Insurance Brokers vs Insurance Agents in Germany [2026]

When it comes to having insurance, you might look for the easiest way to get it. An agent or a broker is the most convenient way as they will do everything according to your needs. If you are looking for the difference between an insurance broker and an insurance agent, you have landed on the right page. This article will describe the terms “insurance broker and insurance agent”, along with the difference between both and how you can find one to get the desired and required services. Let us move towards the article so you may have information without spending much time.

Insurance Brokers and Insurance Agents

Both terms are used for almost similar professionals. An insurance agent or broker is a certified and licensed professional who helps small businesses get insured. They both sell insurance and are specialised in specific areas of interest like property and casualty insurance. This kind of insurance is for the protection and security of small businesses from lawsuits and property losses. Both insurance agents and brokers are licensed in the state of residence and are bound to comply with all the governing rules, regulations, statutes, and legal formalities by the government of the state they live in. As a small business, they also need to have small business insurance for themselves. Small business insurance helps business people to operate in many locations.

Whether you choose an insurance agent or an insurance broker, both are responsible for helping you get and choose the best insurance plan for your needs and requirements. Let’s know about each professional separately.

Insurance Broker

Insurance brokers represent the consumer and search for the best insurer on their behalf. An insurance broker is likely to work for the client but not the insurance company. They also get a commission when they sell an insurance plan. An insurance broker has a detailed meeting with the customer and searches for the best insurance plan in the market that serves the customer’s insurance needs in the best way. They intend to search for the right policy at the right place and time. Their commission is usually called a broker’s fee, a percentage of the policy sold to the clients. As they do not work on behalf of the insurance companies, they are not bound when purchasing an insurance plan and cannot execute the transaction from start to end. They hand over the account to the insurer or an insurance agent to complete the transaction from start to finish.

Insurance Agent

A professional who represents one or more insurance companies to sell their insurance plans and policies and get the commission on each sale. They are allowed to work as a full-time employee or an independent part-time worker. They help clients find the best insurance policy while presenting their insurance company in the transaction. They help people to get the right coverage for their needs through a reliable and excellent insurance policy. They join an insurance company through an agreement or a contract with the insurer. In this agreement, insurance policies which an insurance agent will sell on behalf of the insurer are mentioned along with the commission he will receive on the sale of each plan or policy.

Types of Insurance Agents

There are two kinds of insurance agents, as listed below;

- Captive insurance agent

- Independent insurance agents

Both kinds of insurance agents are obliged to perform their duties in good faith. They are responsible for selling the insurer’s products and making the transaction from start to finish. They get commissions on different kinds of insurance plans once they sell them on behalf of their insurer.

Insurance Broker vs Insurance Agents

As you know, an insurance broker and agent are middlemen between the buyer and the insurance market. They offer different policies with different quotations so the buyer may decide on the insurance plan that best suits his / her requirements. Here are the main differences between an insurance broker and an insurance agent given in the table below;

Choose the Best Insurance Agent or Broker

Choosing the best insurance agent or broker is challenging, but the decision is critical, and you should make it carefully. Fortunately, you do not have to worry about it. Here, we will explain what you should look for in an insurance broker or agent when finding one for services.

Get Recommendations and Referrals

While looking for an insurance agent or broker, discuss with your business partners, friends, business associates, and acquaintances to get their recommendations and referrals. They can tell you about the best insurance broker or agent they know or have services for themselves. This will help you to find a good option.

Check the Customer’s Feedback and Reviews

Search the internet to find the customer’s reviews and feedback before choosing an insurance broker or agent. A quick Google search will tell you all about the previous work of your chosen agent or broker.

Licensed and Experienced Professional

Do not put your business at risk by choosing a professional randomly. An experienced and licensed insurance broker or agent is necessary that help you in the best way to find the most suitable insurance policy for your business needs. An experienced professional can handle multiple insurance types according to your business needs and requirements. The chosen professional must be experienced in the business type you are working in.

Well Reputed and Reliable

Choose an insurance agent or broker whose repute is good in the market. A reliable insurance broker or agent will help you in good faith and will make the whole process from start to end easy and convenient for you. Reliable insurance brokers and agents can connect you to the best and most well-reputed insurance providers in the insurance market.

Type of Insurance Coverage

Do not forget to check the type of small business insurance coverage your chosen professional offers. Choose a professional who can provide different kinds of small business insurance coverage. Types of insurance coverage usually include;

- Worker’s compensation insurance

- General liability insurance

- Commercial property insurance

- Cyber insurance

- Business owner’s insurance

- Commercial auto insurance

- Professional liability insurance

- Errors and omissions insurance

Economical Cost

While choosing an insurance broker or agent, you must go through your budget and ask the fee or commission you will pay the chosen professional. Many insurance brokers and agents charge competitive charges for their services, so choose a professional according to your budget. All the best in choosing the most cost-effective insurance broker or insurance agent!

Who is The Best Insurance Broker?

Most people look for different methods when finding the best broker or agent. Different options include;

- Search engines,

- Social media pages and groups

- Price comparison websites

- Insurance providers and companies

- Friends for recommendations and referrals

Among different reputed and reliable brokers, the best one is NEODIRECT. They can assist you in everything related to the insurance personally or digitally whenever you need. Their rate is highly competitive, and they offer various services to their clients. They are transparent brokers who ensure their clients understand their insurance needs. They provide non-binding and free-of-cost optimisation proposals to their customers from the top insurance providers.

Features and Key Characteristics of Neodirect Insurance Broker

Here are the key characteristics of an insurance broker, “Neodirect”.

- Offer competitive rates in the market

- Organise all of the insurance contracts on behalf of their clients

- Offers transparency and gives independent advice

- Performs risk assessment in advance

- Provide non-binding and free-of-charge optimisation proposals

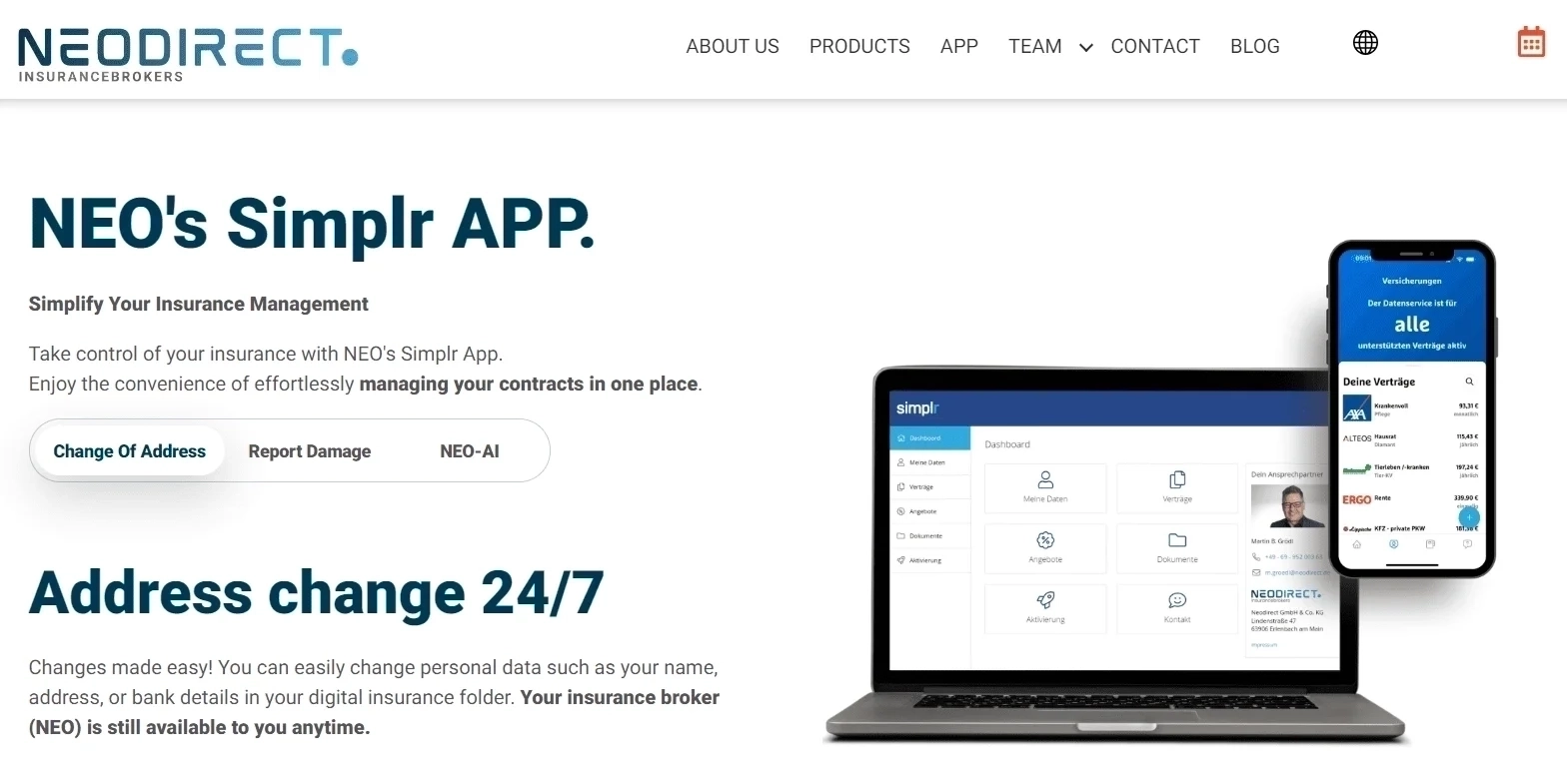

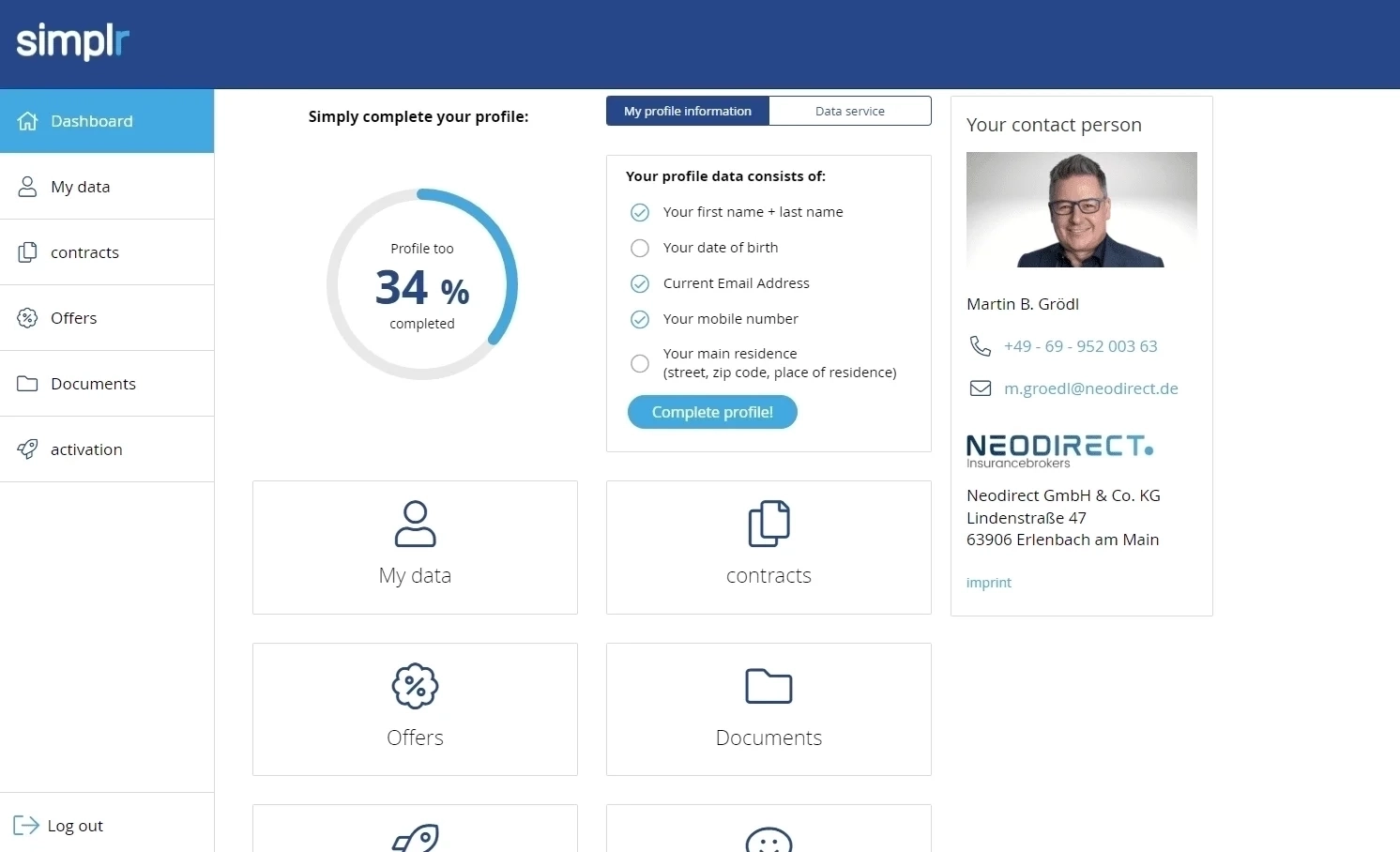

- Have Neo’s Simplr mobile app to manage contracts in one place

- Ensures the understanding of the customer about their insurance needs

- Supports financial well-being

- A comprehensive evaluation of all your insurance contracts

- No fee or evaluation payment (free of cost evaluation)

- Customised and personalised services anywhere you need

Products Offered

Neodirect offers a wide Range of Products to their valuable clients according to their specific needs. You can choose any insurance plan for anything you need. Here are a few scenarios for which they are offering their products.

- Their health insurance plans offer coverage for medical expenses and support health-related issues.

- Their life insurance policies help with financial stability.

- If you want to protect your assets, you can get help from Neodirect with their property insurance.

- Commercial insurance is going to secure your business.

- Drive with safety and have confidence during driving due to the auto insurance.

- Belonging insurance will help you secure your household contents and belongings.

- Pension and labour force insurance plans are for the well-being of your employees and people associated with your business.

Why You Need Simplr App?

The Simplr app offers several benefits for managing insurance policies:

Centralized Management: Simplr provides a free, intuitive platform to view all your insurance contracts at a glance, simplifying management and oversight.

Mobile Accessibility: It’s designed for use on various devices, ensuring that important data and documents are always accessible, whether on a smartphone, tablet, or laptop.

Personalized Assistance: Unlike many online platforms, Simplr offers personalized support, providing users with dedicated contacts for advice and assistance, regardless of their location.

Data Security: The app prioritizes the security of user data and privacy, ensuring all data is encrypted during transmission.

Ease of Use: Simplr allows users to edit, manage, and switch insurance contracts with just a button click, making it user-friendly.

Integrated Tools: It includes comparison calculators to adjust insurance needs according to life situations and check existing insurances.

Advanced Technology: Simplr uses advanced technology to suggest optimal contract improvements, maximizing the value of your investments.

Digital Documentation: Users can upload missing documents via photos, streamlining the completion of contracts without significant effort.

Digital Signatures: The app enables digital signing of contracts, eliminating the need for physical signatures and paperwork.

Flexible Data Modification: It adapts to life changes, allowing easy and quick updates to user data following events like moving or changing banks.

Effective Communication: Simplr ensures that contact details are always available, offering better advice through personal contacts rather than chatbots, individual assistance, easy communication, and immediate solutions through personal interaction.

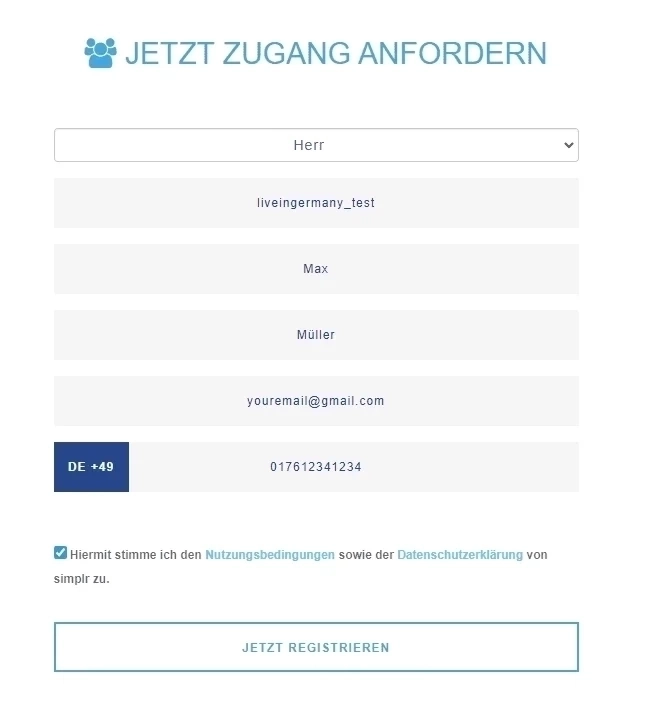

Steps to Register to Simple App

Step 1: Go to this link, and fill out the form using desired username, first name, last name and phone number and press “Jetzt registrieren” after that.

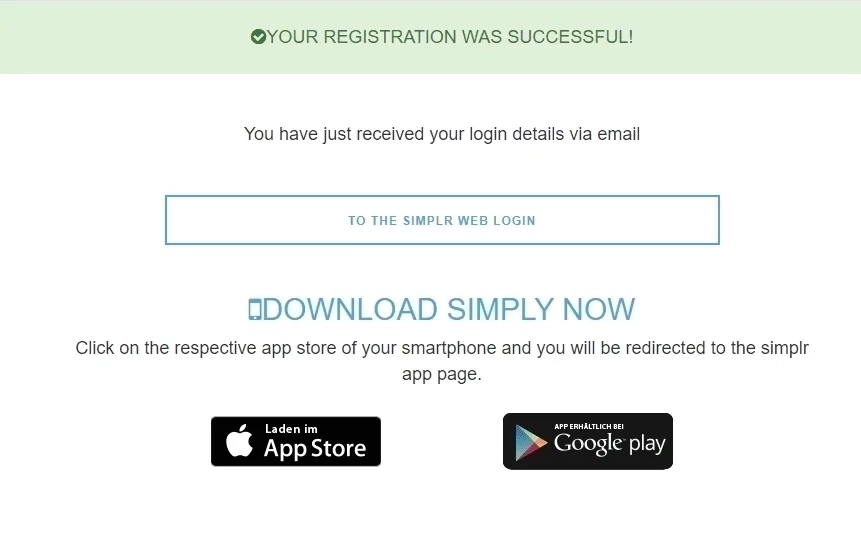

Step 2: After successful submission , you will be redirected to this window, which shows that you can download the app on iOS or Android

Step 3: Once you submit, you will get three emails, one of them is used to set the password for your user name.

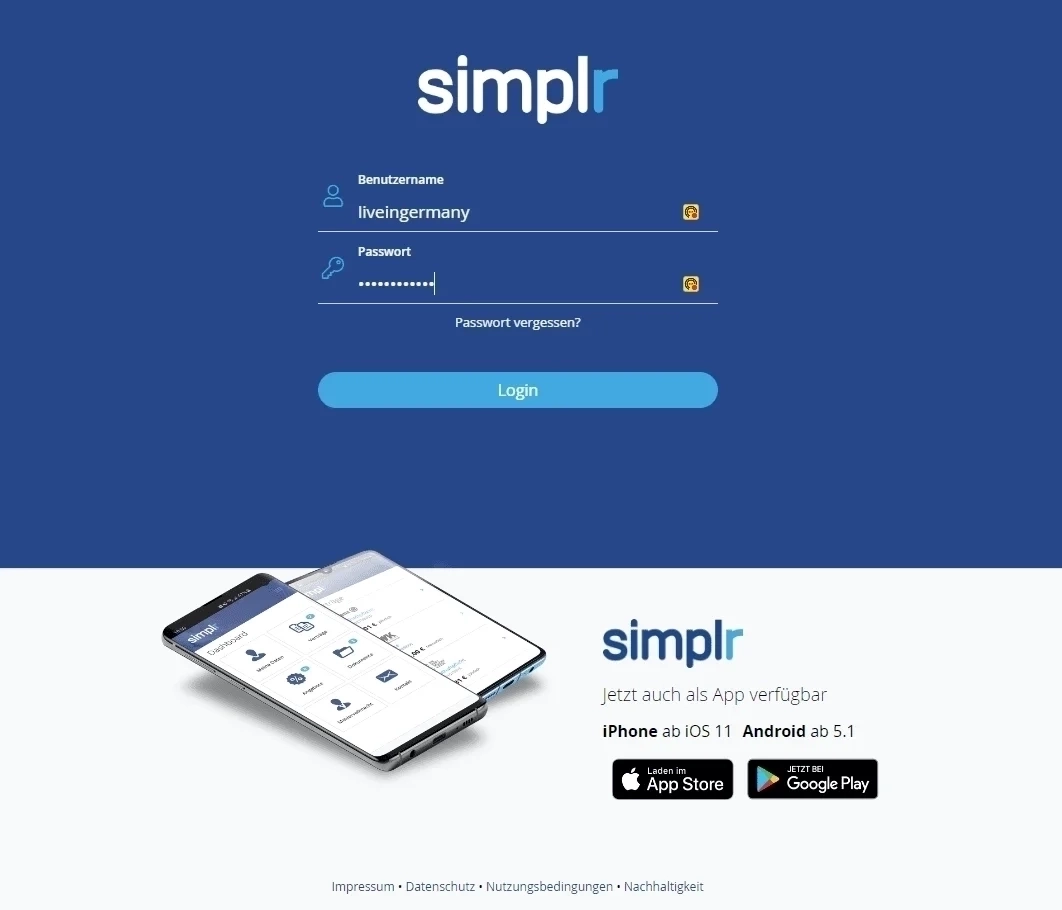

Step 4: Login in to the portal with your username and password which you set via email

Step 5:

Upload Your Current Contracts To Simplr

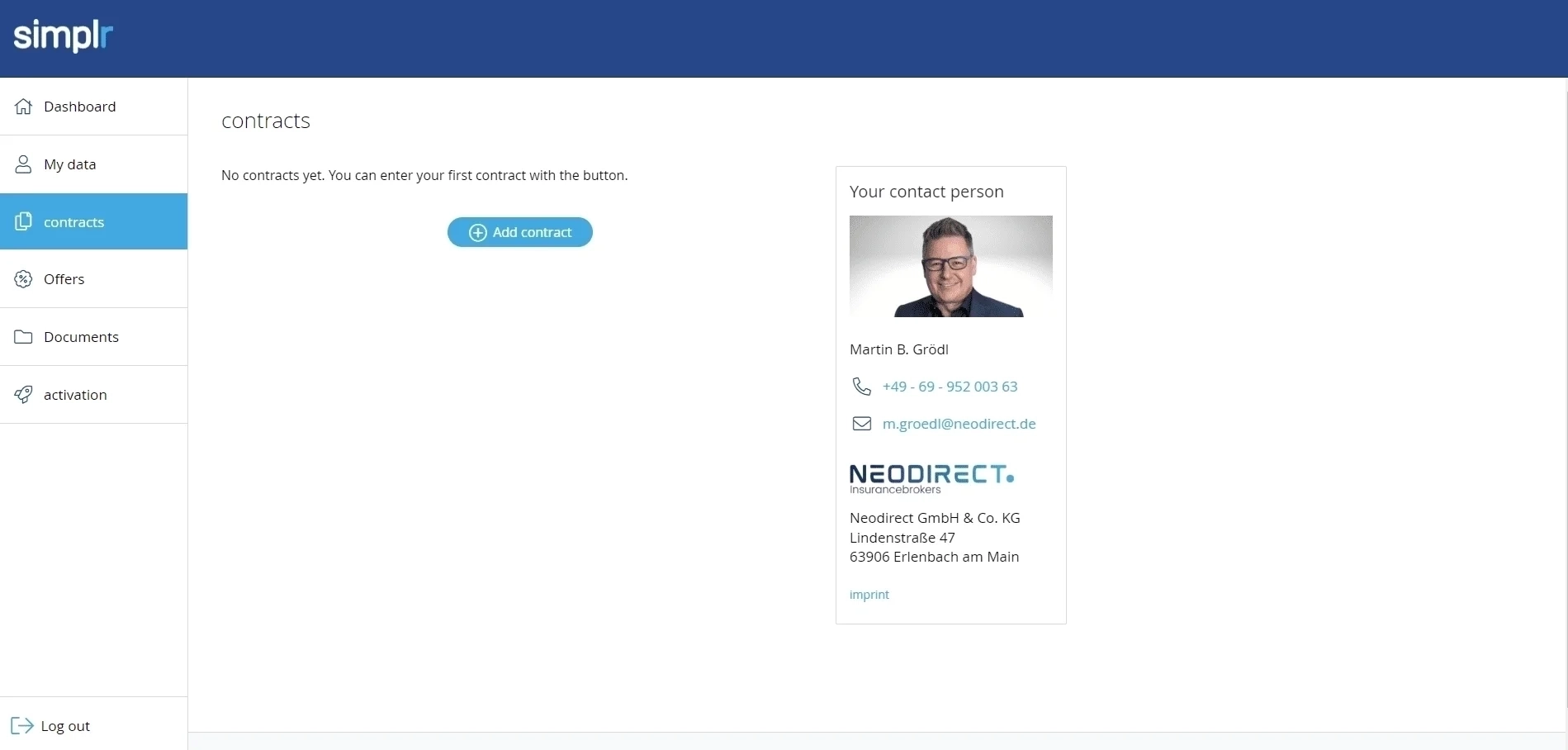

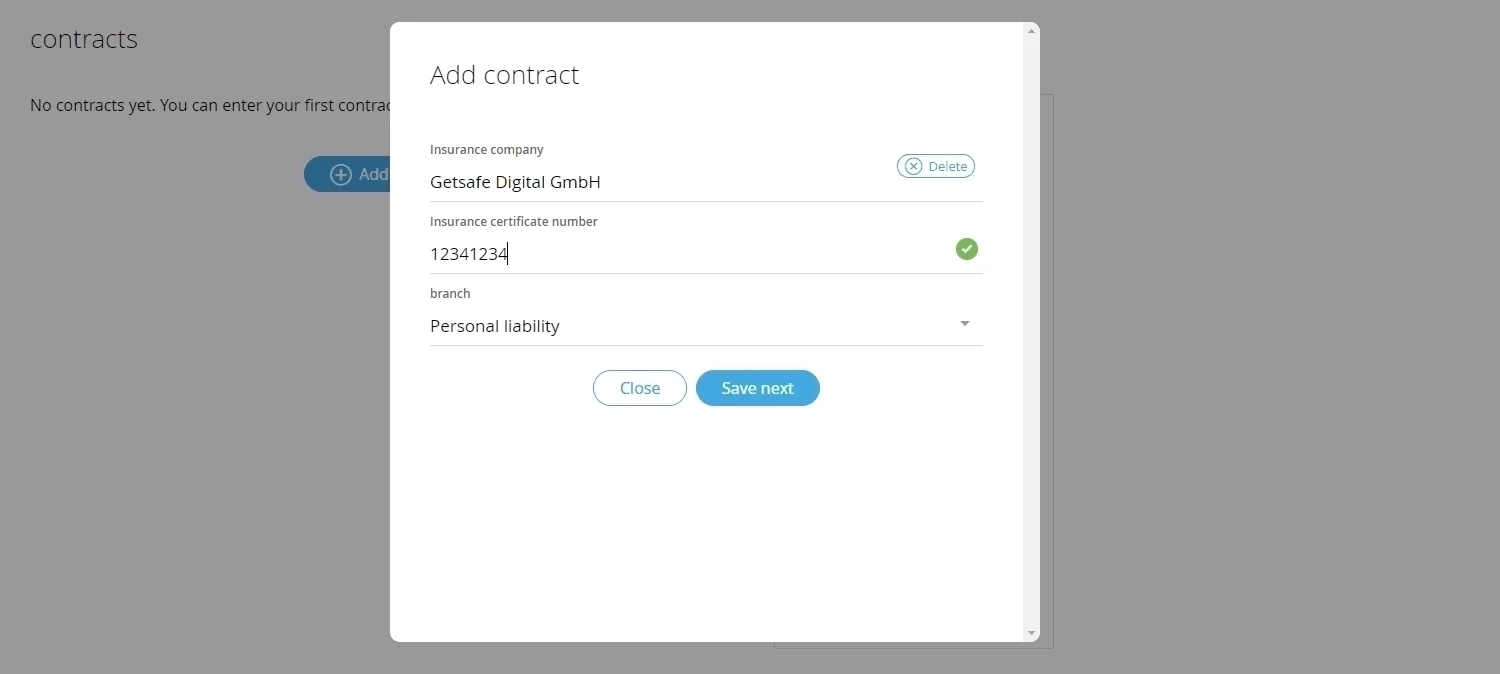

Step 1: Go to the “Contracts” tab, on the left. Press the button “Add Contract”

Step 2: Select your Insurance company, give your insurance number and the type of insurance.

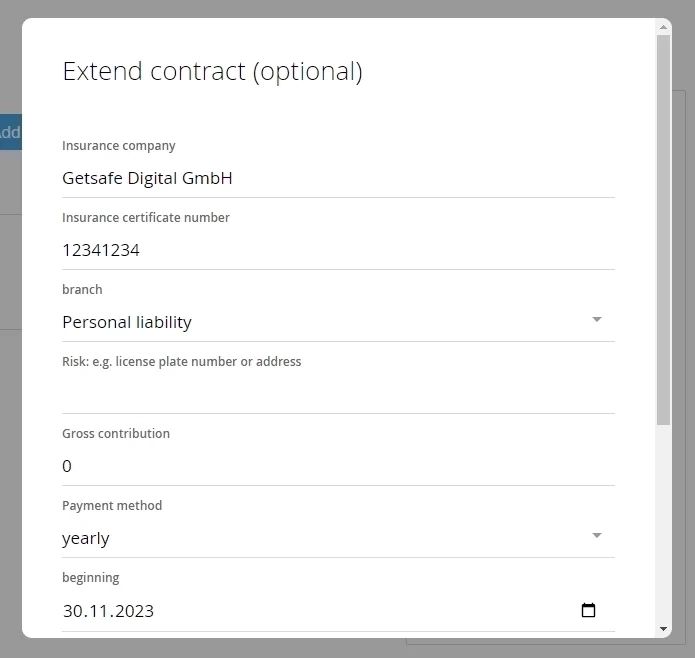

Step 3: Fill the rest of the information regarding your insurance contract and save

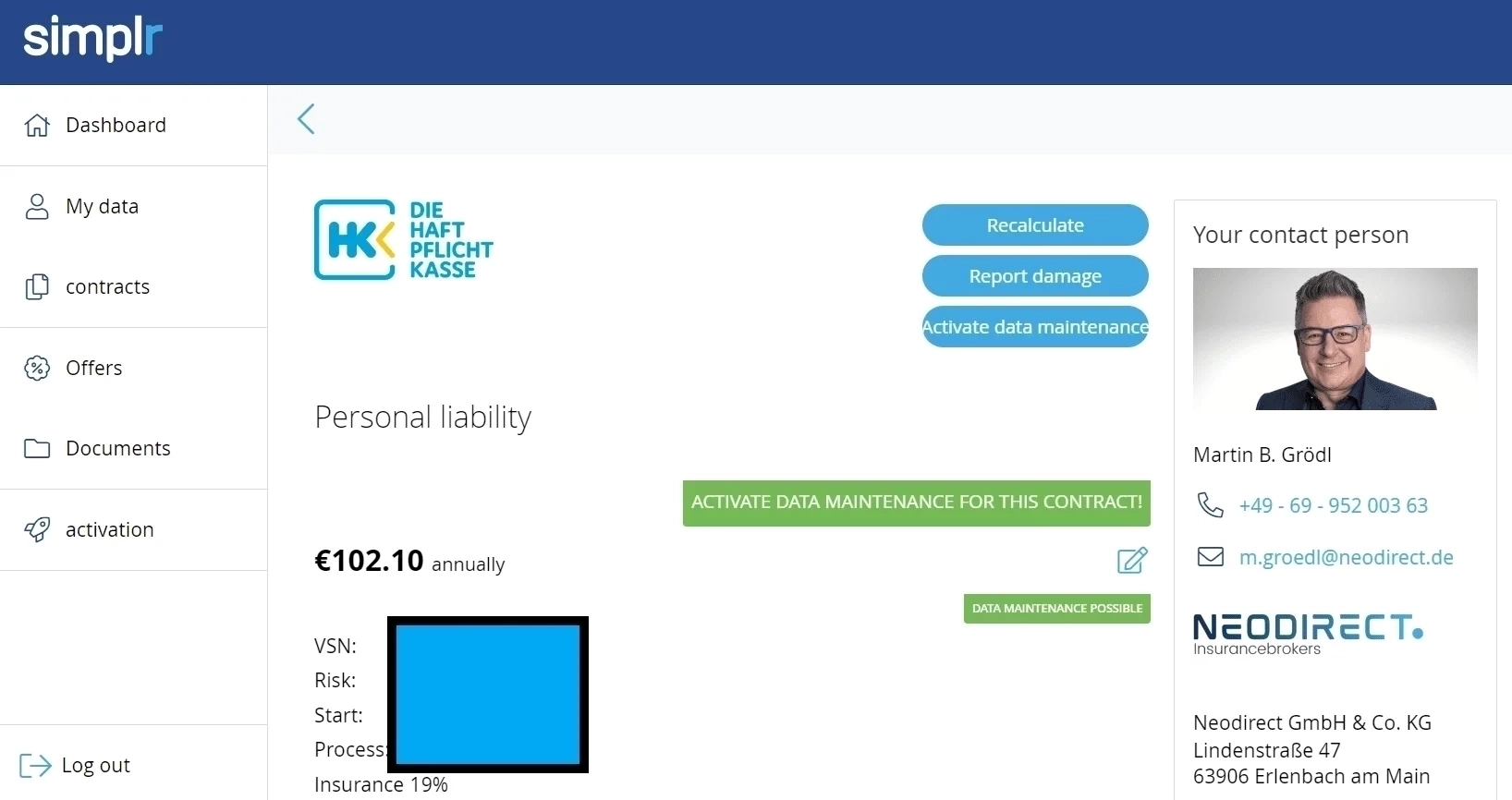

Step 4:Once everything is set, then you can also recalculate your insurance to find the better provider, you can directly make a claim using the app. Moreover, you can also consult “NeoDirect” about your claim and they can guide you better.

Step 4:Once everything is set, then you can also recalculate your insurance to find the better provider, you can directly make a claim using the app. Moreover, you can also consult “NeoDirect” about your claim and they can guide you better.

Calculate a Best Insurance Package Using Simplr Inusurance Broker

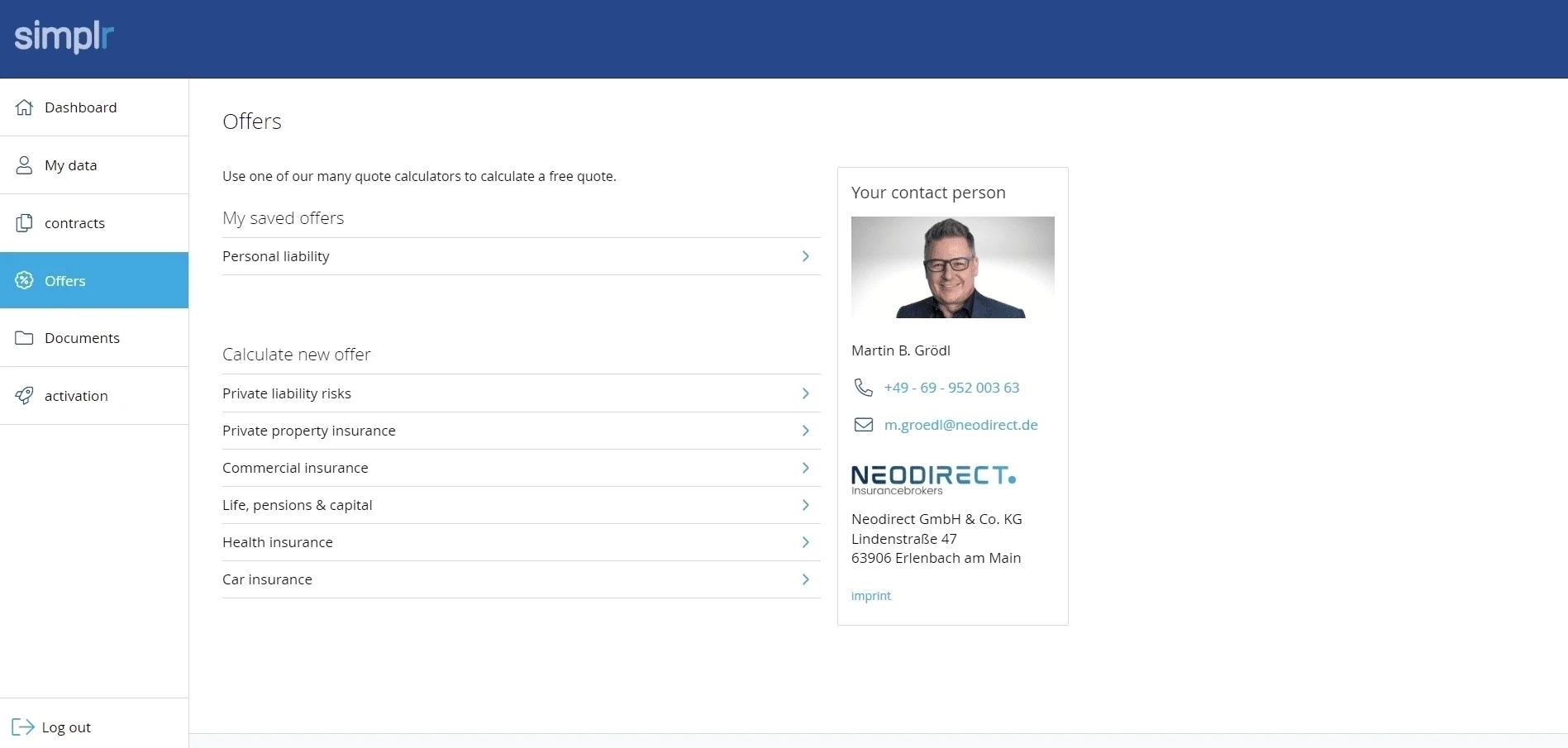

Step 1:Go to “Offer” on the left and select your desired calculator. For this example, we choose liability insurance.

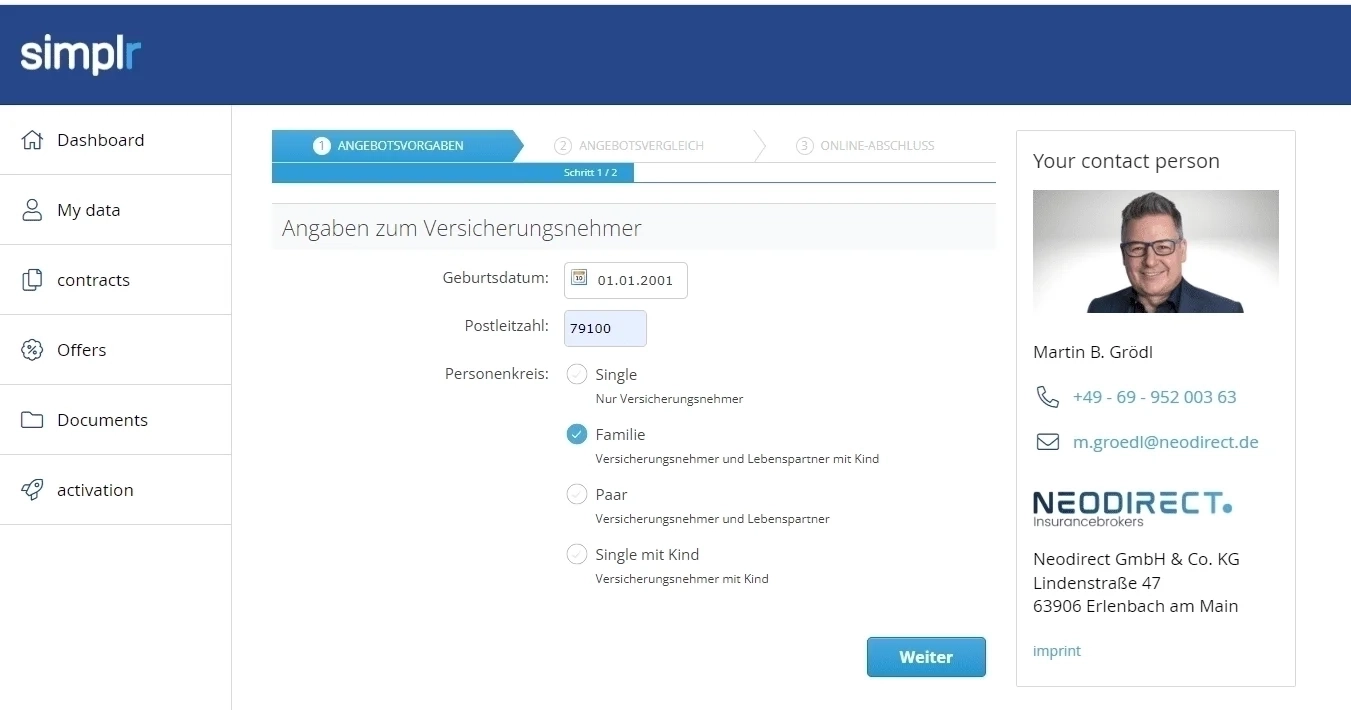

Step 2: Give the asked information like your date of birth, postal code, family status.

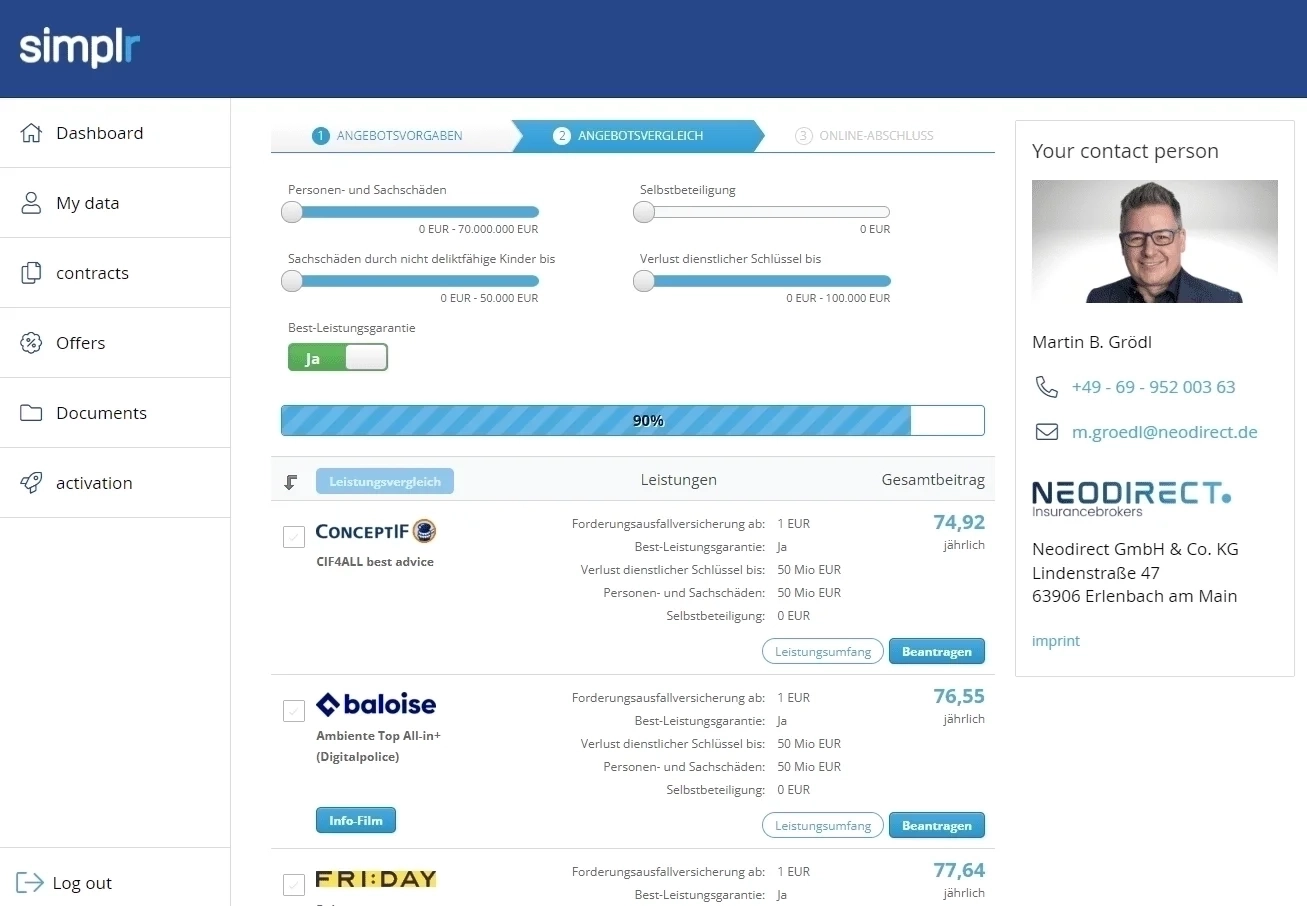

Step 3: Now you can compare different insurances. Don’t forget to turn on the “Beste-Leitungsprämie” toggle for best insurance in germany.

Step 4: Find the one insurance which is suitable for your needs, if you have any confusion then feel free to contact NeoDirect. They also give English support.

Final Thoughts

So, it is all about insurance brokers and insurance agents. The decision is all yours if you choose an insurance broker or agent. Hire a professional who can offer you the best for your insurance needs and handle the process smoothly. First, think carefully if you need an insurance broker who will ultimately work for you or if you want to hire an insurance agent who will work on behalf of the insurance company. Remember that choosing a reliable and experienced professional will save time and cost and help you go through the process quickly, efficiently, and conveniently. Trust, experience, and reliability are the main factors you should focus on while choosing an insurance broker or agent. Cheers, and happy sharing!

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)