How to Start a Business in Germany [Step by Step – 2026 Guide]

Germany is scaling up as the number of new businesses that are registered every year in Germany is just over 2 million, which includes businesses from different fields. Be it beautiful designer cakes, house restoration ideas, event planners or some unique food products, Entrepreneurs in Germany are having a good time with their businesses. So, if you think you have it in you, that unique idea which can stand out and become a great business in future, continue reading this article to learn how to register a business in Germany. In this article, we will try to elaborate and provide you with the necessary information that can help you in the process to start a business in Germany. This will help you launch and expand your business and we hope that you may achieve your entrepreneurial dreams.

Being an entrepreneur in Germany

The Current Situation

In a report from Global Entrepreneurship monitor worldwide in 2006 which states that Germany lacks “entrepreneurial mentality” because of low start-up rates in relation to its population size. But things in Germany started to change since then and its different now. Germany has turned out to be one of the strongest economies in the world as of now and it has also been a place of interests for start-ups quite lately.

German government’s “Digital Agenda 2020” has helped IT and E-Commerce to flourish into the economy and these sectors are playing an important role in the German Economy. Cities like Berlin and Munich have become home to many big companies from IT sector and also from other areas such as Companies that are developing modern manufacturing techniques or companies that are into AI manufacturing. On the other hand, cities like Frankfurt are becoming hub and are becoming a place of interest for finance entrepreneurs.

How to Register a business in Germany? Is it Easy?

German government has started to support entrepreneurs more now as compared to the past. Online businesses have changed the economic world and as a result a new breed of entrepreneurs have emerged. Also, in big cities in Germany many of the online business owners and entrepreneurs have been contributing and generating employment growth which is also a reason why government is supporting these entrepreneurs.

Also, the policies and procedures have become easier than before in order to accommodate and facilitate these business owners. Flexible employment conditions have been created and government subsidies have created a room for young start-up to step up and scale their businesses. Venture capital is in continuous growth and innovative projects are getting more funds than before. These conditions suggest that it is a good time to get a start.

Initial Steps

First and the foremost the initiative to start a business in Germany begins with obtaining residency permit, getting the right visa, and by opening a bank account in Germany. Following this you must pay a visit to the tax office (Finanzamt). You can get yourself registered as a tradesman (Gewerbetreibender) or register yourself as a freelancer (Freiberufler). Prior to the submission at the tax office of your business registration, getting a trade license (Gewerbeschein) will be needed most of the times. An entrepreneur needs to inform the health insurance provider and may start right after that.

A major factor here is to keep up with the regulation and this is a must in any case. German laws are strict when it comes to hygiene, worker safety, working hours and accountancy. For example, if you are thinking of starting a food business, completion of certain safety courses is mandatory, and you have to make sure that all the facilities which are provided are according to the German National Standards.

How Much Would It Cost To Register a Business in Germany?

In order to accumulate what is required, two things are in consideration. Administrative expenses, in contrast, are not too much but on the other hand, the amount required to start up varies as it depends upon how much investment is required.

The actual cost of the business depends on the Business entity in Germany if you going for the Small business (Kleinunternehmer), Sole Proprietorship (Einzelunternehmer). In these two entities, seed capital is not required therefore, you can register a business for less than €50. This is just the registration cost of the company.

On the other hand, if you want to go for UG (mini GmbH) or GmbH then in order to register a company in Germany requires €400. Apart from that €25,000 in seed capital is needed by the investors in order to create a GmbH. But a “mini-GmbH” can be created through an initial investment of €1 and is much cheaper.

What is a GmbH

GmbH stands for “Gesellschaft mit beschrankter haftung” that is similar to a limited liability company. This is an acronym that most entrepreneurs may encounter apart from others.

Founders need to contribute €25,000 into the capital, or develop their capital with €1 to the desired amount (Mini-GmbH’s) to create a GmbH. After creating a GmbH, it must be officially notarized, which normally happens after the completion of registration process.

What Types of Businesses Exist in Germany?

Check out our detailed article on Types of Business in Germany.

Starting a Company/Business in Germany. Can Foreigners do it?

German government is always keen to welcome foreign entrepreneurs who are interested in new ventures in Germany. But if you are willing to do so as a foreigner in Germany you need to keep some special consideration in mind before that. A list of requirements is mentioned below in order to keep and check for what is and will be required to get a start.

In order to start and grow your business in Germany as a foreigner it is very important that you must fit in to the German Culture. In order to do so, learning German language is vital, also knowing music and literature in Germany is also helpful. It is also necessary to blend in with the community that will be the home of the company and it is advised to spend some time with the people of the community and travel across the country to get a better understanding.

Step by Step Guide to Register a Business in Germany

Essentials to start a business in Germany

As mentioned before, key milestones may be similar most of the times. While steps to create a business in Germany may differ as to the nature of the business. But the usual process is mostly similar in every case. Initial Key milestones are:

- Get a business Visa: A 6 months stay will be entitled once you obtain this visa and within this time you can plan your framework of business and complete your required documentation. Proof of financial support is also required along with your staying whereabouts during this time, short-term health insurance, and or a business partner’s letter of invitation, if applicable.

- Get a Trade license: Attending a Finanzamt in your desired city is next, by doing so entrepreneurs can receive their trade license and get registered as a tradesman. €20 fee comes with this and this will specify your company’s area of work.

- Completing your business registration: Registering your business with the Finanzamt is next. Requirements for registering are: a valid visa, a German tax ID number, a functional bank account, current passport, and a residence permit. After the registration you will receive a Tax number and VAT number of your new Business in Germany.

Step 1: Registering your address to start a business in Germany (Anmeldung)

Every time you move into Germany, registering your address is necessary. This is known as Anmeldung. For the first time you register your address, you will be granted a certificate of registration (Anmeldebestatigung) and a tax ID (steueridentifikationsnummer). In order to create an ELSTER account and get your business registered, you require a registered address and a tax ID.

You need :

🔹 A place where you can live in Germany

🔹 Documents which are required for the Anmeldung

You will get:

🔸 Tax ID (Steueridentifikationsnummer) in order to register your business

🔸 A registration certificate (Anmeldebestatigung) in order to register the business and for bank account opening.

Step 2: Opening a Bank account to start a business in Germany

In order to register your business and later for tax payments you’ll require a bank account. A bank account which offers SEPA transfers is necessary and if it’s not a German bank account, don’t worry.

A separate business account is needed in order to form a corporation (UG, GmbH, AG or KGaA) as it is a requirement.

Otherwise, if you are starting as a Freiberufler or Gewerbe, needing a business account is not necessary. For that purpose, your personal bank account can also be utilized. In order to keep things easier for you it is advised to have a business account and also some banks refrain the use of personal account as a business account as per their policy.

You can take a look at my comparison of German banks if you need to open a bank account and doesn’t have one. Kontist, Holvi and Penta are some business banks which offer easier bookkeeping. I personally have an account in Kontist since past 6 months and it’s really good.

Looking for the Best Business Bank Account?

Check out our detailed article on Best Business Bank Account for Self-Employed and Freelancers.

Having Two Bank Accounts is always better

In order to make things easier for yourself, it is advised to have a personal account and a separate business account. By doing this you can do accounting for your business and personal transactions in a much easier way.

Finanzamt can also freeze your accounts

Your bank accounts can get freeze if you are unable to pay your taxes by the Finanzamt. The Finanzamt will not just freeze your business account but all your accounts. This also includes accounts in other EU countries. You will not be able to transfer money or also won’t be able to withdraw money from your bank accounts if they are frozen. If the accounts get freeze by mistake which can also happen, it may take a couple of days to fix and you’ll not be able to do transactions during this time.

A Pfandungsschutzkonto (P-Konto) can protect in such a scenario, as it allows you to access some money in the frozen accounts. This can make both ends meet as you can pay bills or buy food with this money. A bank account can be converted into a P-Konto for free.

You need:

🔹 A registration Certificate (Not required by some banks)

You will get:

🔸A business account in a bank

Step 3: Finding a Tax advisor

Getting a tax advisor in Germany may be expensive, but getting a tax advisor can make you save a lot of money. A tax advisor will be able to register business for you and will be responsible for tax declarations. Having a tax advisor makes it easy to do accounting and having a tax advisor can also prevent from making expensive mistakes.

Step 4: Gewerbe or a Freiberufler?

The tax office makes this decision that if you need to register as a Trade (Gewerbe) or a freelancer (Freiberufler). This happens when your business gets registered with the tax office (Finanzamt).

This is very important to know the difference. In order to become a Tradesman getting a trade license (Gewerbeschein) is necessary and a trade tax (Gewerbesteuer) needs to be paid. Also getting listed in the trade register (Handelsregister) is must and different accounting rules have to be followed sometimes. All of this is required before getting your business registered with the Finanzamt.

Not every freelancer but specific professions like, Doctors, Engineers, Teachers and architects are considered as Freiberufler. Tour guides and food delivery persons are considered as Gewerbe and not Freiberufler. Also, commercial websites are mostly registered and considered as a Gewerbe.

Step 5: Get a Trade License (Gewerbeschein)

In order to get registered as a Gewerbe, before you get your business registered with the Finanzamt you must get a trade license (Gewerbeschein).

You can apply online for a Gewerbeschein if you are in Berlin but a valid residence permit is required prior to applying. Although paper form can be used in the rest of Germany. Also, the tax advisor may also do this for you.

You need:

🔹 Permit of residence (Aufenthaltstitel)

You will get:

🔸 A trade License (Gewerbeschein)

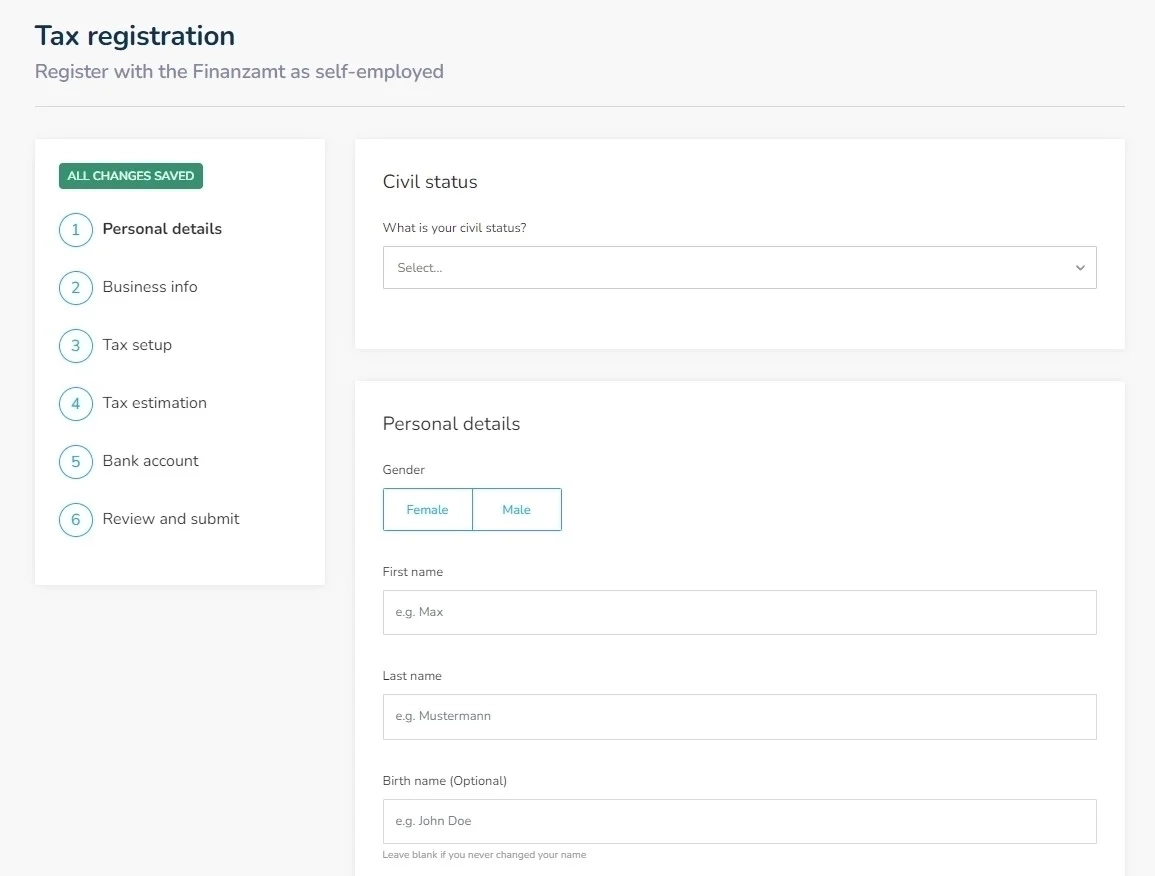

Step 6: Register with Finanzamt to start a business in Germany

Now you need to declare your business at the Finanzamt by filling the Fragebogen zur steuerlichen Erfassung. This has to be done online since 2021. Also, your tax advisor can register your business. Sorted has built a free tool to register your business in English if you find it hard to speak German. Likewise, Firma.de can also register your business for you.

You need:

🔹 Trade license (Gewerbeschein) – In case you register as a Gewerbe

🔹 Bank account that facilitates SEPA Transfers

🔹 Tax ID (Steueridentifikationsnummer)

You will get:

🔸 VAT number (Umsatzsteuernummer)

🔸 Tax Number (Steuernummer)

🔸 Trade register entry (Handelsregister)

Time Required: 5-7 weeks (which includes 1 week in order to create an ELSTER account)

How to Fill Fragebogen zur steuerlichen Erfassung in English

Filling out the Fragen zur Steuerlichen Erfassung could be hard as it is 7 – 8 pages document with so many fields. GetSorted is the only platform which lets you fill this form digitally in English with all the helpful info for each field.

Best App for Freelancers in Germany

If you are a freelancer or self-employed and wanted to start your Einzelunternehmer or kleinunternehmer then GetSorted can help your with this form and also with monthly or quarterly VAT submissions.

Step 7: Getting the Right Residence Permit

In order to be self-employed in Germany, a residence permit is required. Also, it is determined by the nationality you have. This tool can help you in order to find if you need a residence permit or not.

- Citizens from countries like Iceland, Norway, Liechtenstein, and Switzerland or from European Union are already eligible to start a business in Germany.

- You can also start doing business in Germany by having German permanent residence.

- By having a work visa or blue card, you can get self-employed along with your job. Although job shall remain the main source of income and keeping the job is mandatory. If on the residence permit and on the Zusatzblatt it says Selbstandige Tatigkeit gestattet or Erwerbstattigkeit erlaubt then you can do this.

- On student visa, you need to change the residence permit by asking Auslanderbehorde to do so. After this you can study and operate a business simultaneously. A lot of students I know have done this already.

- Otherwise, applying for a German freelance visa is necessary. Clients in Germany are required to get a freelance visa and if clients are not in Germany, you may not get a freelance visa.

You can get your business registered at the Finanzamt and apply for the residence permit at same time.

You need:

🔹 Trade license (Gewerbeschein)

You will get:

🔸 Permit of residence (Aufenthaltstitel)

🔸 Permission to get self-employed in Germany

Time required: approx. 2-3 months.

Step 8: Let your Health Insurance Company Know

Informing your health insurance provider about going freelance is advised if you have a health insurance already. As for freelancers, health insurance can turn out to be a bit expensive because the employers will not the half amount anymore for you. And if you are a freelancer, then the insurance company may deduct the money directly every month from your bank.

Also, the insurance cost will depend upon your income if you are having public health insurance. An estimated income will be used to determine the amount because the future income is not of a certain value. In case of an additional charge or a low charge, you may get a refund or an invoice later as per the amount.

It is also advised to have private health insurance if you are self-employed because it’s cheaper and covers more. It can also save you money, but talking to a health insurance broker is always a good option as the decision is not a simple one.

In Germany, your revenue (reduced through business expenses) is accounted as the basis of taxation as a sole proprietor. For more information, please visit:

Curious About Corporate Tax in Germany?

Check out our detailed article on Corporate Tax in Germany.

Check out Podcast on “How to Start a Business in Germany with Aazar”

How to Start a Business in Germany with Aazar

Conclusion

Through this guide we have tried to give you the insight for what it takes for the expats and local people to get a start for their business in Germany. Further you can consult Firma.de in order to get consultation and in order to get a good start we advise you to go further in depth and plan the idea of your business according to the German Market.

Source: Business vector created by pch.vector – www.freepik.com

How to start a business in Germany – All About Berlin

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.

![Best Apps to Learn German [Free + Paid]](https://liveingermany.de/images/best-app-to-learn-german/best-top-free-and-paid-learn-german-app-with-pros-and-cons.svg.webp-668w.webp)