Best Personal Credit (Privatkredit) in Germany [2026]

Are you moving to Germany for your permanent stay or going on a vacation trip? Has a German company recently hired you? Are you a student moving there for your studies? Are you a business person visiting Germany for a business meeting? Are you worried about financing your wedding event? Do you want to furnish your apartment or want to buy a new microwave? Whatever the case, you would need to know about personal credit in Germany if you need that during your stay. You might need individual credit to fulfil your needs if you are short of funds. It can be a small personal loan to meet your regular expenses or a considerable amount to buy your vehicle. No matter the need, you can get personal credit in Germany. This article will help you to know all about personal credit in Germany, so do not skip and keep reading till the end.

If you are new to Germany and don’t know the language, you might find obtaining personal credit challenging. German’s financial system is also based on a system that makes it more organized, and foreigners find it a bit challenging to follow the set processes. This article will explain how you can quickly get personal credit in Germany. We will also give you important instructions that will help you compare different options so you can select the best choice for your needs. This article will also share the basic requirements you would be asked to fulfil while you are getting your credit. Other information like an instalment plan, interest rate options, fees, and costs, everything is explained ideally so you may get a better idea about obtaining personal credit.

Germany is a country that has significantly developed and organized systems compared to other countries. In the same way, the financial system is also very vast and developed. You will find a lot of traditional banks, and many other banks have adopted the latest techniques. Many banks provide English support to foreigners to better understand personal credit options and different kinds of loans in Germany.

Personal Credit Defined

Most personal loans are classified as fixed instalment loans. These loans are fixed, and the monthly instalments are the same. Personal credit is a loan that is given to a person privately. There are two categories providing loans and credit;

- Loan by a private person

- Loan by a bank

Let’s have a look at both types.

Loan by a Private Person

In this category, loans are provided by a private person. These private individuals have established platforms where you can submit your loan application. You can also get loans from your friends, colleagues, and relatives. It is also called peer-to-peer dealing, where you get credit or loans from private providers. Many providers are usually more flexible in terms and conditions just because they want more customers and market share. That is the reason behind the higher success rate of these private providers.

Loan by a Bank

The people who wish to get a loan apply online or physically at any bank or branch of the bank. The bank will consider various factors and approve the money if you meet all basic and legal requirements.

Key Points to Know about Personal Credit

Amount of The Personal Loan: A few personal loans are between 1,000 Euros to 50,000 Euros, but most loans paid out are between 7,000 Euros to 12,000 Euros.

Interest Rates on Personal Credit: The interest rate in Germany is comparatively low, as Germans and foreigners in Germany have to pay only an annual interest rate of 4% to 6%. Generally, the interest rate is between 1.99% and 19.99% depending on your chosen provider. A few loan providers offer zero interest rates, but the requirements of creditworthiness are really high.

Duration of The Personal Loan: The loan repayment period is between 12 months to 120 months, but in most cases, it is between 48 months to 60 months.

The Amount of Money You Can Borrow: All banks and financial institutions offer different amounts of money you can borrow. It depends on factors like your current job, background, and creditworthiness. Credit providers consider many vital factors before making a final decision on a loan application. Loan amounts vary for people with different income levels. Credit history plays a crucial role in the approval or rejection of your credit application and the loan amount you have mentioned on your online application form.

The Amount of Money You Can Borrow

All banks and financial institutions offer different amounts of money you can borrow. It depends on factors like your current job, background, and creditworthiness. Credit providers consider many vital factors before making a final decision on a loan application. Loan amounts vary for people with different income levels. Credit history plays a crucial role in the approval or rejection of your credit application and the loan amount you have mentioned on your online application form.

Rights of The Borrower in Germany: Germany is a developed and regulated country with rules and procedures for everything. They have a significant focus on consumer protection. As the consumers have to fulfil the legal requirements, they have specific rights. Here are the rights of the borrower;

- You can return the loan anytime you can. Keep in mind that there is a 1% additional fee for the outstanding amount of the loan, and your bank can charge this fee.

- A borrower can withdraw from a loan anytime within 14 days.

- Your concern regarding data protection and security is proper. You can ask your bank or financial institution for all data they have and confirm the protection of personal information before proceeding to the application process.

- If your credit application is rejected, you can ask for the reason for the rejection.

Let’s know the different kinds of personal loans and credit first.

Types of Loans and Personal Credit

There are five different kinds of loans in Germany, as enlisted below.

- Auto Financing

- Instant loan

- Personal consumer loan

- Personal credit line

- Housing loan

Let’s discuss each type of personal credit in detail.

Auto Financing

Autokredit / auto financing/car credit is a fixed installment loan. There are many options for follow-up financing and deciding on the final rates.

Instant Loan

Sofortkredit is also a fixed installment loan. The payout amounts are lower in this kind of personal credit. The lead time is down, and the processing method is faster than the other types of private credit.

Personal Consumer Loan

Ratenkredit is a fixed installment loan and the most common type in Germany. You get it when you look for your personal loan, and you repay the amount in monthly installments. If you go to the traditional banks, you will enjoy lower interest rates than the other big banks and financial institutions.

Personal Credit Line

Rahmenkredit is a personal credit line connected to a bank account overdraft. It can also be connected to a credit card with a specific credit limit.

Housing Loan

Immobilienkredit is another kind of loan that falls in the housing loan or financing category. If you need to purchase some real estate, you will get a housing loan to make a real estate purchase. Housing loans are different from consumer loans or personal credit. You can also find other kinds in our other article about Getting A Loan in Germany.

Eligibility Criteria to Obtain Personal Credit

Being a foreigner, you might be short of funds and need some credit to fulfil your personal needs. Getting personal credit in Germany is not a big deal if you meet the legal and credit requirements. Before you move towards the application process, you must consider the basic needs below.

- Minimum age is 18 years if you are looking to obtain a loan in Germany.

- You must be either a resident of Germany or must have a German address.

- You must have a valid national identity card and a valid passport.

- Valid phone number or email address for correspondence.

- You should show creditworthiness, and your credit history should not be doubtful or bad. Clean credit history makes it easier for credit providers to approve your credit application. Bad credit history will decrease credit offers and will increase interest rates.

- You must have a German bank account.

- You must earn a monthly income of a minimum of 600 Euros, which is a minimum income requirement for a few loan providers.

- Verification of personal information, income proof, and credit history is a must, so your identification and verification documents must be ready. You should have a pay slip or your bank account statement for income proof. If you are a student and moved to Germany for your studies, you should not worry about your income. There are other loan options for students who can quickly get personal credit to fulfill their educational and individual needs.

Application Procedure to Apply for a Loan

Well, there are different platforms where you can apply for personal credit. These platforms offer other loans with the collaboration of foreign banks, financial institutions, credit institutions, and private individuals. Whether you require a small or large amount, the process for both applications is not much different. To get personal credit, you need to go through the various steps of the application process as given below.

- Fill out the online application form.

- Choose the kind of loan.

- Attach or upload the required documents.

- Submit your application.

- Receive your credit.

Here is a brief discussion of each step of the application process.

Fill Out the Online Application Form

This is the first step of the application process, in which you must fill out an online application form. Technological advancement has made it easy, and there is no need to physically visit any office or bank for application submission. If you need specific information and support in English, you can call physically to fulfill your requirement. The application form will require basic information about you, like your name, address, contact details, occupation, and financial position. You will also need to give the relevant information regarding the loan, for example, the amount of the loan, duration, or the timeframe, and the reason for obtaining the personal credit.

Choose The Kind of Loan

You will get different options to select a loan based on the information in the online application form. Your application approval also depends on Germany’s financial position and stay period. If a loan is not suitable and possible in your case, you will not get an offer for that specific kind of credit.

Attach or Upload the Required Documents

In this step, you will need to upload the required documents to showcase that you have entered the exact information. This step will verify the details in your application form and prove your identity.

Required Documents

When applying for credit, your lender will ask you to submit several important documents. The requirement to submit documents varies from lender to lender. The list of a few of the primary documents is given below;

- Salary statement or payslip

- Valid identification document (identity card or a passport)

- Proof of creditworthiness (SCHUFA)

- Pension certificates in some cases

Submit Your Application

Once you complete the verification step, you must sign your application. Online signatures are compulsory before you submit your loan application.

Receive Your Credit

The authorities will carefully review your application, and you will get your requested amount through your bank within 24 hours in most cases.

Important Instructions

You must be very careful when applying for personal credit, as no mistake should exist. There are essential points that you must keep in mind when going through the process of getting personal credit. These are the crucial instructions, so you can make a good decision.

- Improve your credit rating and prepare yourself for all relevant negotiations.

- Make a practical reason why you need a loan. Your purpose will make it easy for lenders to approve your application.

- There are many options, so always compare and choose the best option according to your needs and requirements.

- Different loan providers offer different interest rates. Compare the plans and offers and select the best option to avoid additional costs and charges in terms of a higher interest rate.

- Repay the installation amount and interest rate well in time to avoid fines and additional charges.

- Make a detailed financial plan, as you have to repay the loan in monthly installments. Your financial plan should be realistic.

Top Personal Loan Providers in Germany

After getting all the information, you will be looking for the best providers in Germany. No worries! We have mentioned a few of the top loan providers that might help you in your loan application best. You can contact any of the below credit providers even if you are a foreigner in Germany. The list of the top loan providers is given below;

- Smava

- SWK bank

- 1822 direkt

- Auxmoney

- Verivox

- Tarifcheck

Let’s discuss them one by one briefly.

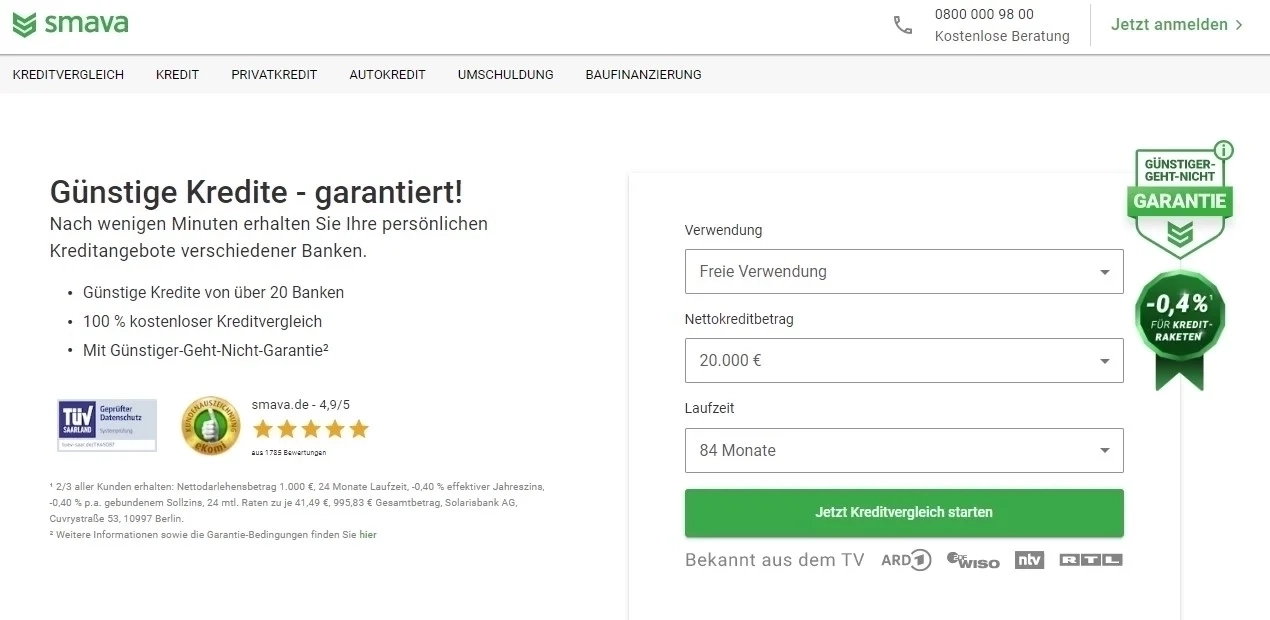

Smava

Smava is the most accessible loan calculator, where you can easily calculate your loan, monthly installments, and interest rate. You can also compare, select, and apply for the best offer according to your requirements.

Pros of Getting a Personal Loan with Smava

- Interest rate ranges between 0.4% to 10.9%.

- The process to apply for the loan application is free of cost.

- Your credit score will remain the same even if you do not continue your loan application.

- Smava offers loan options for self-employed persons.

- They offer loans with the collaboration of different banks, so their terms and conditions are also flexible.

- Their lead time is so fast, usually 14 days.

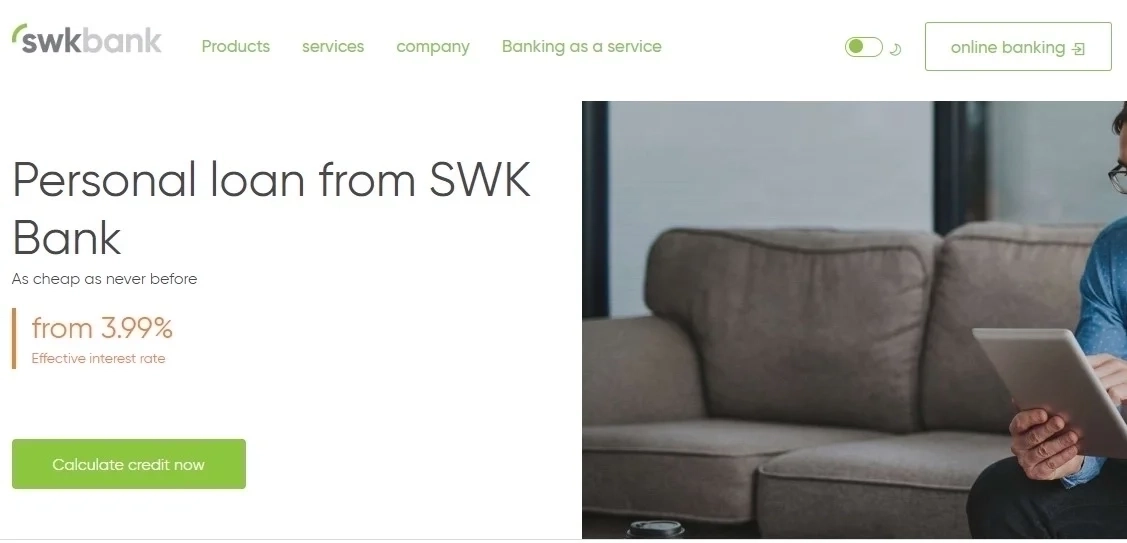

SWK Bank

SWK bank is one of the largest banks in Germany.

Pros of Getting a Personal Loan with SWK Bank

- They have almost 20,000 positive reviews that show their reliability and quality.

- They have over 60 years of experience in their loan-providing services.

- Their complete process to apply for a loan is online and based on a digital system.

- Their process is quick, and the application is straightforward.

- They offer an interest rate of 1.54% to 3.99%.

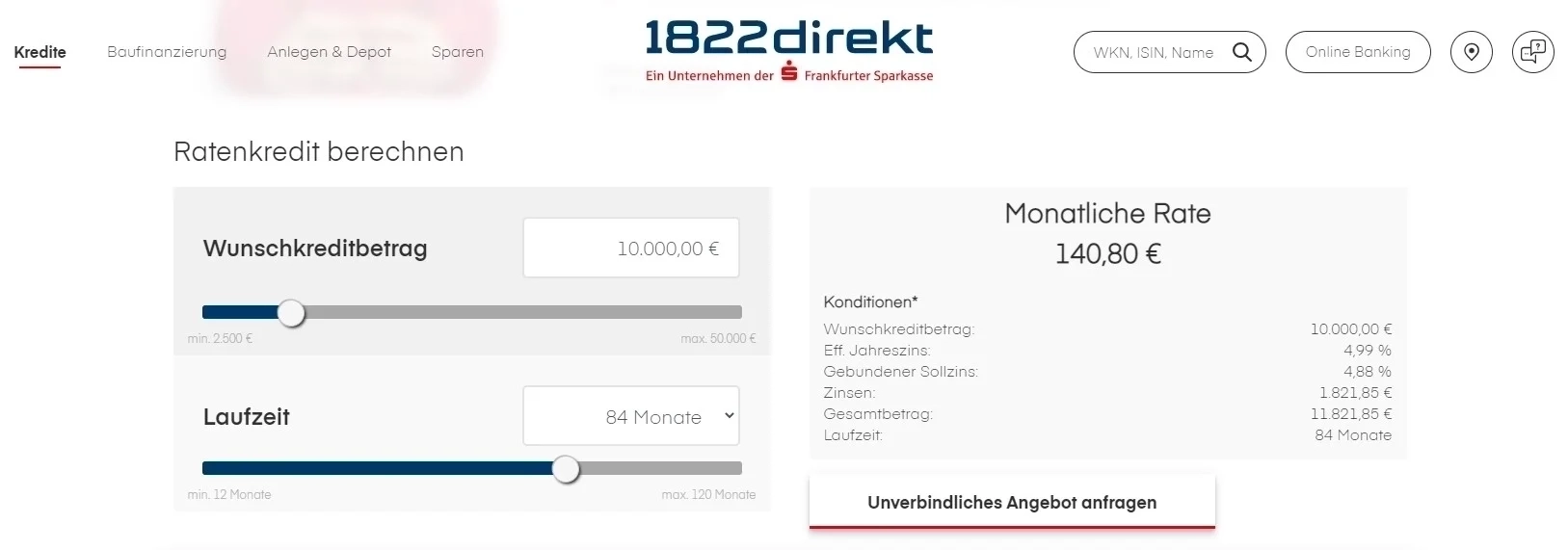

1822 Direkt

This is part of a German bank named Sparkasse bank. Their loan duration varies between 12 months to 120 months.

Pros of Getting a Personal Loan with 1822 Direkt

- They offer an interest rate of 2.49% to 7.31%.

- Customers usually get loans without delay, and the favorable terms and conditions.

- They offer free and significant benefits to their clients.

- You can get debit and credit cards whenever you want.

- Their application process is online, and you do not have to physically visit the branch or office.

Auxmoney

Auxmoney was established in 2007 and provided an online platform to its customers. It is also the easiest way to obtain personal credit.

Pros of Getting a Personal Loan with Auxmoney

- They do not have high costs like other traditional banks.

- The process to apply for a loan is simple, fast, straight, and straightforward.

- They also offer loans to people who have a credit score.

- Their success rate is high as compared to the other credit providers.

- You can use the money you get for any purpose.

- Their rating is 4.8 out of 5 regarding services and satisfied clients.

- Their interest rate fell to an average of 4.42%.

Verivox

Verivox is the platform that offers loan comparison services with many other benefits. While comparing different options, you can choose from foreign German banks.

Pros of Getting a Personal Loan with Verivox

- Their interest rate starts from zero.

- There is no requirement to submit your documents.

- Their system is entirely digital and online.

- If you want to pause your payments, you can do it quickly.

Tarifcheck

It was founded in 2001 and is one of the largest platforms in Germany.

Pros of Getting a Personal Loan with Taricheck

- Interest rate falls between 0.68% to 5.99%

- Clients can compare a lot of loan options through this platform.

- The application process is so simple that you just need to select the duration and amount of the loan.

- The success rate is high among other loan providers.

Wrapping Up

So, this is it. There are several personal credit providers in the German market. You can follow the guidelines and instructions to choose the best option, but make your final decision after careful comparison. Be careful when you are sharing documents and applying for personal credit. Make your repayments in time to avoid any inconvenience. We hope this article gives you the information you need.

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)