German Payslip How to read your Salary Slip [2026 Guide]

Once you have moved to Germany, you will look for the income sources to live your life. You must be looking for various options to learn about the German rules, earning, and well-reputed jobs. After getting a suitable job to meet your expenses, it would be interesting that you receive a salary each month. When the salary hits your bank account, and you receive a salary slip, you must know the details and information about your German pay slip. A pay slip is a piece of paper that gives your salary and wages in full detail. You will see many deductions made out of your salary. Your employer is legally responsible for giving you your pay slip. There are several abbreviations and words in your German pay slip. You must know about these words and abbreviations to understand what you have earned. What deductions are made out of your earnings? In addition, what do they mean?

Wondering What’s Considered a Good Salary?

Check out our detailed article on Good Salary in Germany.

German Deductions Out of Your Salary or Income

When you see your first pay slip, you will see several deductions made out of your income. These deductions are related to taxes, social security contributions, social charges, etc. These deductions are usually 40% of your gross income. The remaining amount is the salary you will receive in your German bank account. These deductions are according to your income, insurance, and tax class.

You can estimate your net salary with the German salary calculator to give you the best idea about your salary. The detailed working on your salary will make you able to make your job decision.

Guide to Read your German Pay Slip

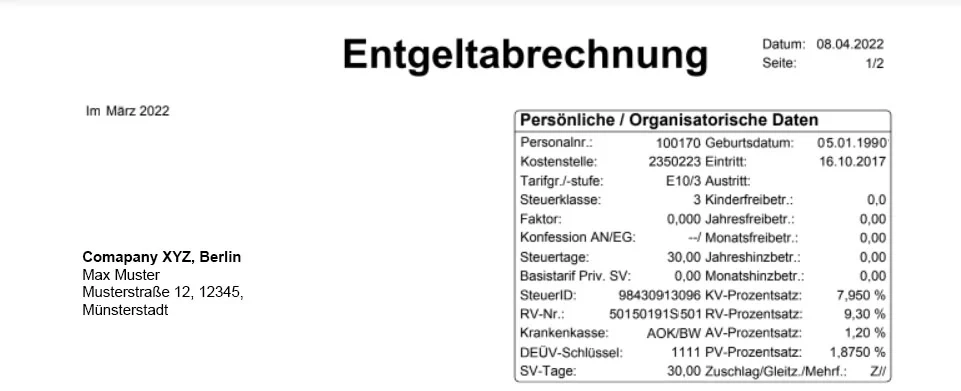

Every German employee will receive a pay slip detailing their salary and deductions at the end of the month. Each employer used their own system to generate payslips that’s why your format could be different from ours but most of the things on the pay slip is same. The format can be different for all companies. Your pay slip will have all the details of your earnings, salary, bonuses, social security contributions, and deductions like taxes. Your pay slip will have several abbreviations as Germans love to use them.

Header

At the top of the German pay slip, there is an employee’s personal information. It might include the employee’s name, address, personal number, date of birth, and religion. It will also explain if the employee has to pay church tax.

- Arbeitnehmer Nr. or a Personal-Nr: Represents the employee number

- Geburtsdatum: It represents your date of birth.

- StKl. or Steuerklasse: It is related to the tax class in Germany.

- Ki.Frbtr. (Kinderfreibeträge) or ZKF (Zahl der Kinderfreibeträge): It is the tax exemptions per child. If it is 1, then this means that you get tax exemption for the 1 Child.

- Konfession or Rel. (Religion) represents religion. RK stands for Roman Catholic; EV stands for Protestant; and — presents no religion)

- Freibetrag, Steuerfr, or Bezug (Steuerfreibezug): It is the tax-free allowance

- St. Tg. (Steuertage): It represents the tax days. It is usually the appropriate time. (If you are working full month then it should be 30 days)

- SV-Nummer (Sozialversicherungs nummer) or RV-Nummer (Rentenversicherungs nummer):It is the social security number

- Krankenkasse: This represents your health insurance fund. Either Private or Public Health Insurance

- KK: % is your health insurance contribution rate.

- Eintritt or Eintrittsdatum:It is the date of hire by your employer.

- SV-Tg. Sozialverischerungstage: It is social security days. It is the appropriate time. (If you are working full month then it should be 30 days)

- BGRS or SV Schlüssel / Beitr.gr. KV / RV / AV / PV: They are the social security codes that indicate your contribution level. The number one is equal to the full contribution.

- Steuer – ID or Lohnsteueridentifikations nummer (Id Nr.): It is your tax ID number

- Url. Anspr. (Urlaubsanspruch):They are the vacation days as per your contract with the company, organization, or employer. By law, it is 20 days, but up to 30 days are common.

- Url. Tg. gen. (Urlaubstage genehmigt): They are the approved vacation day’s year to date YTD.

##imgtag:Best Banks for English Speakers (1)##

Earnings and Salary Information

Below are the items that you may find on your payslip. It is the most interesting part of the payslip. It includes the gross salary of the employee and all items regarding income, but you don’t need to see all items on your salary slip. A few items may appear on your salary slip in a few months, like bonuses.

- Brutto Bezüge or Basisbezüge:It is your gross earnings

- Bezeichnung:It is the description against your salary items.

- Bruttogehalt or Gehalt: It is your monthly base salary

- Geldw. Vorteil or Sachbezug: They are the non-cash benefits, subject to the total tax and social contributions

- VL AG (Vermögenswirksame Leistungen Arbeitgeberanteil):It is the voluntary employer contribution to your savings plan

- Betr. AV or BAV (Betriebliche Altersvorsorge): It is also another employer contribution to your savings plan

- Einmalbezug or Einmalzahlung: It is a one-time bonus, for example, for Christmas, holidays, or achievements.

- Urlaubsgeld: It is the holiday pay

- Gehaltsumwandlung: It is the deduction for the tax or any other social benefits.

- ST-frei (Steuerfreie Bezüge): They are the tax-free benefits

- Gesamtbrutto or Steuer-Brutto: It is the total gross salary but only the taxable amount)

- Nettoverdienst or Auszahlungsbetrag or Netto:It is the net salary paid to your bank account listed at the bottom of your payslip

Information Related to Taxes

The tax bracket and factor depend upon the marital status of the employee. Other tax classes are single, widowed, married with class five, four, three, and married with a part-time job. Your employer will automatically deduct taxes from your salary to pay these taxes to the German tax authorities. These taxes include;

- Steuerrechtliche Abzüge or Gesetzliche Abzüge: is the sum of all tax reductions.

- Lohnsteuer. lfd. (LSt.): The Income tax is calculated progressively (14% – 42%)

- Krankenversicherung .lfd: It is our contribution toward German health insurance. (14.6%)

- Rentenversicherung .lfd: It is the contribution to pension insurance (18.6%)

- Arbeitlosenverischerung .lfd: It is the contribution to unemployment insurance (18.6%)

- Pflegeversicherung .lfd: It is the contribution to the long-term care plan (3.05 – 3.30%)

- laufend (lfd): It means that it is deducted for the current month

- Kirchensteuer (KiSt.): The Church tax depends on whether you have a confession. It is usually between 8% – 9%.

- Solidaritätszuschlag: This was introduced by the German govt. after the unification of east and west Germany, so West Germany pays a portion of its income to the eastern states. It is called the Solidarity surcharge. (max 5, 5%). From 2021, you only have to contribute if you earn more than 73.000 euros gross per year.

- Zusatzbeitrag: This is an additional contribution for example here you can find Hansefit

Social Security Contributions

These contributions are both by the employer and the employee. Employer and employee both pay 50%. You may find these contributions with below terms or abbreviations.

- SV (Sozialversicherung): is the social security insurance.

- KV – Beitrag (Krankenversicherung): is the contribution to statutory health insurance (14.6% state contribution + 0.69-2.5% contribution for your health insurance fund)

- PV – Beitrag (Pflegeversicherung): iIt s the contribution to long-term care insurance (3.05 to 3.30%)

- AV – Beitrag (Arbeitlosenverischerung) It is the contribution to unemployment insurance (2.4%)

- RV – Beitrag (Rentenversicherung): It is the contribution to pension insurance (18.6%)

- SV – rechtliche Abzüge: It is the sum of all social security reductions, usually 50%

- SV – AG – Anteil (Sozialversicherung Arbeitgeber Anteil): It is the sum of all social security contributions paid by the employer, usually 50%

- ZV-pflichtiges Entgelt: In principle, the taxable salary is remuneration subject to supplementary pension. The remuneration is the assessment basis for the levy paid by the employer and for the share of the levy paid by the employee.

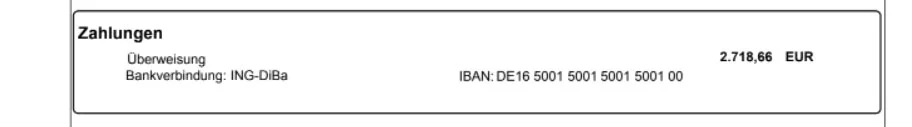

Jahreswert or YTD or TD Income

A bottom section or on the right-most side of your pay slip represents the sum of total earnings and deductions of the year to date or to date. Like if you see the example given in this article. The yearly calculation has been done on the right side of the salary slip. This part gives the final salary or the net pay.

At the end, you will see a bank account where your employer will deposit your salary.

Searching for English-Speaking Banks?

Check out our detailed article on Best English-Speaking Banks in Germany.

Do Not Throw Away Your Pay slip

You must keep a copy of your pay slip either in your record file or online. Your pay slip is the document that you may use as proof of the total number of years you have worked in any company or organization. These documents will also tell about the social security contribution you have paid during your timespan in an organization.

This is important, and you will need this in retirement. If you do not receive your pay slip, you are responsible to ask your employer to provide you with your document. Your employer will keep your pays slips for almost six years. If you have misplaced any of your pay slips, you can ask your employer for a duplicate pay slip. You will need your pay slips each year at the time when you need to file your tax returns.

Final Words

As you have seen that German pay slips have lot of different words and abbreviations which is related to your the related to the taxes and social security contributions to the German welfare system. Pay slip understanding is necessary for all employees working in Germany. It tells you exactly that what is your gross salary and how much of it, is deducted and where and what you are getting at the end. Your employer and the human resource department may also guide you about your pay slip.

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.