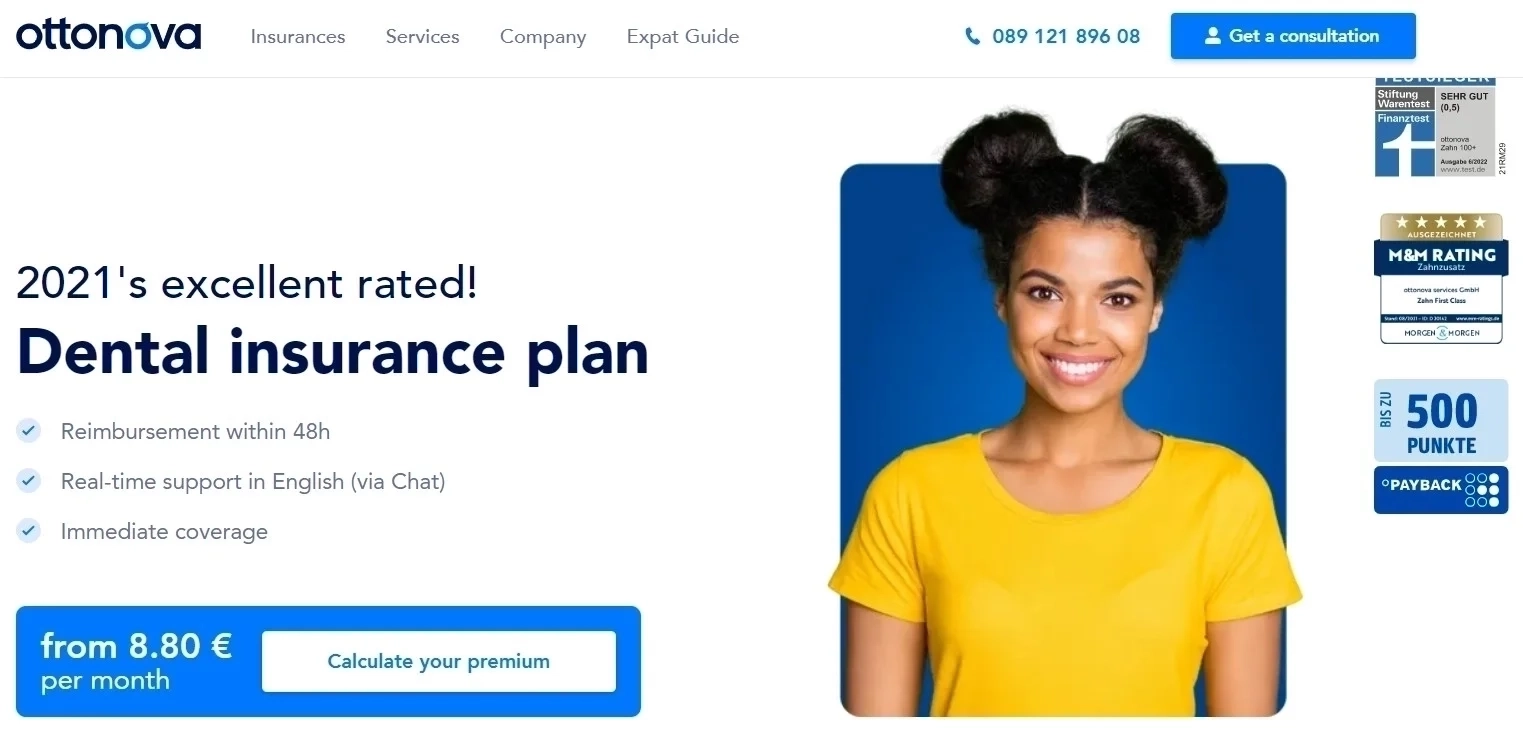

Ottonova

Ottonova is best known dental insurance in Germany for international people. It provides all services 100% digital. You will get comprehensive dental coverage with real-time support in English. This dental insurance is also not expensive.

](https://out.liveingermany.de/ottonova_dental)

Top Features of Ottonova

- Ottonova is 100% digital.

- You do not have to wait for accidents or preventive treatments.

- It starts from 8.80 monthly.

- Ottonova can book an appointment for you.

- Extremely fast reimbursement.

- Can be canceled any month after 2 years.

- Everything is in English (website, customer services, contract, app).

What is Covered by Ottonova Dental Insurance?

- 100% of the cost of dental prostheses is covered. This condition is valid if the partial cost is covered by your public health insurance.

- 100% of the costs of many dental treatments are covered. This includes root canals, plastic fillings, fillings, checkups and periodontal.

- 60-100% of the cost of orthodontics is covered.

- 100% of the cost of orthodontics is covered for patients under 21 years old.

- 80-100% of the cost of implants is covered. Implants include bridges, crowns, and dentures.

- Covers 1 or 2 professional dental cleanings yearly.

What are the Reimbursement Limits in Ottonova?

Ottonova implements a yearly limit for the first 48 months on the maximum reimbursement amount. This limit starts at 800 Euros and it increases by 800 Euros each year. However, this limit does not apply to your professional cleaning, regular dental treatments, and emergency treatments due to an accident. It only applies to implants, inlays, and Onlays. Note that the monthly premium also depends on your age.

](https://out.liveingermany.de/ottonova_dental)

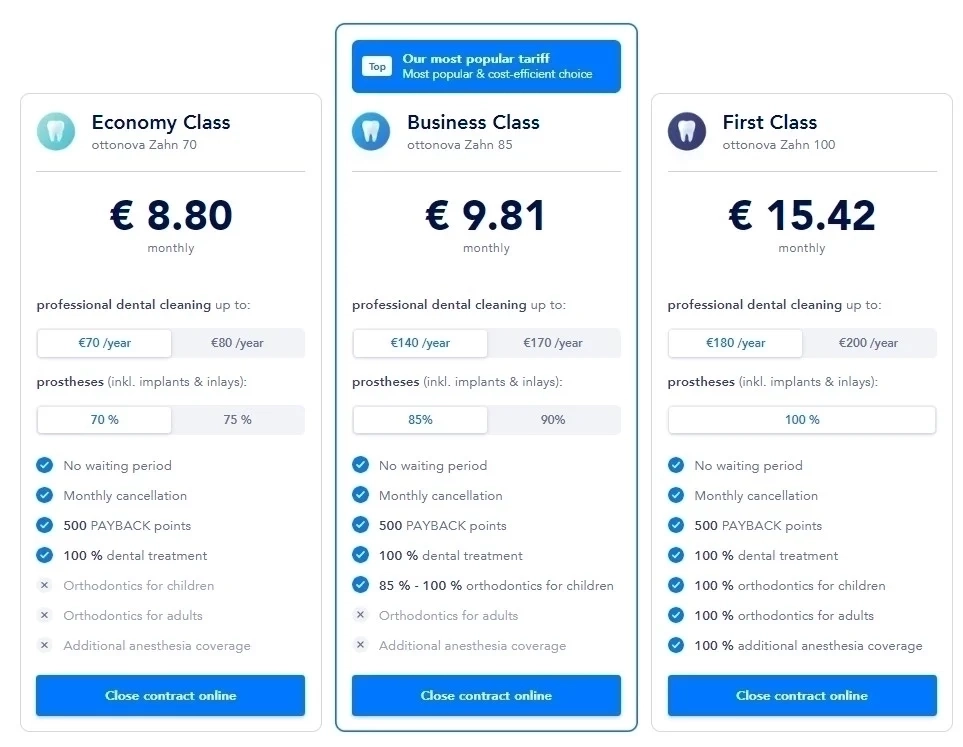

Ottonova offers three types of plans and you can choose one plan according to your needs. The waiting period of each plan is three months. However, in case of preventive treatments, you do not have to wait for treatment. Moreover, you can also shift from one plan to another plan agt any time.

Economy Class (From 8.80 to 9.30 Euros Monthly)

It covers:

- Professional cleaning up to 70 euros a year.

- 100% dental treatments including periodontal, plastic fillings and root canal.

- 70% of the cost of treatments like inlays and implants.

- Dental prosthesis (100% covered if public health insurance partially covers).

- Dental treatments like root canal, periodontal, and plastic fillings (100%).

- Dental prosthesis (100% if public health insurance covers partially).

- 70% of functional therapeutic and functional analytical services.

Business Class (From 9.81 to 11.27 Euros Monthly)

It includes Economy Class plus:

- 85-100% of orthodontics cost for children.

- 85% of functional therapeutic and functional analytical services.

- Up to 70 Euros per professional cleanings (2 times).

First Class (From 15.42 to 15.86 Euros Monthly)

Includes Business Class plus:

- 100% orthodontics for children.

- 100% up to 2,000 Euros for Orthodontics for adults (if your public heatlh insurance partially covers the cost).

- Additional anesthesia services.

- 100% Functional therapeutic and functional analytical services.

- Two professional cleanings included. (one cleaning costs 90 Euros).

What we like

- Immediate protection without waiting.

- Superfast reimbursement.

- High-quality dentures.

- Immediate service for professional tooth cleaning.

What we did not like

- It covers orthodontic treatments for adults only if the GKV (Public Health Insurance) covers the costs.

Getsafe

GetSafe is also trustworthy insurance that is helping many ex-pats in terms of dental insurance. This insurance provides great coverage for dental treatments for a low price. With the GetSafe app, you can manage everything online by signing up. You can get a 10 Euros discount if you sign up for the GetSafe app by using this link

](https://out.liveingermany.de/getsafe_zahnzusatz)

Top Features of GetSafe

- You will get a reimbursement within 48 hours.

- Starting from 9.31 Euros monthly.

- Everything is available in English including customer service, contract, App, and website.

- Monthly cancellable after 2 years.

- You do not have to wait for treatments like fissure sealing, caries diagnosis, accident treatment, and professional cleaning.

What is Covered by GetSafe Dental Insurance?

- 100% coverage for periodontal treatment, fillings, and root canals.

- Up to 100% treatment reimbursement.

- Coverage for a dental cleaning (up to 80 Euros per year)

For the first 48 months of the insurance policy, GetSafe offers an annual reimbursement limit. You can reimburse up to 800 Euros in the first 12 months. Of course, this limit does not apply in the case of an accident. Moreover, the reimbursement limit increases every year by 800 Euros and after 48 months it will be unlimited.

There is one simple plan offered by GetSafe and your age decides the monthly premium. Generally, the premium value increase after 5 years.

What we like

- Up to 100% cost reimbursement for treatment.

- Payments within 48 hours.

What we did not like

- Only have one Tarif.

Feather

Feather is a well-known insurance company that also offers dental insurance. It provides full digital services and you can sign-up with no paperwork. Their team is always ready to support you in English

](https://out.liveingermany.de/feather_dental)

Top Features of Feather

- No waiting time at all.

- All services are available in English.

- It is cancellable any time after one year.

- Starting from the basic plan which is 10.9 Euros monthly to the advanced plan 16 Euros monthly.

What is Covered by Feather Dental Insurance?

- In advanced plan, get 90 to 100% reimbursement for tooth replacement.

- The advanced plan also includes teeth whitening every 2 years (up to 200 Euros).

- Get up to 100% reimbursement for treatments including root canal, professional cleaning, composite fillings, certain orthodontic treatments, mouthguards against teeth grinding and periodontal treatments.

BASIC VS ADVANCED PLAN:

There are two plans offered by Feather: basic and advanced. You can choose a plan according to your needs and income.

BASIC PLAN: * Annual reimbursement limit of 150 Euros in the first year. * Annual reimbursement limit of 300 Euros in the second year. * No limit with the starting of third year (only orthodontics is not included).

ADVANCED PLAN: * Covers all treatments such as inlays, Onlays, dentures, teeth whitening, bridges, implants, tooth replacement and crowns. * No reimbursement limit for the treatments mentioned above. Limits are applied only for orthodontics. * Annual reimbursement limit for tooth replacement (in the first 4 years).

What we like

- Professional dental cleaning.

- Preventative treatments.

- High quality fillings.

- Restorative treatments.

- No waiting period.

What we did not like

- It does not cover pre-existing or ongoing treatments, issues, or complaints.

- It will not cover the cost of orthodontic treatments if you're over 21.

Dental Insurance For People With Earning Low

If you do not earn well and you cannot afford supplemented dental insurance, then Germany has a solution for you called “Härtefallregelung”. 100% of your dental cost is covered by your insurance, if you earn gross income lower than 1,316 Euros monthly. These are statistics of 2021. If you have one other dependent, then this criteria goes up to 1,809.5 Euros. For every additional dependent, the extra amount is 329.

If you earn little bit more of the gross income mentioned above, then you still may get the more coverage as standard amount. You just need to ask your insurance company, whether you re eligible and how much they will cover the dental treatment. To apply for this scheme, send a formal application to your insurance company.

Conclusion

Getting additional private dental insurance to extend your general public health insurance coverage can be worth your while if you tend to have bad teeth. It depends on how extensive you would like your cover to be and on how old you are. When we take a look at the most comprehensive coverage of all providers at age 32, you would pay 28,44 euros per month with Ottonova, 25,80 euros with Feather, and 12,58 euros with Getsafe.

Source: People vector created by pch.vector – www.freepik.com

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.