What is Tax ID and Tax number in Germany? [2026] - Live In Germany

The tax ID and tax number are two unique numbers for distinct purposes used in Germany. In this article, we will be explaining the need for both numbers and their differences. We will also discuss what freelance tax and VAT numbers in Germany are. The tax ID (steuerliche Identifikationsnummer – IdNr) is an essential requirement for expats. This includes both the living and working class. The Federal Central Tax Office issues a unique number to all who are registered in Germany so that taxes can be administered.

What is a Tax ID? (Steuer-ID)

In order to streamline and centralize the taxation, Germany introduced the concept of tax ID in 2007. The earlier tax ID numbers were replaced in all aspects of income tax. The tax ID numbers issued before 2007 are considered valid still. On the other hand, they are being phased out gradually.

The Tax Identification number (Steueridentifikationsnummer) is assigned to every resident of Germany, it doesn’t matter if you are a German or not. After your city registration, you will get a Tax Number in a few days from the German tax office (Finanazamt). This number is used by the tax authorities to identify you. The format looks like “12 345 678 901”. The tax ID is permanent; it never changes. One thing to keep in mind is that whenever you are filling any form and your see these names

- Steuerliche Identifikationsnummer

- Persönliche Identificationsnummer,

- Identifikationsnummer

- Steuer-IdNr.

- IdNr

- Steuer-ID.

Then this means that you need to write your Tax identification number here.

The tax ID is required by the employer in order to calculate income tax. In case you don’t have a tax ID, more income tax will be charged to your salary from your employer. The excess amount charged can be returned once you file a tax return. The tax ID isn’t an essential requirement when starting to work somewhere. But some employers are unaware of that.

How Can You Get a Tax ID?

Upon registering for the first time, tax ID is issued automatically. People, either working or staying for more than 3 months, need to register their address at Bürgeramt. This is a local citizen’s office. The exercise has to be done within 14 days of arrival.

When registering for the tax ID, a legal form of identification is required. An identity card or a passport is included in this. Proof of residence certificate (Wohnungsgeberbestätigung) is also required. Upon registering successfully, you will receive a registration certificate (Anmeldebescheinigung). After registering at the Rathaus , the tax ID will be delivered to you via postal service. This could take around two to four weeks.

Where To Find Your Tax ID?

Following are the documents where the tax ID can be found easily:

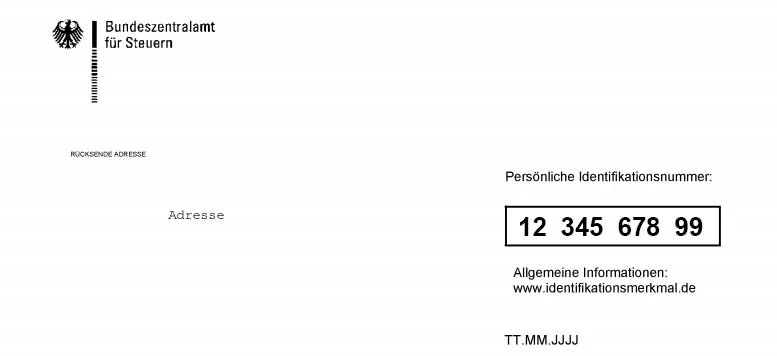

- After your first city registration, you will recieve this document from the Federal office of Tax (Bundeszentralamt für Steuern) in Germany. You can find your 10 digit tax id on this piece of paper. We would recommend to put this paper in your important documents file, because every time you need to contact German tax office then you need this number for your correspondence.

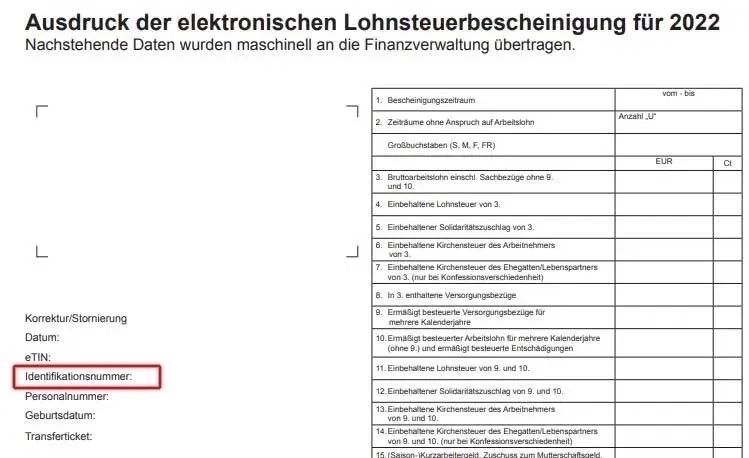

- In case, you don’t have that tax id document then you can also find your tax id, on your income tax report (Einkommensteuerbescheid)

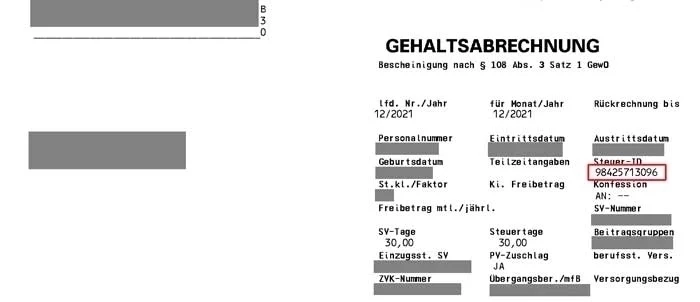

- Other than that, you can also find the tax id on your payslips (Gehaltsabrechnung). If you want to know how to read your German salary slip then check out this Guide.

On your payslips Gehaltsabrechnung * On your Entgeltabrechnung * Your employer and your tax advisor know your tax ID.

What happens if I Lost my Tax ID?

If the documents mentioned above have been lost or misplaced by you, a new tax ID can be retrieved for free. You will have to request a new letter to Finanzamt for that. An online form needs to be filled out for this purpose.

The duration of arriving at the tax ID takes around six weeks. If you are in a hurry or need the tax ID for something important, you can head over to your Finanzamt for inquiry. If your tax ID is ready, they will print it for you then and there. To know your assigned Finanzamt, you can enter your postal code in the search bar.

What is a Tax Number? (Steuernummer)

In Germany, the tax number (Steuernummer) is assigned to an individual by a local tax office (Finanzamt). Compared to Tax ID, this number is not a permanent number because it changes when you change the city, but as long as you are in the same city, this tax number stays the same. The tax number helps Finanzamt in the rapid identification of records. For instance, when filing for the tax declaration. Tax returns need to be filed every year, whether it is mandatory for you or not depends if you are self employed or not. If you are an employee then you can use online Tax return platforms in Germany to file your tax return. For self-employed, we recommend GetSorted

In case you never filed a tax declaration, chances are you don’t have a tax number yet. The format of the tax number depends upon which German state you are residing in. The format looks like 122/1523/5965 and it usually has 10 to 11 digits. However, in the unified federal format, there are 13 digits in 5133081508159 formats.

In case you move to a different city in Germany, you will be assigned to a new tax office (Finanzamt). They will then provide you with a new tax number. After getting married, you will have to file a joint tax declaration. At that time, you will get 1 tax number together.

Where To Find Your German Tax Number?

After filing your first tax declaration, you will be issued a German tax number. With the help of tax authorities, you can find that on your tax assessment (Steuerbescheid).

How Can You Get a Tax Number?

When your business is registered with Finanzamt, you get a Steuernummer. Around 4 to 6 weeks later, you receive your tax number by postal service. In case it gets later than that, you can simply approach your local Finanzamt, either on phone or in person.

As mentioned before that this Tax number (Steuernummer) is unique till you are in the same city or your marital status is not changing. if anything changes then you get a new tax number (Steuernummer) so in simple words, this number is not a permanent number like Tax ID. In case your business has been moved to a new area according to Finanzamt, a new Steuernummer will be assigned to you.

Tax ID vs Tax Number

It has to be noted that there is a difference between a tax number (Steuernummer) and a tax ID. The tax number is a unique number used by freelancers for tax returns and invoicing. The tax number is also sometimes called freelance tax number. The format is 00/000/00000. As previously mentioned, the tax number relates to your responsible tax office and the area you live in. in case of a change of address, the tax number will change as well.

Moving forward, the tax number is planned to be phased out. It will get replaced entirely by a tax ID. At the moment, the ones who are self-employed do have a need to keep tax numbers too. There is a questionnaire for tax collection (Fragebogen zur steuerlichen Erfassung) which you can submit to get your tax number.

What Is The VAT Number In Germany?

The Value added Tax (VAT) number in Germany is called Umsatzsteuer-Identifikationsnummer or in short USt-ID, you will also find this short version on some of the receipts which you get from the supermarket . It is a 9-digit number starting with the country code (DE for Germany): DEXXXXXXXXX.

The VAT number is essential for every business operating outside Germany and within the European Union. On the other hand, you don’t need a VAT number if you have registered a side business (Kleingewerbe) or are only operating in Germany. It is necessary to place the VAT number in each invoice and the Impressum (imprint) of your website.

In order to obtain a VAT number, a questionnaire for tax registration (Fragebogen zur steuerlichen Erfassung) needs to be filed. Make sure you tick the relevant boxes. This form is filled out when registering for business.

In case you have any further questions related to tax concerning your business, it is advised strongly to consult with a certified tax consultant.

What Is The Freelance Tax Number In Germany?

Adding some further information to confuse, there is one more kind of tax number. This one is obtained when you register your self-owned business as a freelancer. This number looks the same as it does with the non-business tax number first received with the tax assessment. The provided freelance tax number has to be mentioned on all invoices.

When you register yourself as a freelancer or as a business by the German Tax Office (Finanzamt), you will get a 7 page long questionnaire called Fragebogen zur Steuerlichen Erfassung (questionnaire for tax registration). In this form, you have the option whether you want to apply VAT number or not. If you are going for the small company (klein unternehmer) then you can also tell finanzamt about that using this form.

Conclusion

In this guide, we have tried our best to give you an overview of all type of Tax IDs and numbers which you get in Germany like tax ID (Steuer-ID) is a unique ID which stays with you till your stay in Germany. Next, we have a unique tax number (Steuernummer) until you change the city or your marital status. After that, there are other numbers associated with self-employment like Steuernummer for self-employed and VAT number. There are all different numbers and each serves a different purpose.

Source: Customer vector created by vectorjuice – www.freepik.com

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)