Best Legal Insurance in Germany [2026 List] - Live In Germany

Legal conflicts can come at any instance as we live in this busy world. Getting legal insurance can cover up the hassle that one may go through. Getting legal insurance in Germany can help get a lawyer that will help you give advice and can also help in getting the claim from the insurance company. This can give you a sense of security. In this article you will get to know about the different types, costs, what it can cover and a comparison among the best legal insurances in Germany.

Best Legal Insurance in Germany

Highlights From the Article

If you are running out of time, just go through the main highlights of the best legal insurance in Germany.

GetSafe: Provides English Support, Digital insurance without paperwork, quick signup, and easy to file claim within the application.

Feather: No paperwork, with support in English, easy and quick sign up.

If you want to read further and compare with the available options of legal in

What does it mean by Legal Insurance in Germany?

There are multiple insurances in Germany, as a matter of fact, you can almost cover everything under the insurance in Germany as it is considered to be the country of insurances.

Not every insurance that is available in Germany is necessary but getting legal insurance is a must as it can benefit a lot. If you are a law abiding citizen you may not be able to utilize the legal insurance more often but one should not think of not having a legal insurance in Germany even if they don’t take law in hand. This can also provide benefits if you face any legal obligation and can cover the legal matter that may occur to a person living in Germany.

Legal Insurance

In Germany legal insurance is known as “Rechtsschutzversicherung”. It can help with the expensive costs if someone sues you or if you need to sue someone while going into a legal matter. If you have legal insurance in Germany then you have the option to consult with your lawyer, and what to do if you are in legal court.

It provides free access to lawyers and your lawyer can represent you in court. If someone moves to Germany for work or is staying more than 6 months its recommended to have a legal insurance.

Why to have a Legal Insurance in Germany

It is difficult for expats that live in Germany to know the rules and regulations and sometimes having less knowledge can end up in legal conduct. Having legal insurance in Germany can provide a sense of security and peace of mind as the insurance company is there for you in case you need any legal assistance.

Disagreements can happen anywhere in your surrounding with your employer, neighbor, landlord and if a person is covered with a legal insurance in Germany, he/she has every right to seek justice without having the concern that it is expensive or if you can afford it or not.

A survey held by statista in 2020, indicates that 41% of the population have legal insurance in Germany and it seems like a large percentage. So, what does this means for the expats?

For people who are living in Germany for a while, they might have noticed how keen German people are to exercise their rights. Because the country itself focuses on correct order and procedures, the people living in it are also direct.

So, having legal insurance in Germany will enable you to afford and fight for your rights in courts if it is needed. And in case you are an expat and have a higher risk of getting sued, it can cover up the hassle.

Expensive Legal Costs

Being a good citizen is not enough because not everyone around you is as nice as you are. This can also become the reason due to which conflict can arise. Costs of legal insurance in Germany may look like a lot at first but, compared to the legal expenses in Germany it may not feel that much and it is worth everything you pay for.

Costs of lawyers and courts are high in Germany and a lawyer can cost between 80 euro to 500 euro per hour. But, this should not restrict a person from having justice. Every person has the right to get legal assistance wherever required and this is where legal insurance finds you for good.

Having a lawyer can cost around a few thousand euros but, in some cases it is not necessary to have a lawyer but its better if you get a lawyer provided by the legal insurance. Even if you lose a legal case, your legal expenses are covered through your insurance.

What is Covered in Legal Insurance in Germany?

Expenses like lawyer, court, witness and translation costs are covered in the legal insurance in Germany. Moreover, in case of losing a case legal insurance will also cover the cost of the opposing side.

Following areas are covered in the legal insurance in Germany:

- Laws of employment

- Landlord or neighbor disputes

- Tax disputes

- Private contracts and consumer protection

- Compensation claims

- Family law ( Some insurance policies include Divorce)

- Accidents, loss of driver license or traffic violation

- Inheritance Issues

What is NOT Covered in Legal Insurance in Germany?

Legal insurance in Germany does not cover the following areas.

- Claims in between the waiting period.

- Legal assistance before the purchase of legal insurance.

- Compensation for damages, fines or tickets

- Legal divorce expenses which basic legal insurance does not cover.

Whereas, it is important to understand and make sure to go through what is and what is not included in your policy. Also, there may be a need to go for a specialized legal insurance policy if you are a high level executive or are self-employed.

Waiting Period. What is it?

Waiting period is a period of a few months after which the insurance will come into effect once you buy it. Disputes that may occur in between the waiting period are also not covered in the insurance. People may try to buy legal insurance when they know they’ll be in a dispute soon and waiting period prevents that. Any disputes which may have happened before the purchase of policy will not be covered.

Waiting period may vary in length as it depends on the type of legal insurance and the insurance company too. For example, usually there is no waiting period in traffic legal protection. Private, professional, and home rental usually have a three months waiting period. But on the other hand legal protection in case of divorce can have a three years of waiting period.

Types of Legal Insurance in Germany

Mainly there are four types of legal insurance in Germany which are home rental, private, professional and traffic legal insurance.

Professional Legal Insurance

Issues can happen at your workplace and it can happen anytime. No matter how good the employer is there can be a situation where you find yourself on the opposite side and may seek justice. Not most of the people are lucky enough to not have an issue at workplace which might require legal assistance.

There are multiple situations where people get fired in a mass layoff and were offered a severance package. This can be a perfect example why you need to have a lawyer. The way HR offers it might attract you but do not just sign it and agree. A lawyer can get you consultancy and can check the package for you and instead of getting a 6 months’ salary stated in the package you might get more.

On the other hand people without legal insurance may accept the package which is available. But if you have legal insurance you must consult the lawyer and get the things done the right way. After all, everyone has the right to seek justice.

So, having legal insurance can cover legal issues that may occur at the workplace. Few examples are:

- Getting terminated from your job without any reason.

- Getting a better severance package

- Salary difference in comparison to someone doing the same job as you.

- Getting a claim of your vacation days or outstanding salary due.

- Getting a negative reference letter or if your employer denies to send you a reference letter.

Private Legal Insurance in Germany

The following may be included in private legal insurance.

Dispute with Authorities

You may encounter a legal dispute as a result of a fine or for example if you disagree with the assessment done by the tax office.

It is important to know here that you can even sue the German Tax Office. Filing your tax return in Germany and getting the tax assessment from the German tax office where you’re being told the amount of tax you can get back or the amount which you have to pay.

It is not necessary that the German tax office will always be right. And yes, you can file an objection if you do not agree with the assessment done by the tax office. I have objected a couple of times and got my euros back.

This is to consider here that the tax office is being run by humans and there is always a chance that error can happen. Sometimes they might not consider some expenses which you can actually claim. In this case, you can file an objection and put up your argument as to why you think this expense can be claimed and if you have the legal assistance and the argument is justified. You can actually get thousands of Euros in terms of a tax refund.

Private Purchase Contract

An example of this can be a dispute which may result if you make an online purchase and receive a defective product or in case of a dispute of improper handyman services.

Internet Protection

An example of this could be a theft of credit card initials and or payment made without authorization and also if your private data is published without your permission or consent.

Criminal Law Protection

The accusation of an offense that is negligent can be dealt with private legal insurance.

Other Legal Support

Legal assistance can be of use if you get victimized in a crime and or something falls on you and hits you and gets injured and as a result, you lose your earnings. Private legal insurance will be able to claim compensation for the damage done.

Home Rental Legal Insurance in Germany

With this, you can get assistance in the following areas.

Dispute with the Landlord

Disputes with the landlord are very common where sometimes it may be observed that the landlord does not want to keep you in the house anymore or maybe the landlord may void the notice period. There may be a scenario where the landlord denies paying back the deposit you have made. Also, there may be a dispute with the landlord regarding utility expenses. Even if you don’t know whether the increase in rent is justified or not!

In such scenarios a home rental legal insurance can provide assistance. In Germany, there are a lot of rights that cover tenants but this will be of help when you have an understanding of the rights given. With the help of a lawyer, legal insurance will be able to protect your rights as a tenant. Or even if you are a Landlord, home rental legal insurance can help resolve a dispute with your property management company.

Dispute with the Neighbors

Having good neighbors is not always the case if you are not lucky. Neighbors can create problems that will result in disputes. Disputes may occur over the use of the common area or maybe due to creating much noise in the neighborhood. Home rental insurance can protect you in case of such disputes.

In a case, it was observed that a neighbor was upset because the person trimmed his tree in the garden and this went into the court as well and sued his neighbor. Even a small issue with the neighbor can result in a dispute and this is the reason to have home rental insurance.

Purchase of Real Estate

If you are planning to buy a house in Germany, a lawyer can review the purchase contract and your legal insurance can review it for you. Or if a seller is increasing the price after the contract is signed legal protection can be of help in this case. Also, the home rental insurance can help if the property is defective and you want to reverse the purchase.

Having home rental insurance is a must if you need to cover your rental property or if you have an investment property. This is a separate coverage from private legal insurance and some companies might let you have this as an add-on.

Traffic Legal Insurance in Germany

Having good driving skills does not ensure that accidents will not happen. And just having good driving skills does not guarantee how others on the road may drive. What if someone bumps into your car and claims that you’re at fault? Or what happens if the other person’s liability insurance company denies paying if you have an accident?

Having traffic legal insurance ensures the affordability to consult a lawyer in such cases. Or if you are at fault, the traffic legal insurance may be able to reduce the amount of penalty.

A traffic legal insurance covers traffic disputes related to drivers, buyers or owners of vehicles. Examples are:

- Disputes related to car dealership or buying car, repair or warranty claims

- Disputes related to traffic authorities, e.g. administrative penalties, withdrawing your driving license.

- Dispute in an accident as to who is at fault or damage claim and compensation as a result of suffering or pain in an accident

Choosing Your Legal Insurance

Private, professional and traffic legal insurance are usually offered as a single package by many of the insurance companies. But the decision of selecting the legal insurance should be based on your needs and requirements. Also, home rental legal insurance is usually provided as an option to add-on to your policy.

It is not necessary that legal insurance companies provide coverage that fits all the areas. So, in order to get coverage of what you need, you will have to think carefully about what is required. Does this also depend on the individual situation that you are in as if you are self-employed or not? Or do you have car ownership? What type of property do you own?

So, you need to go through the policy very carefully in order to get a clear idea of what you are getting and what is covered within the policy. Divorce law may not be covered and has to be purchased as an add-on if not included in the basic policy.

Cost of legal Insurance in Germany

Coverage level and the insurance provider determines the cost of the legal insurance. And it can get more and more expensive depending upon the add-ons you purchase. A basic legal insurance policy may cost less than 20 Euros a month. But, depending upon the policy a deductible amount of around 150 – 300 Euros may be required in case of a claim.

The price of legal insurance is quite affordable if we compare it with the legal costs in Germany which can easily cost thousands of Euros and are a source to provide peace of mind. It is also important to note that legal costs are determined by the amount in a dispute. Legal costs can get more expensive if the amount in the dispute is high.

Best Legal Insurance Providers in Germany

Getsafe and or Feather are the recommended legal insurance in Germany for expats because:

- Because they provide services in English

- Fully Digital

- Freedom to choose your Lawyer ( you can choose an English-speaking Lawyer )

It is important to note that both these have Euro 300 deductible in the initial year, which gets reduced by 100 Euro with no claim each year. In case of a claim, the deductible gets increased to 500 Euro in the following year (with a reduction of 100 Euro with no claim each year).

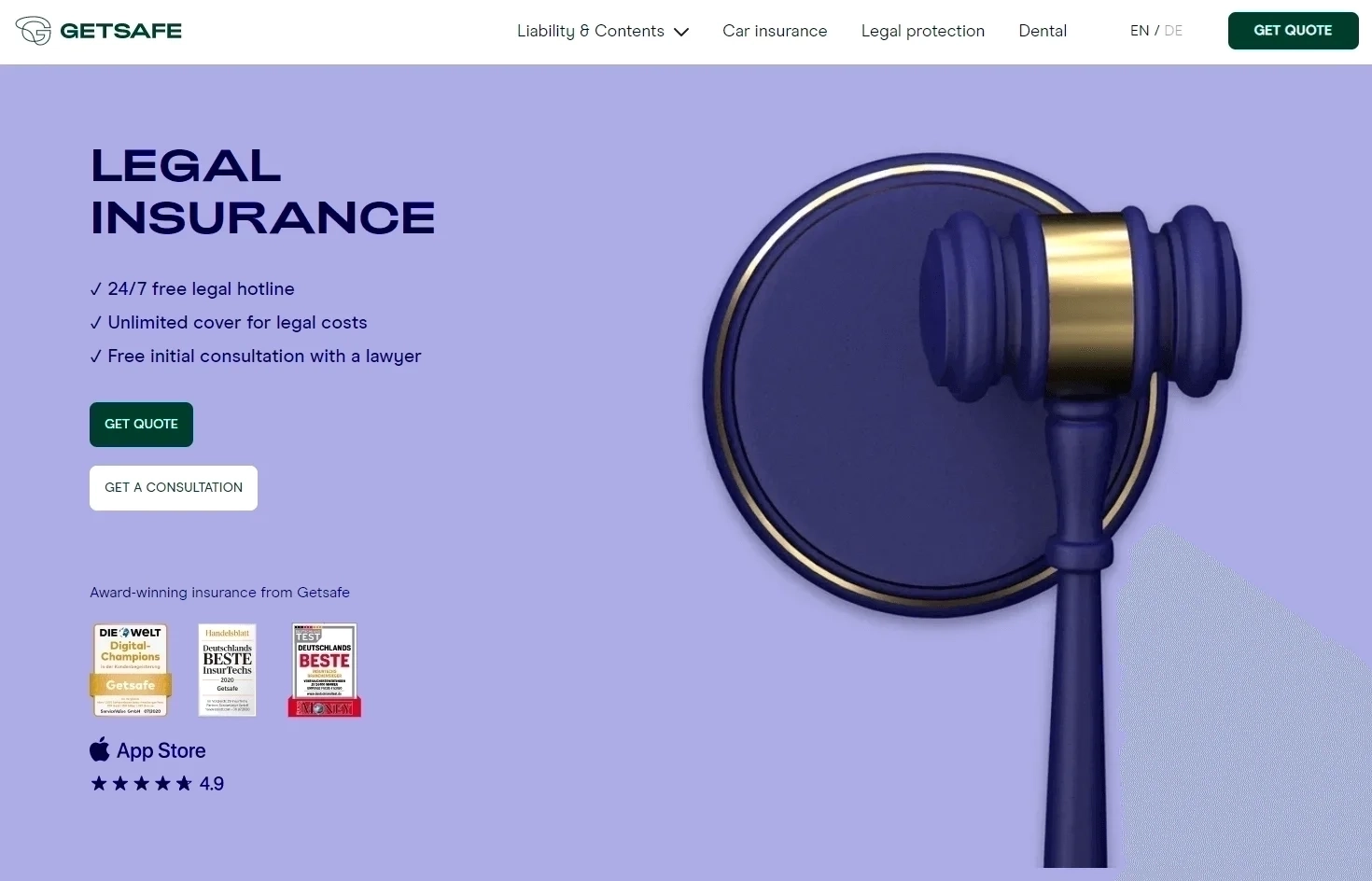

Getsafe

Initially started as an insurance broker in 2015, Getsafe offers its own digital products with which you can manage everything from your phone, which means there is absolutely no paperwork!

Key Features

- Claims can be filed within the app

- 24/7 legal assistance

- Private, Professional and traffic legal protection is included

- Add-on purchase of Criminal legal protection and Home legal protection can be made

Secure Your 15€ Discount with our PromoCode:

LIVEINGERMANY15

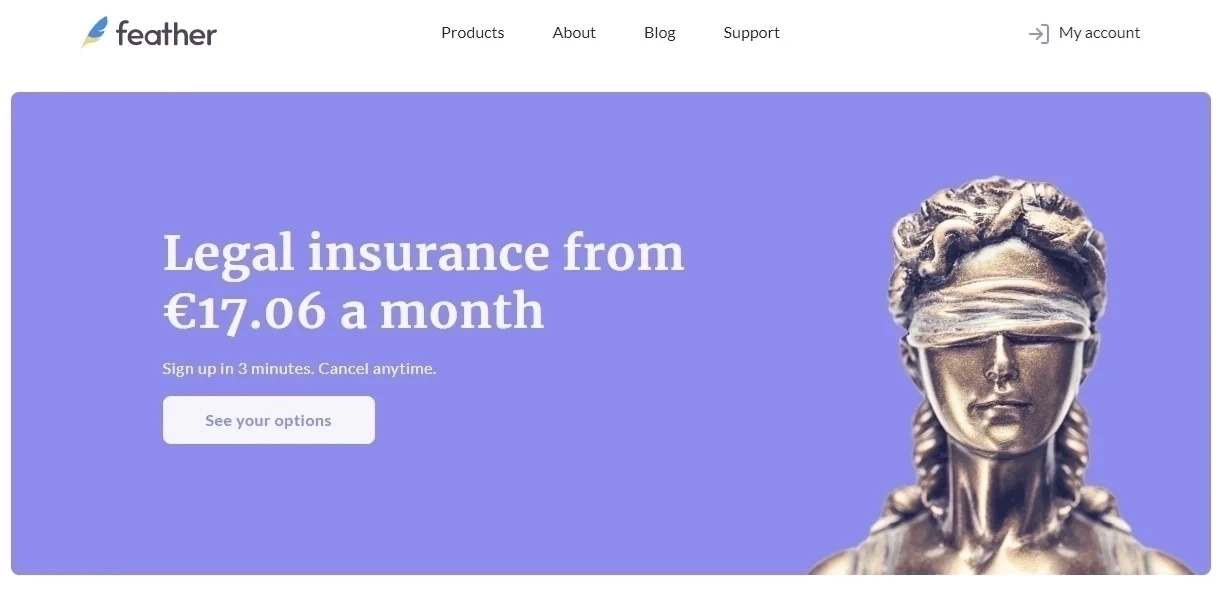

Feather

Starting in 2018, Feather offers multiple types of insurance with English customer support.

Key Features

- Professional, Private, traffic, and home legal protection is included

- Reduced waiting period by choosing advanced cover

Neodirect: An Overview

Neodirect is an insurance broker based in Frankfurt, Eschborn, and Berlin, offering a wide range of insurance products and services. They work with over 150 insurance companies to find the best coverage solutions for their clients. Key features include personal assistance, transparency, efficiency, and a user-friendly app for easy management of insurance matters.

Insurance Broker vs. Insurance Agent

- Insurance Broker: Independent intermediaries who work for clients, not insurance companies. Brokers offer policies from various insurers, focusing on finding the best solutions for the client’s needs.

- Insurance Agent: Representatives of specific insurance companies. Agents sell policies from the companies they represent, which may limit the range of options compared to brokers. They are knowledgeable about their company’s products and assist clients in selecting suitable policies.

Conclusion

Although there may seem like many types of taxes to pay in Europe and elsewhere throughout the world-the radio tax in Germany is an essential one that should not be overlooked. It could become really expensive if you fail to pay this radio fee.

Source: Witness vector created by pch.vector – www.freepik.com

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)