If you have moved to Germany, then you are likely to come across the term “SCHUFA score”. You will be soon asked about your SCHUFA score. SCHUFA score is of great significance in the lives of Germans. This article will explain to you everything about the SCHUFA score. At the end of this article, you will be crystal clear about all the queries related to SCHUFA score i.e., what is SCHUFA score, how to get this, and how to keep your SCHUFA score good.

SCHUFA – What is it?

SCHUFA is the abbreviation of Schutzgemeinschaft für allgemeine kreditsicherung. Its English meaning is General Credit Protection Agency. This agency is responsible to keep a track of all your payments. The agency monitors your financial behavior through your payments and checks your trustworthiness.

The SCHUFA Holding AG tracks and keeps your SCHUFA record. The holding automatically starts your SCHUFA record as soon as you make a payment contract. The company collects your financial record from different sources i.e., mobile phone companies, bank accounts, credit card companies, internet provider, etc. Then the company generates your financial report to describe how credible and reliable you are.

Your SCHUFA score depicts your credibility. So, make sure to keep it high. If you make a delay in paying your bills, or you miss your payments, you will encounter a decrease in your SCHUFA score. With a decreased SCHUFA score, you will put yourself at credit risk.

SCHUFA Report – How to get yours?

There are many ways to get a SCHUFA report. However, the method you use to get your SCHUFA report matters a lot. SCHUFA reports received from one method may not be accepted by all parties i.e., Landlords, banks, etc. So, make sure to get your SCHUFA report keeping in mind the purpose for which it is required.

Free SCHUFA Report

Every German resident has a legal right to get a free SCHUFA report every year. This is because every resident should be equally allowed to have a look at their financial record.

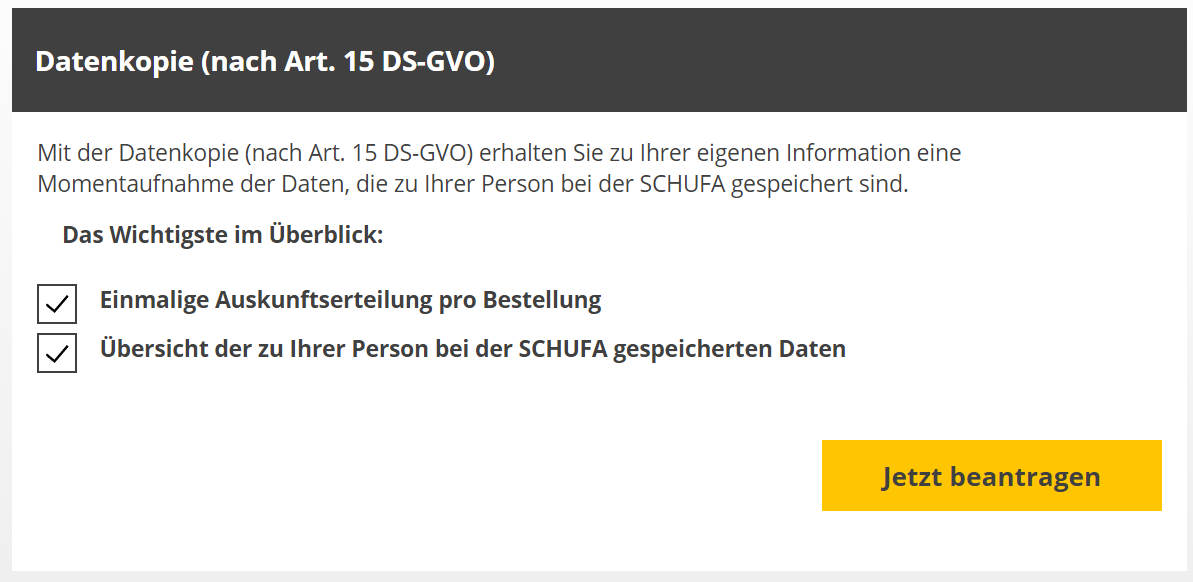

If you want to apply for a free SCHUFA report, then go to their official website to place your request. The report is called Datenkopie which means data copy. In the right column, you can see the option Jetzt beantragen. Click on this option and enter all your details on the next page that appears on your screen.

If you want to avoid excessive questioning from their side, you can upload your passport copy and Meldebescheinigung which is one of the papers from your registration. This will speed up the verification process at the website. Once you complete the application process, you will receive your free SCHUFA report via email. It may take a few days, so wait patiently for your free report.

This report is limited to your personal use. You can’t give it to any third party. For instance, if you want to rent an apartment, then you can’t give this free SCHUFA report to your landlord. This report is particularly for you. It allows you to check your financial record annually. However, for sharing your SCHUFA record with a third party, you will have to apply for the paid SCHUFA report.

Online SCHUFA Report

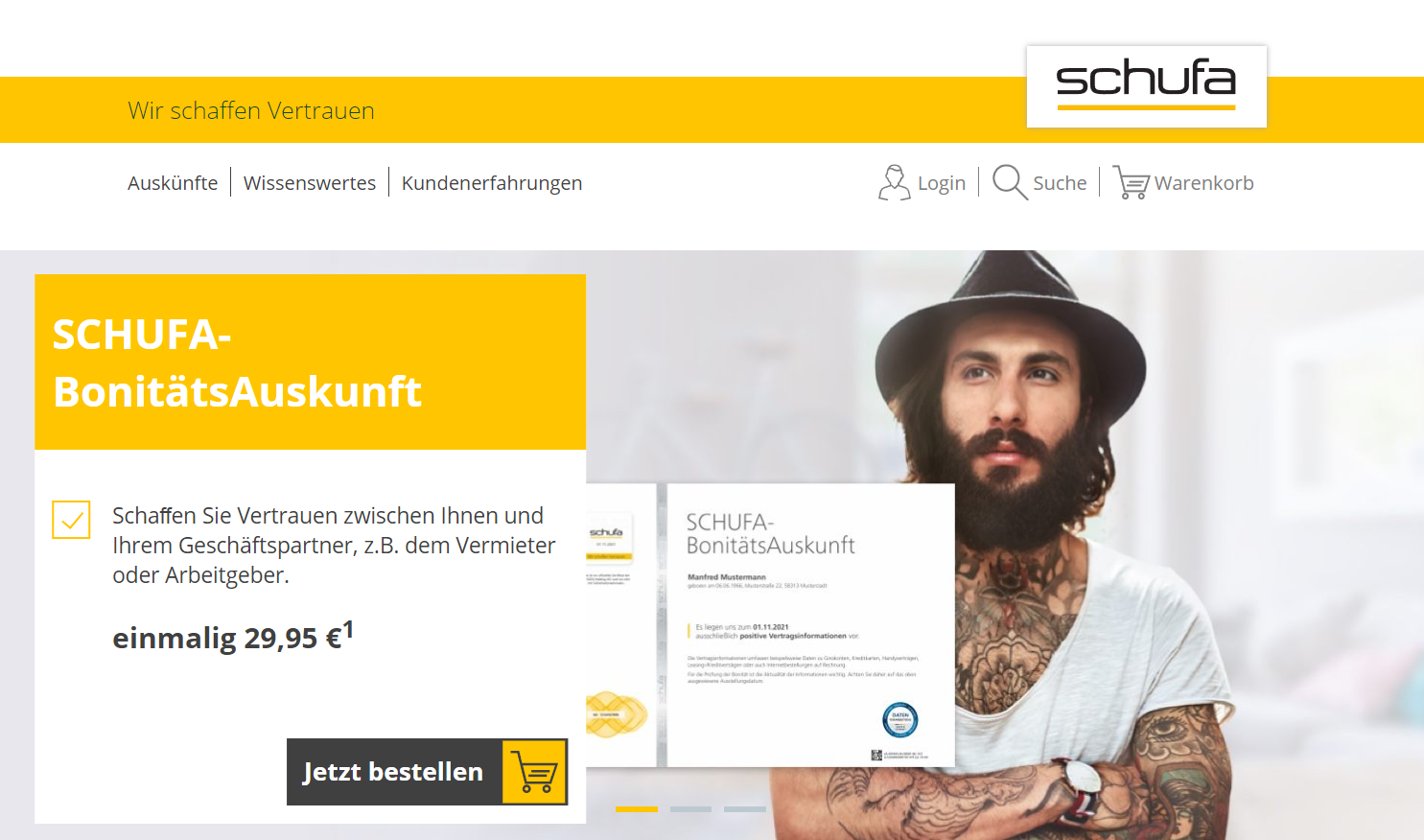

If you are in a hurry and you can’t wait for the free SCHUFA report to arrive in your mailbox after days, you can get a SCHUFA report online immediately. However, you will have to pay 29,95 euros to get an instant SCHUFA record.

Go to their official website and click on Jetzt Bestellen to order your Bonitätsauskunft record. Fill in your personal details and specify the payment method. Pay for this service and you will be able to download your SCHUFA record from the website instantly.

This SCHUFA report is acceptable to all the landlords. So, you can share the printed copy of this instant report with your landlord to prove your financial credibility. Also, you can mail a soft copy of this report to your landlord.

SCHUFA Report from the Bank

You can get your SCHUFA record from your nearest bank. Visit the nearest bank during working hours. Make sure to take your passport and Meldebescheinigung with you. You can easily receive your SCHUFA report from your nearest bank. The cost of this service is 29,95 euros.

It doesn’t matter whether you have an account in the bank you are visiting or not. Feel free to visit any bank near you. You only need to have a German bank account so that you will be able to pay 29,95 euros from your bank account.

Is a good SCHUFA score necessary?

Yes, a good SCHUFA score is vital to making a financial contract in Germany. Whether you want to buy a new apartment, rent a flat, buy a mobile phone or apply for a loan, you need your SCHUFA document for financial proceedings. If you have a good SCHUFA score, you will not face any hindrance to process with your financial matters. However, if you have a bad SCHUFA score, you will not be considered trustworthy in Germany. Your credibility will be questioned whenever you apply for a credit card or try to open a bank account with a low SCHUFA score.

A good SCHUFA score is a guarantee that you are likely to fulfill your financial responsibilities. Therefore, having a good SCHUFA score is necessary if you are in Germany.

What Percentage of SCHUFA Score is good?

Your SCHUFA score is also known as Basis score. When your financial record starts, you get an initial score of 100. It will remain 100 if you pay your bills on time. When you show an irresponsible attitude towards your financial duties, your score will start decreasing. For instance, if you make a delay in paying your bills, your SCHUFA score will decline.

If you want a very good SCHUFA score, it should be above or equal to 97%. Well, a 95% SCHUFA score is also good. You should keep your SCHUFA score above 95%.

A low SCHUFA score will depict that you are not credible and trustworthy. You will not be able to open a bank account or apply for a credit card with a low SCHUFA score. To save yourself from this frustration, you should keep your SCHUFA score as high as possible.

Here is the risk level associated with your SCHUFA score. Check your SCHUFA score and determine the credit risk level associated with it from the table below.

How to keep your SCHUFA score high?

It is crucial to have a high SCHUFA score. If you are looking for some tips to maintain a high SCHUFA score, then here you go with some recommendations.

- Make sure to pay all your bills on time. If you pay your bills late, it will reduce your SCHUFA score.

- If you have too many credit cards, then you need to cancel some of them. Only keep those that are necessary. Avoid keeping useless credit cards. Cancel those credit cards that are out of use.

- Don’t let your bank balance drop to zero. Instead, keep it healthy to keep your SCHUFA score high.

- Don’t open too many bank accounts. Particularly, avoid keeping inactive bank accounts if you want a high SCHUFA score.

- Don’t switch your bank accounts excessively. Switching a lot will urge you to mess up with your accounts. Consequently, you will reflect your irresponsible behavior in your financial record.

- Keep a check on your SCHUFA record annually through the free report. Make sure that it is free of errors. If you encounter any mistake in your SCHUFA record, place your objection immediately to get corrections in your record. It is your official right to have a correct SCHUFA record.

- Moving a lot can impose a negative impact on your SCHUFA score. So, avoid it.

- Take a bigger loan rather than taking small loans from time to time. A single bigger loan will have a lesser negative impact on your SCHUFA score as compared to many smaller loans.

Conclusion

SCHUFA score is a pure rating of your financial credibility. It depends on how you pay your bills and deal with your financial responsibilities. Your SCHUFA score determines whether you can buy a house on rent or not. It is your SCHUFA score that will determine whether you are eligible to receive a loan or not.