Best Bicycle Insurance in Germany [2026 List] - Live In Germany

Not everyone loves cars, and you might have friends and people in your surroundings who love to ride the cycle. There may be less number of cyclists on the roads of your home country, but if you are travelling to Germany, you will see a lot of cycles on the roads of Germany. Let us share that the preferred mode of transport is a two-wheeler in Germany. Suppose you are impressed by the cyclists in Germany and are planning to buy your cycle. In that case, you must have your cycle insured for better protection, security, and recovery of the losses or damages.

List of Best Bicycle Insurance in Germany

Biking is very popular in Germany. Germany has specific road lanes for cyclists, and the discussion about improving the cycling infrastructure is always the main concern of political meetings. The number of bicycles, especially e-bikes, is increasing daily, but everyone is buying with a different purpose. People are buying two-wheelers either for work or leisure. Are you an expat looking for the best insurance options in Germany? If yes, you can find this article helpful. There are two basic ways to get bike insurance in Germany;

- Home content insurance

- Independent bike insurance

Let’s see the list of best bicycle insurance in Germany.

- Helden

- Hepster

- MVK

- Feather

Need Advice on Buying a Cycle in Germany?

Check out our detailed article on Buying a Bicycle in Germany.

Helden

Helden is an insurance service provider based in Hamburg. It was founded in 2016, and you can customize its insurance policy according to your needs. Customers can find it all in one insurance plan that fulfills all the customer’s requirements. You can get insurance for any bike you have, whether it is old or has a carbon frame. Their process is very quick and paperless.

](https://out.liveingermany.de/helden_fahrrad)

Benefits of Helden

- If you have a 3-year-old bike, you can get it insured through Helden.

- There is no lock requirement to get insurance if you choose Helden.

- You will have no deduction in your insurance policy.

- If you choose Helden’s insurance plan, you can enjoy an additional pick-up service.

- You can get insurance for your old and second-hand bicycles too.

- Customer support is available in English.

- You can cancel your insurance policy anytime.

Drawbacks of Helden

- Bikes older than 3 years are not included in insurance plans by Helden.

- The website is only in German.

Insurance Coverage by Helden

Coverage is available for;

- Bike parts

- Battery protection

- Luggage

- Bikes used for sports purposes

- Accessories

- Damages due to accidents

Hepster

This German insurance company was founded in 2016, offering insurance services for sports equipment at a higher cost. They strive for excellence with a vision to create the best experience for their valued customers. They are successful due to their modern technology, quality services, and efficiency. Their insurance has a very quick and online sign-up process covering theft, accidents, and wear and tear. They offer their services both for casual bikes and E-bikes.

](https://out.liveingermany.de/hepster_fahrrad)

Insurance Subscriptions by Hepster

This option is very good for those needing an insurance plan for a specific period, for example, summer, race, or tour. They offer two kinds of covers, as mentioned below;

- Monthly subscription

- Annual subscription

You can choose an annual subscription due to the given key facts.

- They offer one-time protection of 7 to 30 days.

- Annual cover starts from 5 Euros per month (60 Euros per year).

- The price and rate also depend on the price of the bike.

- There are no deductions if you have an annual subscription to Hepster.

- You can cancel your subscription after three days when one year of the contract has passed.

Insurance Coverage by Hepster

Coverage is available for;

- Bikes with carbon frame

- Spare parts of your bicycle

- Both private and professional use

- Both borrowed and rented bike

- Bike accessories

- Battery protection

- Luggage

Benefits of Hepster

- It is a great option for those with expensive bikes or bicycles, even 10000 Euros.

- It covers losses due to theft and burglary.

- They pay for the wear and tear due to accidents.

- There is no limit on the purchase price of the bicycles.

- They also protect bikes with carbon frames that other insurance companies do not offer, so it is one of the best bicycle insurance in Germany.

- There is no age restriction by Hepster.

- They pay for the restoration value of the bicycle.

- They offer their services worldwide.

- Their customer support and protection are available 24 hours.

- If your bike is older than 1 year, you must wait for 6 weeks to get your bike insured.

Drawback of Hepster

- The major drawback is that the website is only in German.

- Hepster does not offer customer support and application in English.

- Protection against wear and tear has a waiting time of 4 months.

- Wear and tear is only for bicycles not older than 3 years.

MVK

MVK is a very old company with a history of almost 120 years as it was founded in 1899. They offer their services for both casual and common bikes as well as for E-bikes. Their plans are classified as classic and top. If you are cost-conscious, MVK is a great option, as bike costs are low. The classic plan is for those who do not love to travel, as it does not include breakdown services.

](https://out.liveingermany.de/mvk_farrrad)

Insurance Coverage by MVK

Coverage is available for;

- Parts of the bicycles

- Tire, brake, and gear damages in case of E-bikes

- Battery protection

- Damages due to accidents, wear and tear, and vandalism

- Private bikes only

Benefits of MVK

- You can get both your new and second-hand bike insured.

- The age limit for insurance of old bikes is 3 years.

- You will find zero deductible amounts.

- Pick-up services are available.

Limitations of MVK

- An optional breakdown is included.

- Bikes beyond 3 years are not acceptable in any of the insurance policies.

- You cannot use a number lock for your bike.

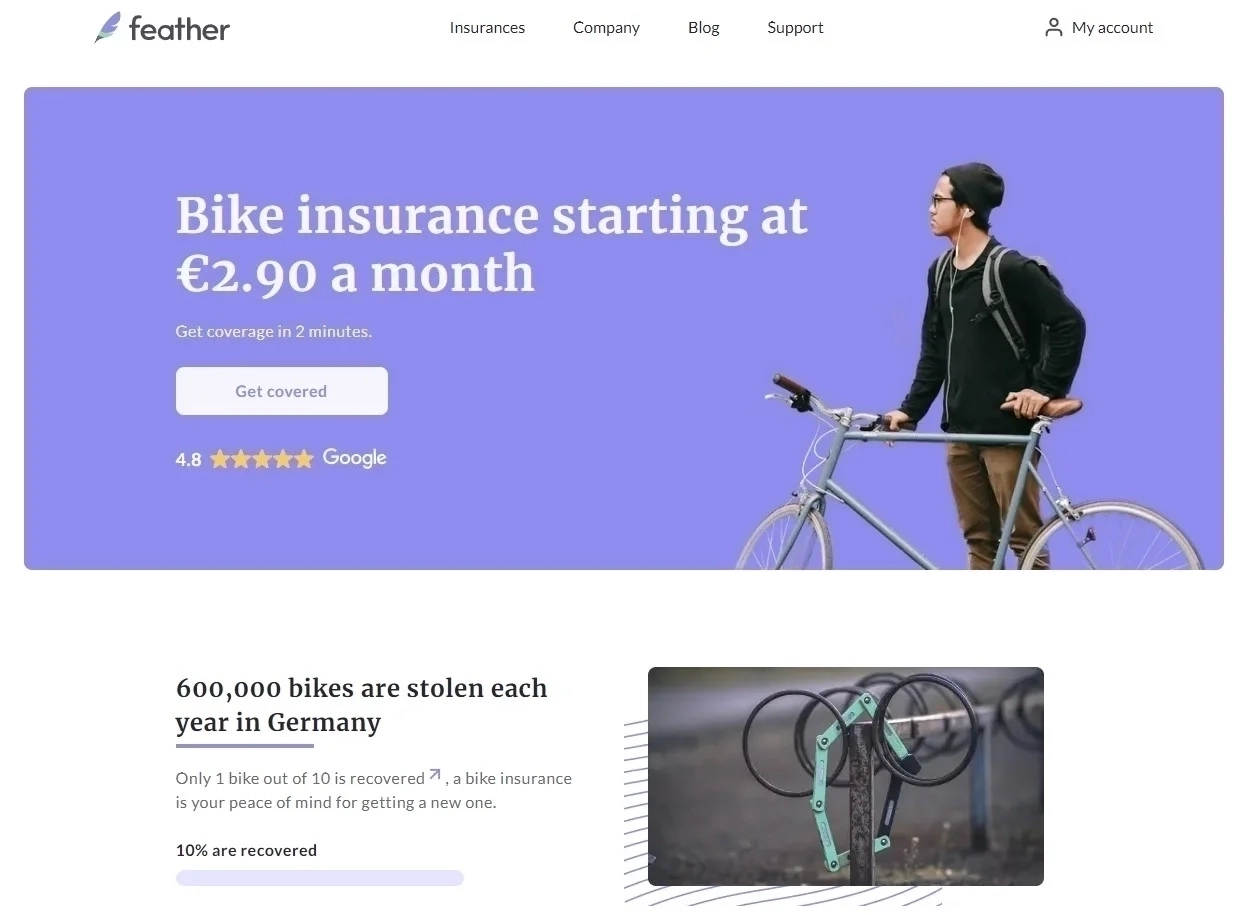

Feather

This digital insurance company provides quick, easy, crystal clear, and customer-oriented services. Their consultation is fully transparent irrespective of the gender, income level, or nationality of the client. Customers can easily check the website as they provide an English version. They do not deduct anything from the customer’s insurance. Their process is very simple, easy, quick, and paperless.

Insurance Covers by Feather

Insurance coverage by Feather includes coverage for

- Parts of the bikes

- Battery protection

- Damages due to wear and tear and vandalism

- Private bikes only

They offer two kinds of covers, as mentioned below;

- Basic cover

- Comfort cover

Let’s discuss these covers one by one.

Basic Cover

Their basic insurance starts from 290 Euros per month. A cycle holder can secure themselves from theft with a basic insurance cover.

Comfort Cover

The comfort cover protects the customers from accidents and wear and tear losses. The comfort cover has a lot of benefits and disadvantages. Keep reading to learn about the benefits and disadvantages of comfort insurance Feather covers.

Benefits of Feather Comfort Cover

- Insurance pays the restoration cost of the bicycle.

- It covers a bike that is up to 10000 Euros.

- It covers damages due to theft and burglary.

- They offer an English version of their website.

- They provide customer support in English.

- They offer a customer-focused application for the ease of their clients.

- Insurance provides protection 24 by 7.

- It offers coverage worldwide.

- Customers can cancel it at any time.

Disadvantages of Feather Comfort Cover

- The waiting time for wear and tear protection is 6 months.

- The customer is asked to lock the bicycle against an immovable object to get benefits from the insurance.

- The minimum value to get insurance must be more than 29 Euros.

- You can get your bikes insured if they are 0 to 6 months old.

- They do not offer insurance for bikes with carbon frames.

If you want Feather insurance, buy your bicycle from an official retailer. There is no recommendation for second-hand options as they are not in very good condition for the insurance plans.

Cost of Bike Insurance by Feather

The cost of bike insurance by Feather depends on the price of your bike and the type of bike you have. There are two kinds of bikes; standard bikes and E-bikes. You can easily calculate the cost of your insurance by visiting their website. The website has a calculator where you can click on the option of the bike you have and type the price of your bike; the calculator will tell you the cost of your basic and comfort cover.

Short Summary of Best Insurance Options

| Key Point | Helden | Hepster | MVK | Feather |

|---|---|---|---|---|

| Age requirement | 3 years | 1 year for casual bikes, 3 years for E-bikes | 3 years | 6 months |

| Second hand bikes | Acceptable | Acceptable | Acceptable | Not acceptable |

| Service availability | 24 hours | 24 hours | 24 hours | 24 hours |

| Breakdown or pick up services | Available | Different policies for both | Optional services | Not available |

| English website or customer support | No | No | No | Yes |

| Deductions | Zero | Zero | Zero | Zero |

| Notice period | Not applied | 3 days | 3 months | 3 months |

| Duration of the contract (duration to cancel the contract) | On daily basis | 7, 14, or 30 days; 3 months for E-bikes, 1 year | 1 year | 1 year |

| Worldwide availability | Yes | Yes | Only for 6 months | Yes |

Benefits of Cycling

No matter if you never ride a cycle in your home country, you can ride it if you travel to Germany for business, work, or a permanent stay. There are several benefits associated with cycling that you can enjoy while cycling. A few of the benefits are mentioned here.

- It provides strength to muscles and bones.

- Cycling keeps a human being active and healthy.

- It reduces stress levels.

- It enhances joint mobility.

- It is environmentally friendly as it causes no pollution.

- Cycling helps to reduce fat in the body and lose weight too.

Best Time to Get Your Bike Insured

It is highly recommended to get your bike insured when you buy it, which is new. First, you must get insurance against the theft of your bicycle. If you are new to Germany and have no idea about the best bicycle insurance in Germany, you need to check your home content insurance. You may have bicycle theft insurance added to your home content insurance. If it is not included in that, you need to find an insurance provider to get separate bike insurance for better protection of your bicycle.

Reasons to Get Your Bike Insured

One of the reasons is that Germans are more concerned about their environment, so they are highly interested in cycling to keep the environment safe and clean. Germany is a great and well-developed country, but theft cases are common. If you are moving to the larger cities of Germany, you will hear about theft cases on and off. There are few stats as per records of 2020

- Loss due to theft was 110 million Euros

- Stolen-insured bicycles were 145000.

- The average price of a bike was 730 Euros.

- Cologne, Munich, Hamburg, Berlin, and Leipzig were major cities with theft cases.

A comparison of reported cases and solved cases is given in the below table;

| Cities | Reported Cases | Solved Cases |

|---|---|---|

| Munich | 6050 | 604 |

| Cologne | 7587 | 532 |

| Leipzig | 9129 | 861 |

| Hamburg | 14576 | 581 |

| Berlin | 27588 | 1285 |

According to 2021, * 125000 bikes were lost. * The total damage was 110 million Euros. * The average loss was 860 Euros per theft. * Twenty-five thousand cases were reported in Berlin, the highest among all cities.

Damages Not Covered by Bicycle Insurance.

Before you sign a contract, you need to know the losses or damages you need to bear yourself. Below is the list of damages not covered by the bicycle insurance.

- Damages made by yourself or intentional losses

- Expenses due to maintenance and inspection

- Losses due to another third party, for example, the manufacturer of the bike, fixing a defect in the bike.

- Scratches, painting, rust, or oxidation

- Damage beyond the insured amount or sum

- Damages during race or cycling competitions

- Loss due to not using an approved or appropriate lock

- Damage if the stolen bike case is not reported to the police.

- Damage to another third party

Wrapping Up

So, this is the end of the article. Now, you have a better idea about cycling in Germany, benefits linked to it, and you can easily choose the best bicycle insurance in Germany. Bike theft is common, unfortunately, especially in Berlin. So, whenever you plan to buy a cycle, you must gather all the insurance information to get it insured right after you buy it online or from a local retailer. Take care and get your important asset secured by an insurance company.

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)