Change Tax Class in Germany – via Form or Elster 2025

Welcome to our comprehensive guide on how to change your tax class in Germany! Understanding and modifying your tax class can have a significant impact on your financial situation, whether you’re a resident or an expatriate living in this vibrant country. In this blog, we will demystify the German tax system, explain the reasons why you might want to change your tax class, and provide you with step-by-step instructions on how to do it successfully. Whether you’re getting married, divorced, or experiencing other life changes, optimizing your tax class is a crucial step toward managing your finances efficiently. So, let’s dive in and empower you with the knowledge you need to navigate the German tax landscape with confidence.

When Do I Have To Change My Tax Class?

The change in tax class is required when family circumstances change. which is, divorce or marriage if done in Germany. When you inform your Rathaus about such family circumstances then they automatically communicates to the German Tax Office (Finanzamt)

Reasons For Changing Tax Class

- Marriage: After marriage, the tax class changes to Tax class 4. If one spouse is earning less than the other then the combination of Tax class 3 and 5 has to be communicated with the help of the form. You can find that below.

- Separation/divorce: In case of separation or a divorce, the tax class changes. If you don’t have children or children without full custody, it changes to tax class 1. If you are a single parent and you have sole custody, it changes to tax class 2.

- Death of a spouse: The death of your spouse results in change to tax class 3 for the two years after death. Afterwards, it changes to tax class 1 or 2

- Birth of a child and you will have sole custody: For this reason, your tax class changes to tax class 2.

How to Change your Tax Class after Marriage?

After marriage, you and your spouse need to register by the City registration office (Bürgeramt or Rathaus). After the registration of your marriage at the Rathaus or Standesamt, they will automatically forward your tax class changes to the German Tax office (Finanzamt). After a wedding, the Finanzamt will change both spouses’ tax class to tax class 4 by default. Doesn’t matter whether one spouse is not earning any income or significantly less than the other.

There are people who wish to switch between tax classes 3 and 5. For this purpose, a change can be requested via the form. If a married couple wants a switch to either tax class 3 or 5, it is only logical if one of them is earning at least 60% of the total income of their household. There are multiple times in a year when the married couple can change their tax classes. This is applicable from 2020. Before this period, only one change per year was allowed.

How Can I Change My Tax Class?

It is easy to change your tax class as a married couple. In Germany, it requires only one bureaucratic document.

- First you have to fill out the form of tax class change for married people (Antrag auf Steuerklassenwechsel bei Ehegatten).

- Save that form as a PDF file.

- Make a hard copy of that and take signature of both spouses.

- Send it to your responsible tax office (Finanzamt).

Once you change to tax classes 3 and 5, you are automatically obligated to file a joint tax declaration at the end of the year.

Guide to fill The Antrag Auf Steuerklassenwechsel Bei Ehegatten using Online Form

##imgtag:downloaded_image##

Field 1 Steuernummer :

Your local tax office (Finanzamt) assigns you an individual tax number. You can easily locate that on your tax assessment (Steuerbescheid) if you have done a tax declaration previously. If in case you are unable to find it, leave the space empty.

Field 2 - An das Finanzamt:

Your responsible tax office or the name of your city.

Field 3 - Bei Wohnsitzwechsel: bisheriges Finanzamt

The name of your former assigned tax office, in case you have moved.

Field 5: Identifikationsnummer (ldNr.)

Tax ID of the partner who is filing this request. The tax can be easily found on any of your salary slip.

Field 5-6: Name \& Vorname

Last name \& First name

Field 6 - 9: Staße, Hausnummer, Postleitzahl \& Wohnort

Street, House Number, Postcode \& City

Field 10: Verheiratet/Verpartnert seit, Verwitwet seit, Geschieden/Lebenspart. aufgehoben seit, Verheiratet/Verpartnert seit Verwitwet seit Dauernd getrennt lebend seit

Married since

Widowed since

Divorced since

Permanently separated since

Field 11 - Identifikationsnummer (IdNr.):

The other partner’s Tax ID

Field 12 - 15 - Name, Vorname, Straße, Hausnummer, PLZ, Wohnort

Last Name, First Name

Street, House number, Postal Code \& City (If different)

Field 17 - Bisherige Steuerklassenkombination:

Here you can tick the current tax class of you and your spouse: If you are doing it first time then it is IV/IV

Field 18 - Ich / Wir beantrage(n) die Steuerklassenkombination:

Here you can tick the required tax class of you and your spouse: Please check the table above

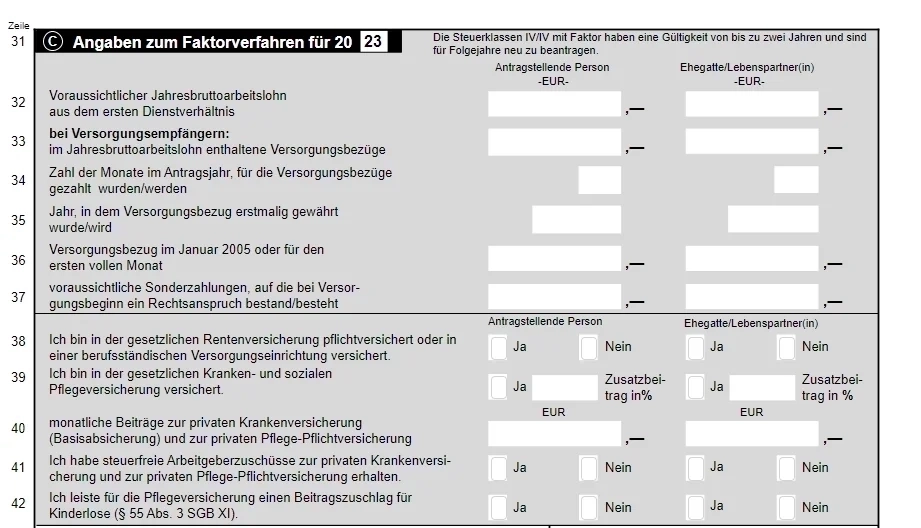

Field 31 - 42- Angaben zum Faktorberfahren für 20__

You can leave this part

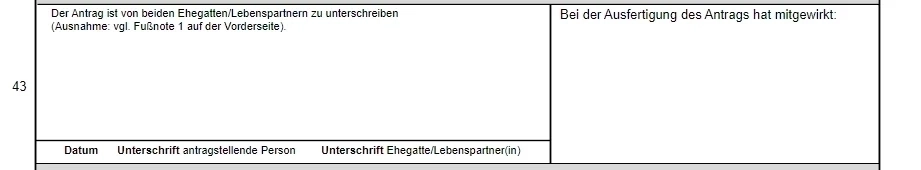

Field 43 - Der Antrag ist von beiden Ehegatten/Lebenspartnern zu unterschreiben

Both spouses have to sign; the partner filing the request signs first.

Guide to Fill The Antrag Auf Steuerklassenwechsel Bei Ehegatten using Elster

For this method, you need to have the Elster account. Kindly follow the instructions of registering at Elster. If you haven’t created one then do that before following this guide.

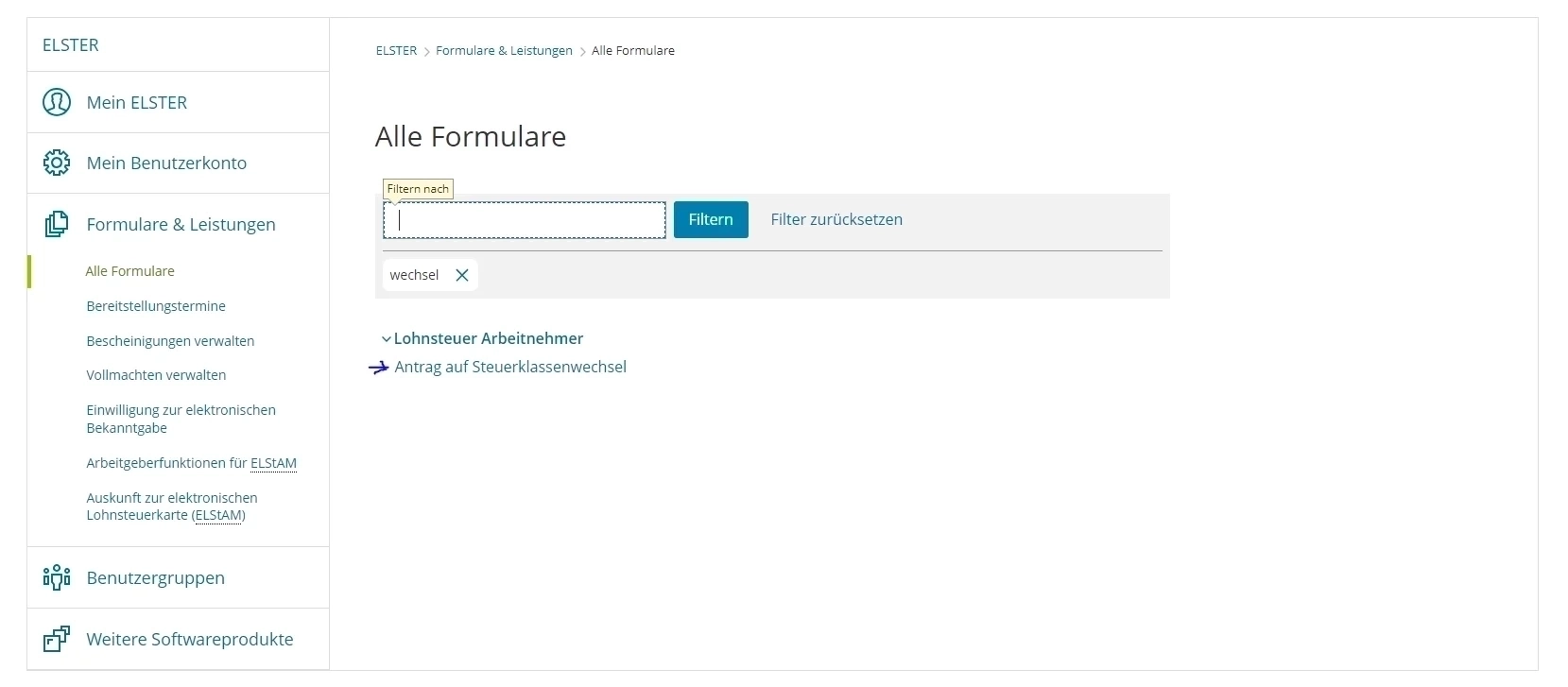

Step 1: Form of “Antrag auf Steuerklassenwechsel”

Once you have your elster account up and running then login and then on the left side, you will see “Formulare \& Leistungen” and once you are there search for “Wechsel” and then you will see the window like below. Then open the form for “Antrag auf Steuerklassenwechsel”

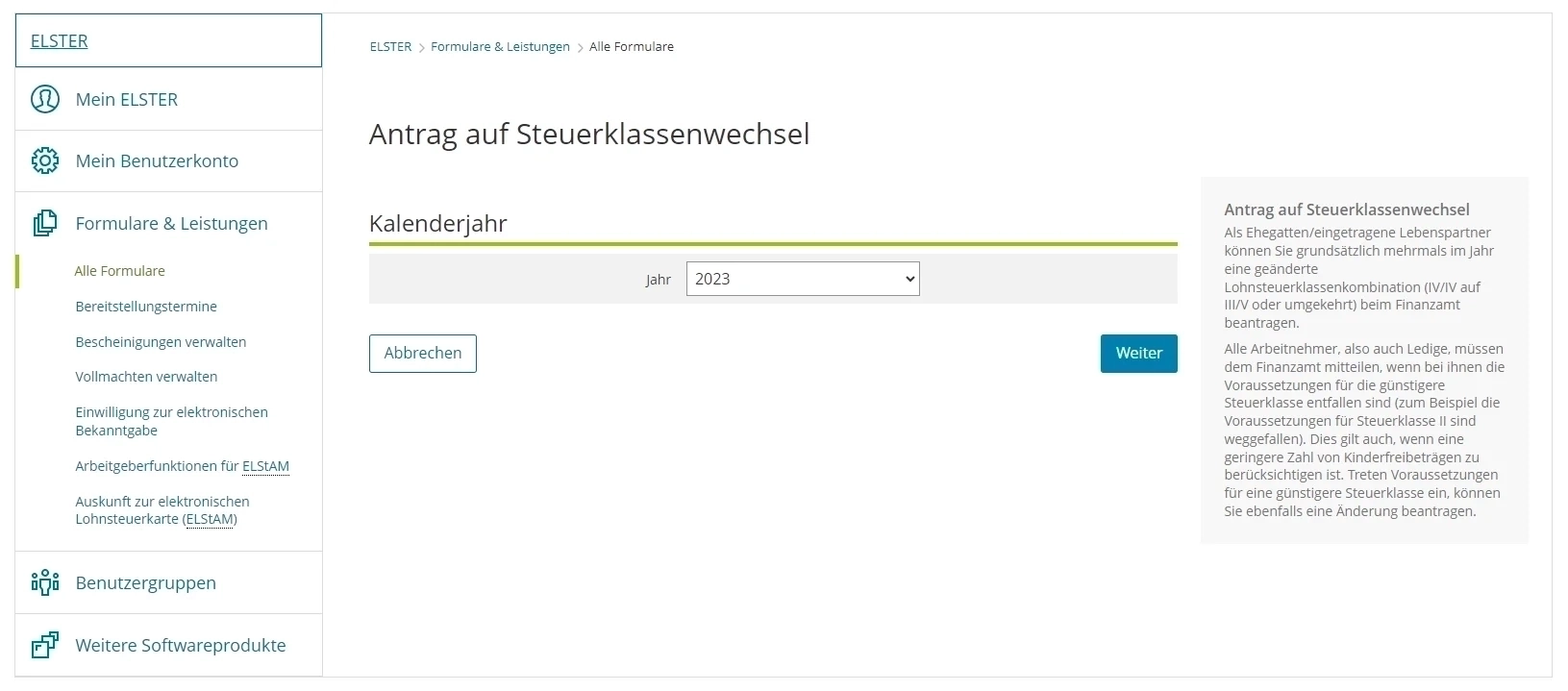

Step 2: Kalenderjahr (Select Year)

Select your current year. For example in this case 2023

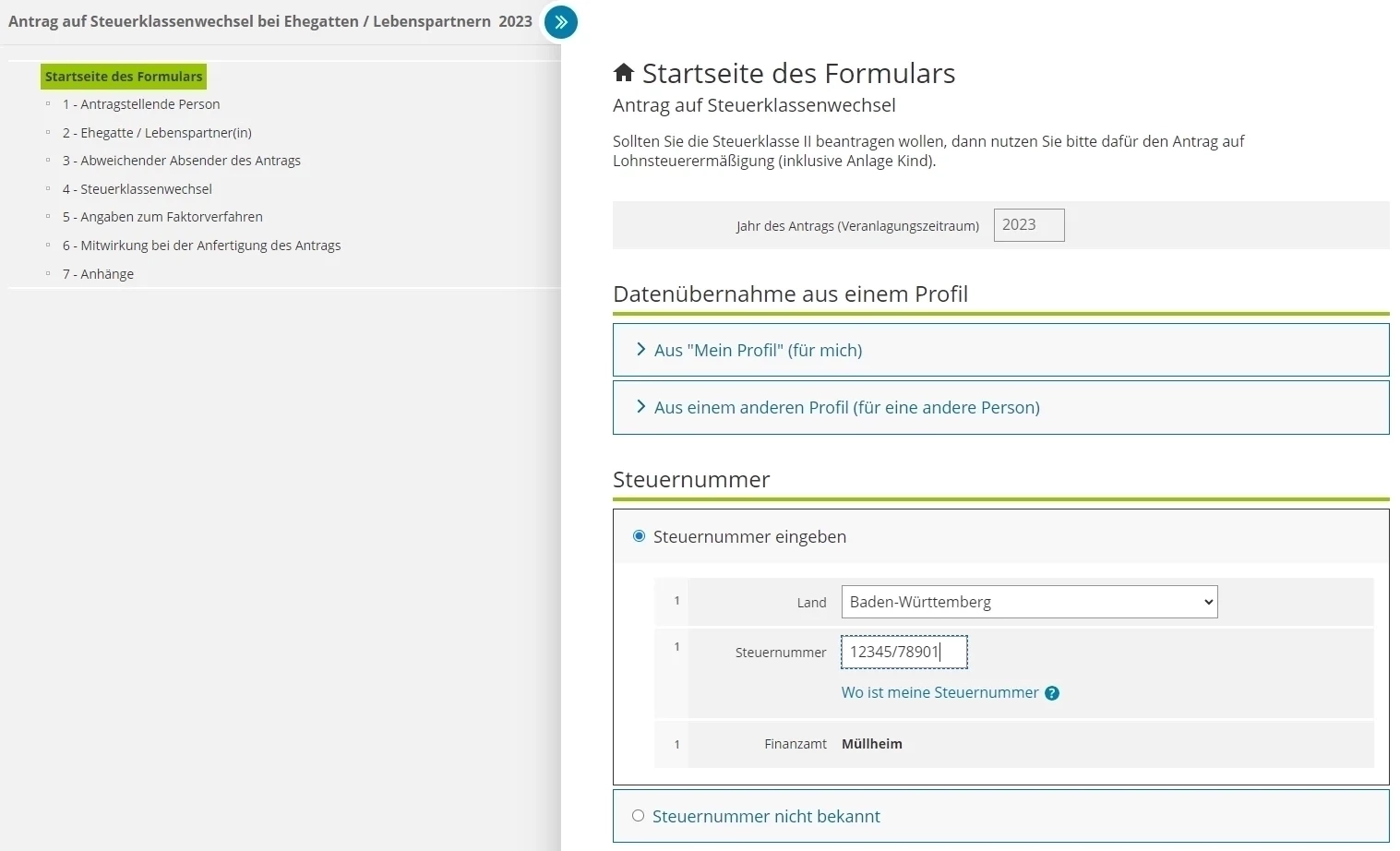

Step 3: Startseite des Formular

Steuernummer:

Select your State in the first field and then give your 10 digit Steuernummer (Tax number) in the second field. Third field is then automatically filled with the responsible finanzamt of your city.

After that go to the next page by pressing “Nächste seite”

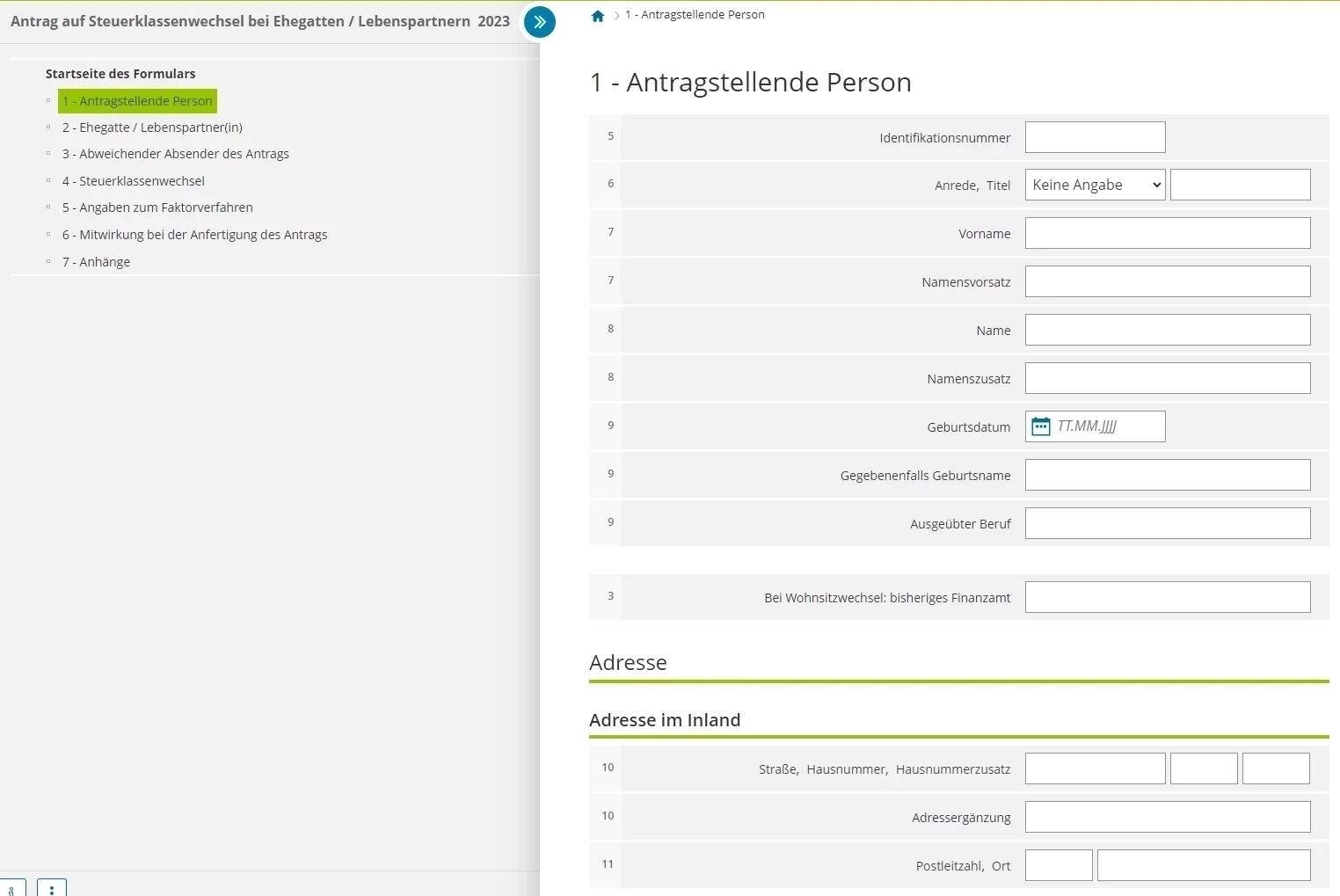

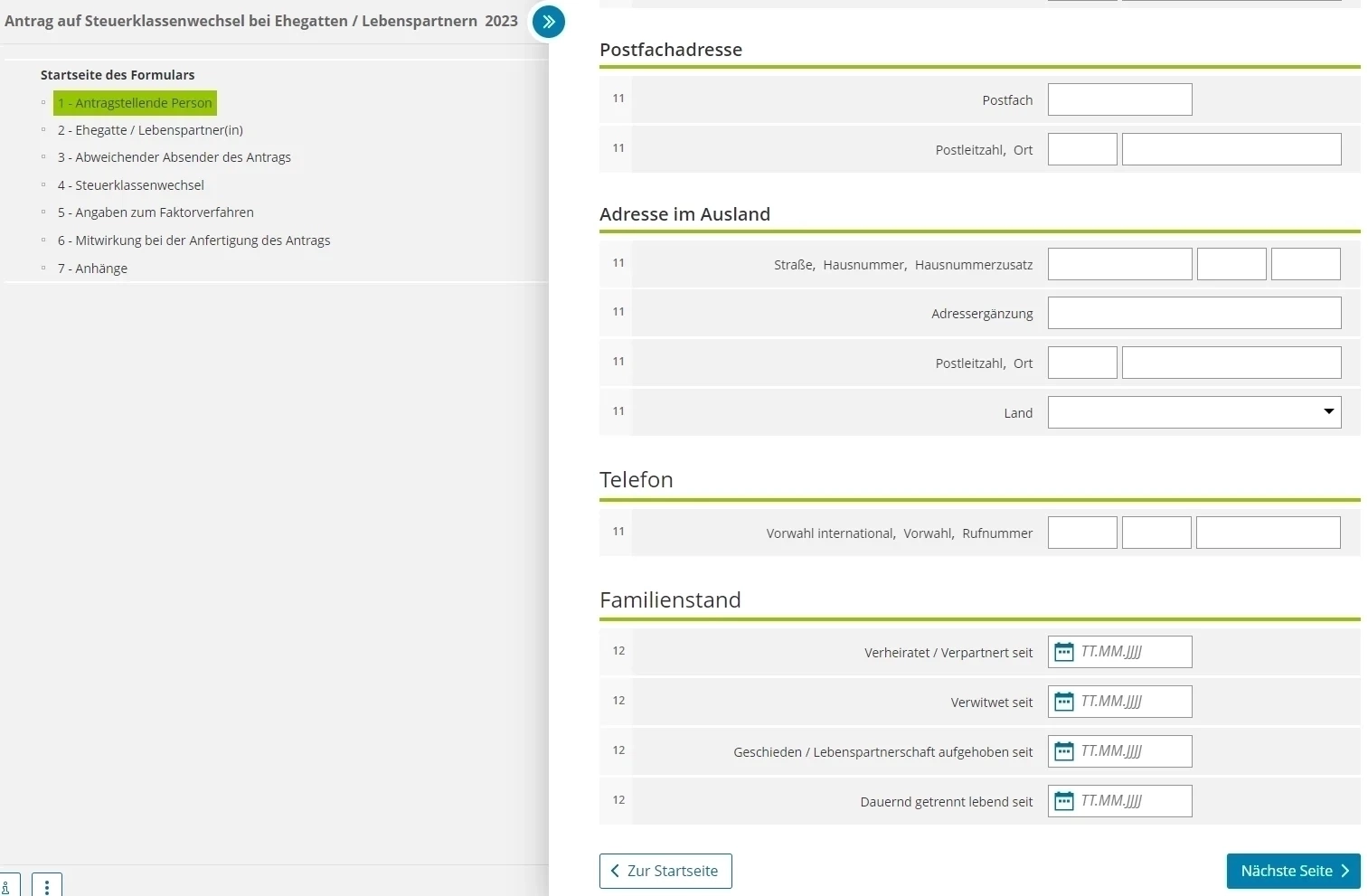

Step 4: Antragstellende Person (Applicant)

Antragstellende Person (Applicant)

Field 5: Identifikationsnummer (ldNr.): Tax ID of the partner who is filing this request. The tax can be easily found on any of your salary slip.

Field 7-8: Name \& Vorname: Applicant’s Last name \& First name

Field 9: Applicant’s date of birth. In “Gegebenenfalls Geburtsname”, write your previous name (only if applicable like the last name change in case of marriage). In “Ausgeübter Beruf”, Write your profession like Engineer for example

Field 3: Write your previous Finanzamt, in case you recently moved

Adresse im Inland (Applicant’s Address in Germany)

Field 6 – 9: Staße, Hausnummer, Postleitzahl \& Wohnort: Applicant’s Street, House Number, Postcode \& City

Field 10: Verheiratet/Verpartnert seit, Verwitwet seit, Geschieden/Lebenspart. aufgehoben seit, Verheiratet/Verpartnert seit Verwitwet seit Dauernd getrennt lebend seit

In this field you will write whatever is applicable to you. For example changing of the class due to Marriage, divorced etc

- Married since

- Widowed since

- Divorced since

- Permanently separated since

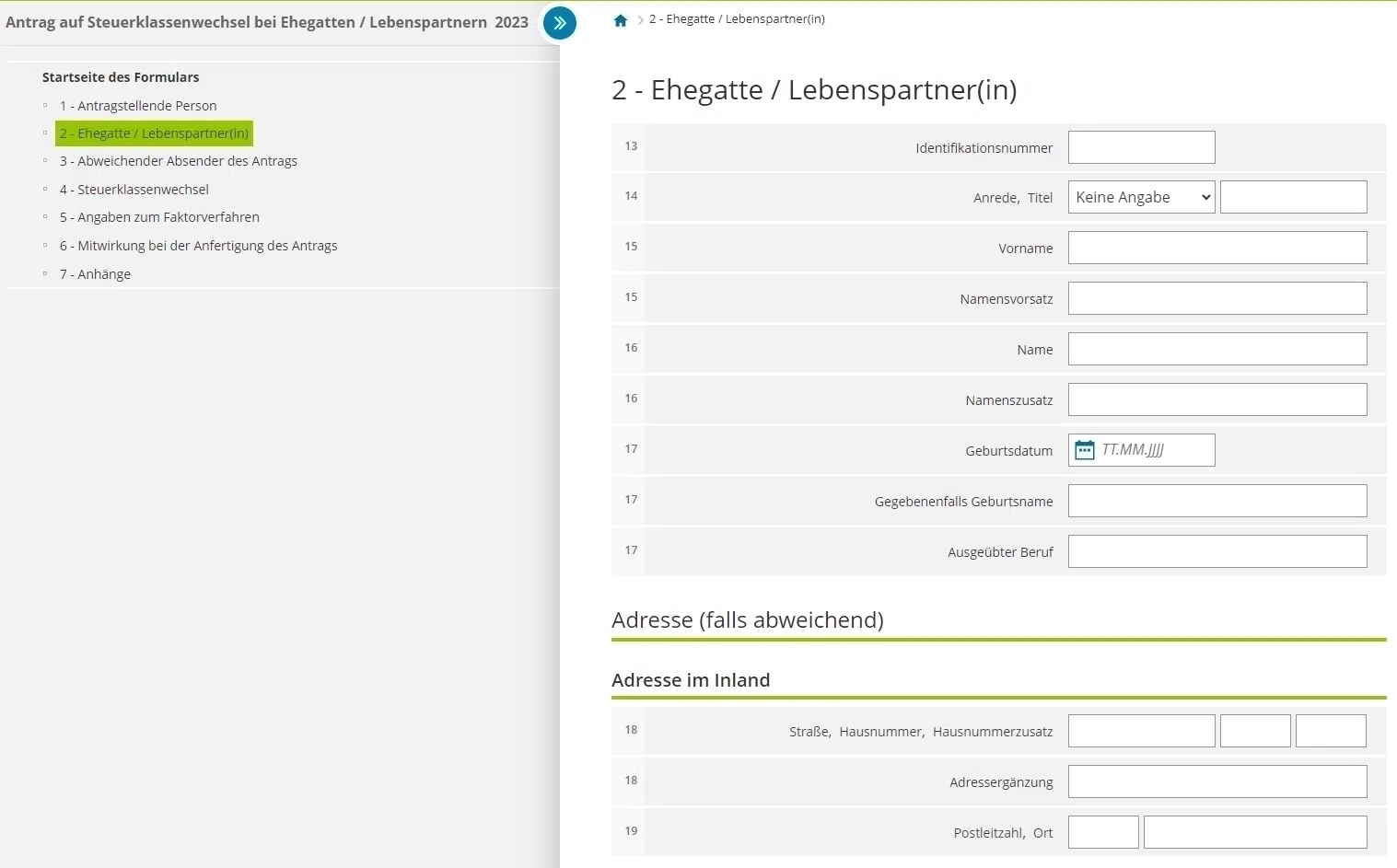

tep 5: Ehegatte / Lebenspartner(in) (Spouse)

Ehegatte / Lebenspartner(in) (Spouse)

Field 13: Identifikationsnummer (ldNr.): if your spouse recently moved to Germany and you don’t have this information then you can leave it blank

Field 15-16: Name \& Vorname: Spouse’s Last name \& First name

Field 17: Spouse’s date of birth. In “Gegebenenfalls Geburtsname”, write your previous name (only if applicable like the last name change in case of marriage). In “Ausgeübter Beruf”, Write your profession like Engineer for example

Adresse im Inland (Spouse’s Address in Germany) – only if spouse lives in separate household

Field 18 – 19: Staße, Hausnummer, Postleitzahl \& Wohnort: Spouse’s Street, House Number, Postcode \& City

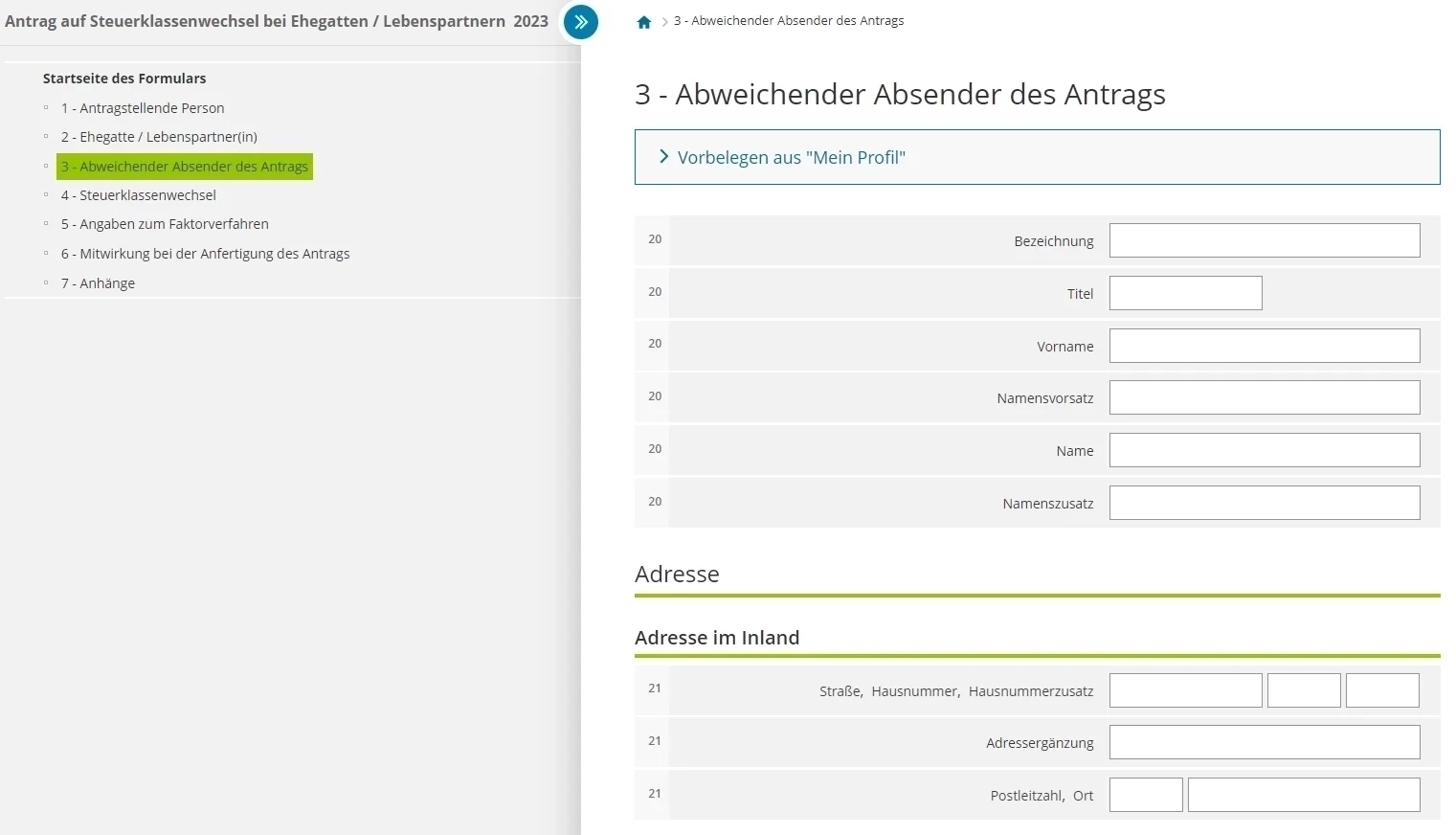

Step 6: Abweichender Absender des Antrags (Name of the Sender)

This step is only applicable to those who are sending applications on behalf of someone. Usually tax consultants fill out these forms for their clients.

So if you are the actual applicant then leave this page empty

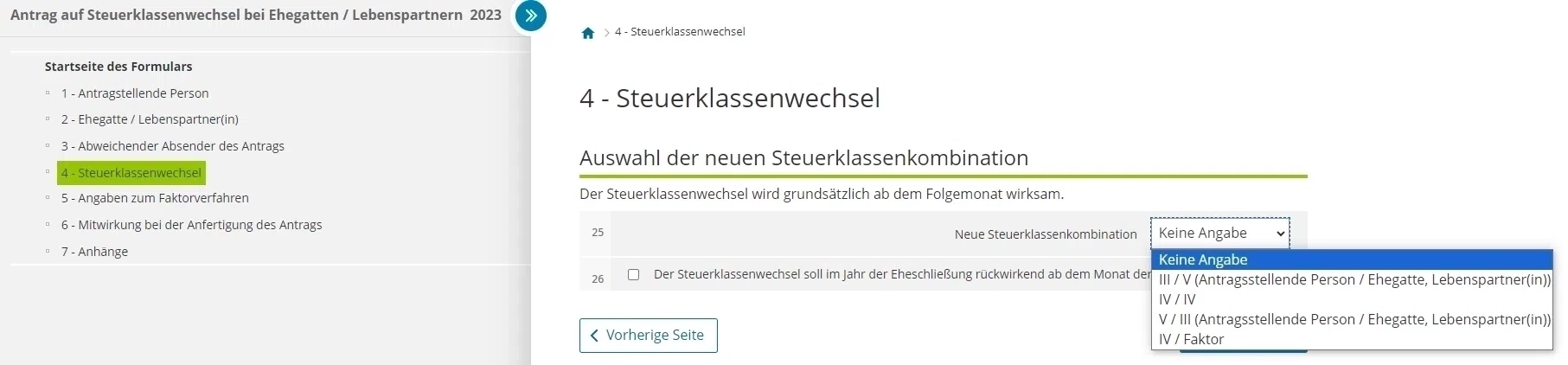

Step 7: Steuerklassenwechsel (Change of Tax Class)

Dropdown 25: You need to select your tax class. You can select your tax class based on this guide.

Checkbox 26: Suppose you got married in 2022 and you are filling this form in 2023. Then checking this checkbox means that they will change the tax class from the date of your marriage. This is beneficial in a way that your tax will be recalculated for all the months where your tax class was not changed. You might get a return for all those months or you have to pay back if extra income tax is calculated.

Step 8: Angaben zum Faktorverfahren (Applicable for factor purpose)

If both partners are earning then you can fill out these fields basis of your income. Then finanzamt will calculate the Class 4 with a factor for you. For this step, do your own research.

Step 9: Mitwirkung bei der Anfertigung des Antrags (PArticipation in filling out these forms)

Applicable to tax consultants.

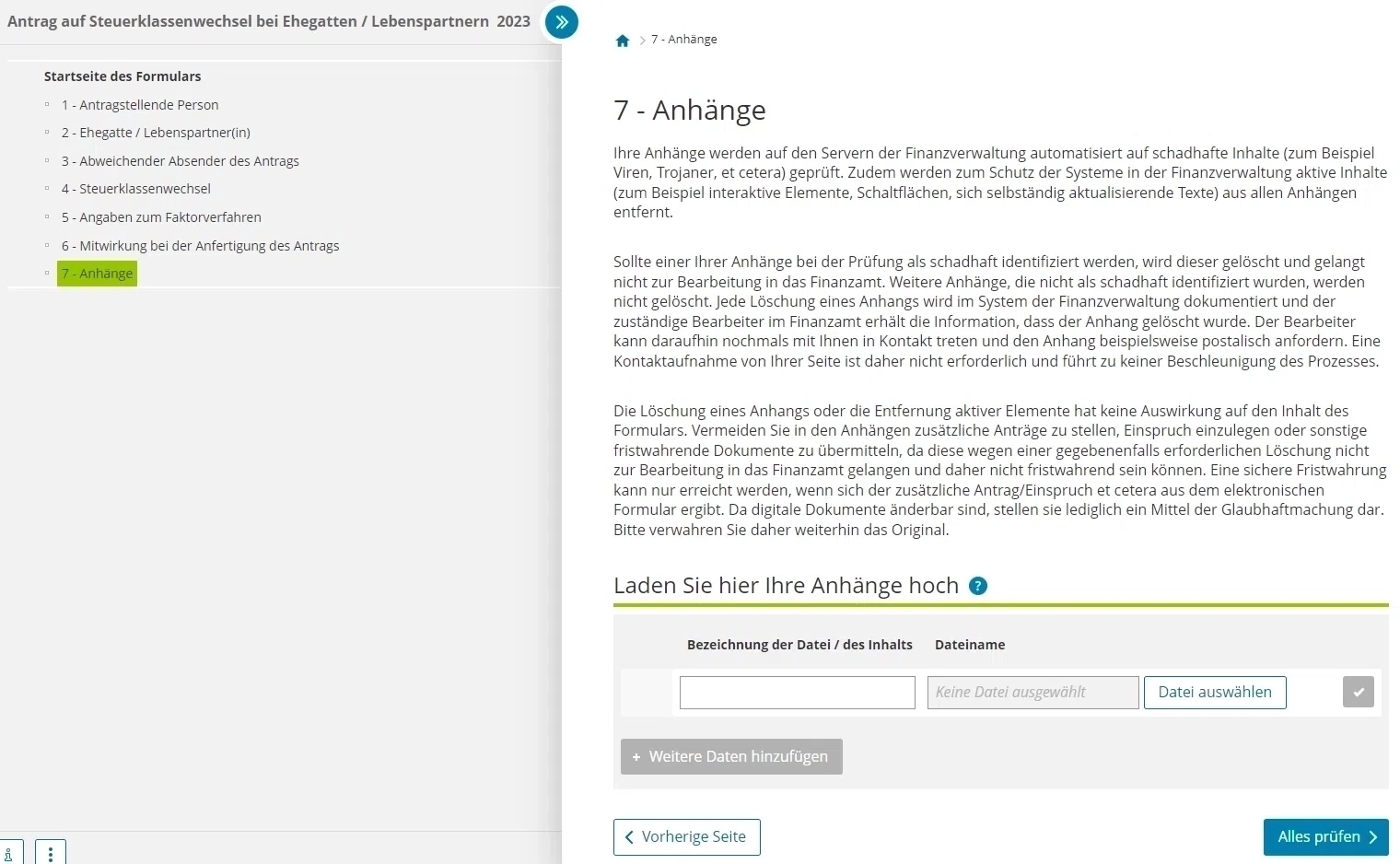

Step 9: Anhänge (Attachment)

Here you can upload supporting documents. Usually you can upload your marriage certificate if it is in English or German, but it is not necessary as you have already declared then when your spouse did city registration.

Step 10: Prüfen

In the next step, you can click on “Alles prüfen”. This will tell you if any field is missing or incorrect. Fix those errors and then you can see the overview of all your fields. Kindly check your inputs again. If everything is fine then Send the form. Here is your paperless solution.

Conclusion

Tax class in Germany is decided by your marital status. The choice of tax class is allowed only after getting married. The income of both spouses can decide if a change in tax class makes sense. If it makes sense, they receive a temporary tax advantage on their monthly income. With this in mind, remember that the income tax amount per year remains identical.

Source: Infographic vector created by vectorjuice – www.freepik.com

Jibran Shahid

Hi, I am Jibran, your fellow expat living in Germany since 2014. With over 10 years of personal and professional experience navigating life as a foreigner, I am dedicated to providing well-researched and practical guides to help you settle and thrive in Germany. Whether you are looking for advice on bureaucracy, accommodation, jobs, or cultural integration, I have got you covered with tips and insights tailored specifically for expats. Join me on my journey as I share valuable information to make your life in Germany easier and more enjoyable.